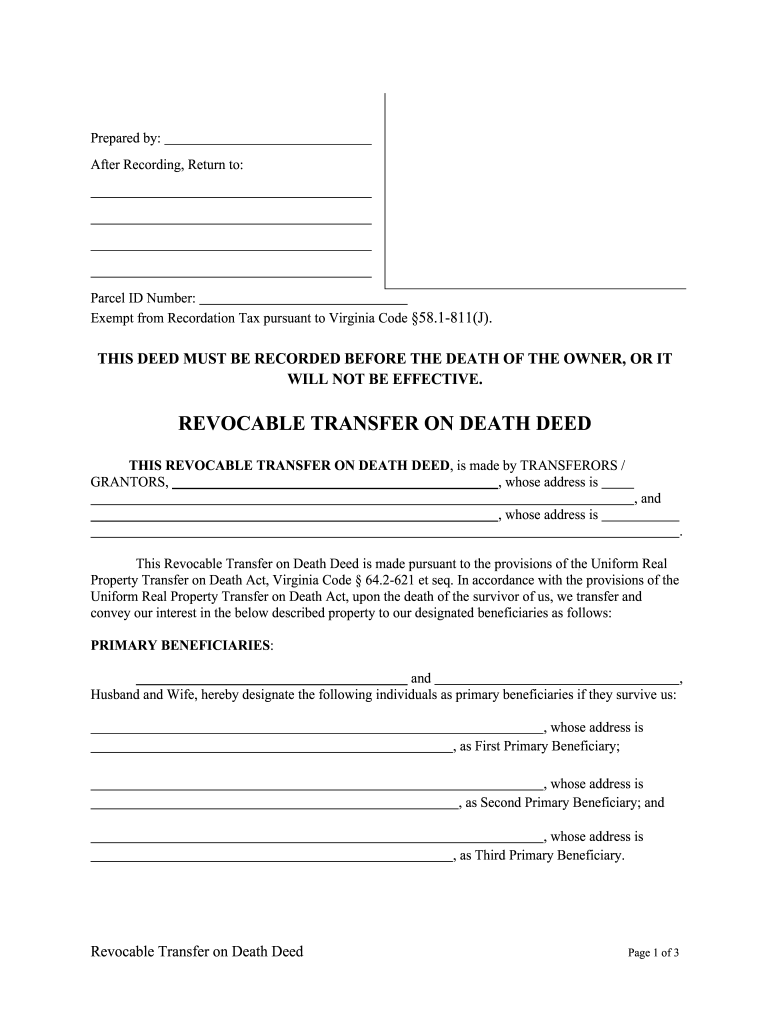

Transfer on Death Deed Form

What is the Transfer On Death Deed

The Transfer On Death Deed (TODD) is a legal instrument that allows an individual to transfer real property to a designated beneficiary upon their death, bypassing the probate process. This deed is particularly useful for estate planning, as it enables property owners to maintain control of their assets during their lifetime while ensuring a smooth transition to heirs without the complexities of probate court. In Virginia, this deed must be executed in accordance with state laws to be considered valid.

How to use the Transfer On Death Deed

To utilize a Transfer On Death Deed effectively, an individual must first complete the deed form, specifying the property to be transferred and naming the beneficiary. It is essential to sign the deed in the presence of a notary public to ensure its legality. Once signed, the deed must be recorded in the local land records office where the property is located. This step is crucial, as it provides public notice of the transfer and protects the rights of the beneficiary.

Steps to complete the Transfer On Death Deed

Completing a Transfer On Death Deed involves several key steps:

- Obtain the appropriate TODD form from a reliable source.

- Fill out the form with accurate property details and beneficiary information.

- Sign the deed in front of a notary public to authenticate it.

- Record the signed deed with the local land records office to ensure it is legally binding.

Following these steps helps ensure that the transfer is executed smoothly upon the property owner's death.

Legal use of the Transfer On Death Deed

The legal use of a Transfer On Death Deed is governed by state laws, which dictate how the deed must be executed and recorded. In Virginia, the deed must be signed, notarized, and recorded to be effective. This legal framework allows property owners to designate beneficiaries without transferring ownership during their lifetime. It is advisable to consult with a legal professional to ensure compliance with all applicable laws and regulations.

Key elements of the Transfer On Death Deed

Key elements of the Transfer On Death Deed include:

- Property Description: A clear and accurate description of the property being transferred.

- Beneficiary Designation: The name and details of the individual(s) who will receive the property upon the owner's death.

- Signature and Notarization: The property owner's signature, along with notarization, is required for the deed to be valid.

- Recording: The deed must be recorded with the appropriate local authority to take effect.

Understanding these elements is vital for ensuring the deed's effectiveness and legality.

State-specific rules for the Transfer On Death Deed

Each state has specific rules governing the use of Transfer On Death Deeds. In Virginia, the deed must comply with the Virginia Code, which outlines the necessary procedures for execution and recording. Additionally, there may be restrictions on the types of properties that can be transferred using this deed. It is important for individuals to familiarize themselves with their state’s regulations to ensure proper use and compliance.

Quick guide on how to complete transfer on death deed 481377926

Effectively Prepare Transfer On Death Deed on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the needed form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and efficiently. Manage Transfer On Death Deed on any device with the airSlate SignNow app available for Android and iOS, and streamline any document-related task today.

The easiest way to modify and eSign Transfer On Death Deed effortlessly

- Obtain Transfer On Death Deed and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of your documents to highlight or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require the printing of new document versions. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Alter and eSign Transfer On Death Deed to ensure effective communication at every phase of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a revocable transfer death and how does it work?

A revocable transfer on death (TOD) allows you to designate beneficiaries for your assets without going through probate. This means that upon your death, the designated beneficiaries can directly receive the assets, streamlining the transfer process. It's an effective way to ensure your assets are passed on according to your wishes after revocable transfer death.

-

What are the benefits of using airSlate SignNow for revocable transfer death documentation?

Using airSlate SignNow for your revocable transfer death documents simplifies the eSigning process and ensures your documents are legally binding. Our platform offers secure storage and the ability to invite multiple signers, making it easier to manage your estate planning efficiently. Additionally, our user-friendly interface helps you complete transactions without hassle.

-

How does airSlate SignNow integrate with other tools for revocable transfer death planning?

airSlate SignNow integrates seamlessly with various tools such as CRM systems, cloud storage, and productivity applications. These integrations streamline your workflow, making it easier to manage all documentation related to revocable transfer death. You can easily access and share documents with advisors, ensuring everyone involved is informed.

-

What features does airSlate SignNow offer to streamline revocable transfer death documents?

AirSlate SignNow provides features like customizable templates, electronic signatures, and secure document storage specifically tailored for revocable transfer death processes. You can create, send, and manage your documents from a centralized platform, saving time and reducing the complexity of estate planning. This ensures your transfers follow your wishes effectively.

-

Is airSlate SignNow secure for managing revocable transfer death documents?

Yes, airSlate SignNow prioritizes security, offering encrypted data transmission and secure storage for your revocable transfer death documents. We comply with legal standards to ensure your sensitive information is protected at all times. You can have peace of mind knowing that your estate planning details are kept confidential.

-

What is the pricing structure for using airSlate SignNow for revocable transfer death documents?

AirSlate SignNow offers flexible pricing plans that cater to various needs, making it cost-effective for handling revocable transfer death documents. Our plans are designed to fit both individuals and business organizations. You can choose a plan that aligns with your requirements, ensuring that you get the best value without compromising on features.

-

Can I use airSlate SignNow for multiple revocable transfer death transactions?

Absolutely! AirSlate SignNow allows you to manage multiple revocable transfer death transactions without any limitations. You can set up numerous documents, manage signers, and track their statuses all in one place. This feature makes it easy to handle estate planning for different assets or beneficiaries.

Get more for Transfer On Death Deed

- Va poa form

- Washington power of attorney for sale of motor vehicle form

- Complaint regarding breach of contract to divide estate proceeds implied contract good faith and fair dealing promissory form

- Notice of claim forms

- Easement deed form

- Fence agreement form

- Attorney agreement contractor form

- Officer contractor form

Find out other Transfer On Death Deed

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter