Florida Caveat by Creditor Form

What is the Florida Caveat By Creditor

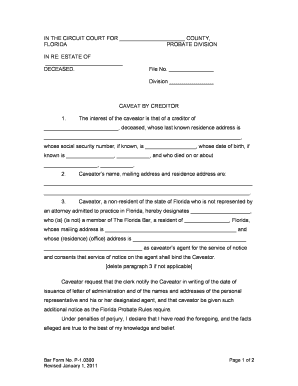

The Florida Caveat By Creditor is a legal document that allows a creditor to formally notify the court of their interest in a debtor's estate. This document serves as a protective measure for creditors, ensuring that they are informed of any legal proceedings involving the debtor's assets. By filing this caveat, creditors can assert their rights and potentially recover debts owed to them.

How to use the Florida Caveat By Creditor

To effectively use the Florida Caveat By Creditor, a creditor must first complete the required form accurately. This includes providing essential details such as the debtor's name, the nature of the debt, and any relevant case numbers. Once the form is filled out, it must be filed with the appropriate court. This action officially registers the creditor's claim and ensures they receive notifications about any related legal actions.

Steps to complete the Florida Caveat By Creditor

Completing the Florida Caveat By Creditor involves several key steps:

- Gather necessary information about the debtor and the debt.

- Obtain the Florida Caveat By Creditor form from the appropriate court or legal resource.

- Fill out the form with accurate and complete information.

- Sign the form, ensuring that all required signatures are included.

- File the completed form with the court, either in person or electronically.

- Keep a copy of the filed caveat for your records.

Key elements of the Florida Caveat By Creditor

Several key elements must be included in the Florida Caveat By Creditor to ensure its validity:

- The full name and contact information of the creditor.

- The debtor's full name and any known aliases.

- A detailed description of the debt owed.

- Any relevant case numbers or court information.

- The date of filing and the creditor's signature.

Legal use of the Florida Caveat By Creditor

The legal use of the Florida Caveat By Creditor is crucial for protecting a creditor's interests. By filing this document, creditors can ensure they are notified of any legal proceedings that may affect their ability to collect the debt. This caveat acts as a formal declaration of the creditor's claim, which can be essential in disputes or bankruptcy proceedings involving the debtor.

Form Submission Methods (Online / Mail / In-Person)

The Florida Caveat By Creditor can be submitted through various methods, depending on the court's requirements:

- Online Submission: Many courts offer electronic filing systems where creditors can submit the caveat digitally.

- Mail: Creditors may also choose to send the completed form via postal mail to the appropriate court address.

- In-Person: Submitting the form in person at the courthouse is another option, allowing for immediate confirmation of filing.

Quick guide on how to complete florida caveat by creditor

Effortlessly Prepare Florida Caveat By Creditor on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Florida Caveat By Creditor seamlessly on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The Most Efficient Way to Edit and Electronically Sign Florida Caveat By Creditor with Ease

- Find Florida Caveat By Creditor and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools offered by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal enforceability as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new document versions. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Florida Caveat By Creditor to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Florida Caveat By Creditor?

A Florida Caveat By Creditor is a legal notice that informs the court of a creditor's interest in a deceased person's estate. It protects the creditor's rights by ensuring they are notified of any proceedings related to the estate. Understanding this process is crucial for managing debts owed to you.

-

How does airSlate SignNow assist with creating a Florida Caveat By Creditor?

airSlate SignNow streamlines the process of drafting and eSigning a Florida Caveat By Creditor. Our platform provides templates and easy editing tools, allowing you to customize documents quickly and efficiently. You can also track the status of your caveat submissions with our robust management features.

-

Is there a cost associated with filing a Florida Caveat By Creditor using airSlate SignNow?

Yes, while airSlate SignNow offers a cost-effective solution for eSigning and document management, the actual filing fees for a Florida Caveat By Creditor are set by the court. It's important to account for both our service fees and any court-associated costs when budgeting for your legal documents.

-

What are the benefits of using airSlate SignNow for legal documents?

Using airSlate SignNow for a Florida Caveat By Creditor provides convenience, security, and efficiency. The platform enables you to eSign documents quickly, ensuring a smooth process without the need for printing, scanning, or faxing. Additionally, our cloud storage protects your documents and allows easy access from anywhere.

-

Can I integrate airSlate SignNow with other software for managing Florida Caveat By Creditor documents?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, including CRM and project management software. This ensures that your workflow for handling a Florida Caveat By Creditor is streamlined, enabling better collaboration and document management.

-

Does airSlate SignNow provide customer support for filing a Florida Caveat By Creditor?

Yes, airSlate SignNow offers comprehensive customer support to assist you with any questions or issues related to filing a Florida Caveat By Creditor. Our support team is available via chat, email, and phone, ensuring that you receive help whenever needed throughout your document management process.

-

Are there security measures in place to protect my Florida Caveat By Creditor documents?

Yes, security is a top priority at airSlate SignNow. We implement advanced encryption and authorization protocols to safeguard all your documents, including any Florida Caveat By Creditor submissions. Your private information remains confidential and secure throughout the entire process.

Get more for Florida Caveat By Creditor

- New jersey payment property form

- New jersey notice of intent not to renew at end of specified term from landlord to tenant for residential property form

- New jersey notice of dishonored check civil keywords bad check bounced check form

- New jersey property manager agreement form

- New jersey commercial tenant form

- New jersey non foreign affidavit under irc 1445 form

- New jersey minutes for organizational meeting new jersey form

- Nj note form

Find out other Florida Caveat By Creditor

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast