Collector Abuse Form

Understanding Collector Abuse

Collector abuse refers to unethical or illegal practices employed by debt collectors when attempting to recover debts. These practices can include harassment, threats, and deception, which violate consumer protection laws. In the United States, the Fair Debt Collection Practices Act (FDCPA) governs the behavior of debt collectors, ensuring that consumers are treated fairly and with respect.

Steps to Address Collector Abuse

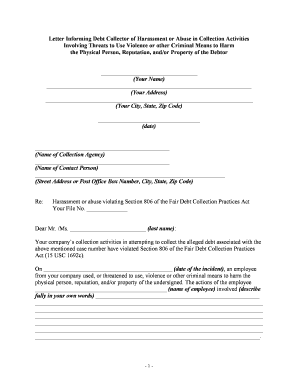

Addressing collector abuse involves several key steps to protect your rights and ensure compliance with the law. First, document all interactions with the collector, noting dates, times, and the nature of the communication. Next, review the FDCPA to understand your rights. If you believe you are a victim of harassment or threats, consider sending a cease-and-desist letter to the collector. This letter formally requests that they stop all communication with you. If the abuse continues, you may want to file a complaint with the Consumer Financial Protection Bureau (CFPB) or consult with a legal professional for further guidance.

Legal Use of Collector Abuse Documentation

Documenting instances of collector abuse is crucial for legal recourse. This documentation can serve as evidence in disputes or legal proceedings. Keep records of all communications, including phone calls, letters, and emails. If you receive threatening messages or experience harassment, these records can help establish a pattern of abusive behavior. Legal action may be pursued against the collector if they violate the FDCPA or other relevant laws.

Key Elements of Collector Abuse

Several key elements characterize collector abuse. These include persistent harassment, use of threats or intimidation, false statements regarding the debt, and failure to provide required disclosures. Collectors may also contact third parties without your consent or disclose your debt status publicly, which can harm your reputation. Understanding these elements can empower consumers to recognize their rights and take action against abusive practices.

State-Specific Rules for Collector Abuse

In addition to federal regulations, each state may have its own laws governing debt collection practices. These laws can vary significantly, providing additional protections for consumers. It's essential to be aware of your state's specific rules regarding collector conduct, as they may offer broader protections than the FDCPA. Researching state laws can help you better understand your rights and the actions you can take against abusive collectors.

Examples of Collector Abuse

Examples of collector abuse include aggressive phone calls at all hours, threats of legal action, and misrepresentation of the debt amount. Other forms may involve contacting friends or family members to discuss your debt or using profane language during conversations. Recognizing these behaviors is crucial for identifying abusive practices and taking appropriate action to protect yourself.

Quick guide on how to complete collector abuse

Complete Collector Abuse effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can find the right form and securely save it online. airSlate SignNow provides all the tools you need to create, alter, and eSign your documents rapidly without delays. Manage Collector Abuse on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The most efficient way to modify and eSign Collector Abuse effortlessly

- Locate Collector Abuse and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you prefer to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Collector Abuse and guarantee outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is debt harassment and how can airSlate SignNow help?

Debt harassment refers to aggressive tactics used by collectors to recover unpaid debts. airSlate SignNow provides a secure platform for documenting any communications related to debt harassment, allowing you to keep clear records of all interactions.

-

How does airSlate SignNow assist in handling debt harassment disputes?

With airSlate SignNow, you can easily eSign and send documents that formally dispute debt harassment claims. This streamlines communication between you and the creditors, providing a legal channel for addressing any inappropriate behavior.

-

Can I use airSlate SignNow to create templates for debt harassment response letters?

Yes! airSlate SignNow allows users to create templates for response letters specifically addressing debt harassment issues. This feature saves time and ensures consistency in your communications with debt collectors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing tiers to fit different business needs. Regardless of the package you choose, you’ll have access to features that help manage communications related to debt harassment effectively.

-

Is airSlate SignNow user-friendly for those unfamiliar with technology?

Absolutely! airSlate SignNow is designed with an intuitive interface that makes it easy for anyone to navigate, even if you’re not tech-savvy. This is crucial when addressing sensitive issues like debt harassment, as simplicity can relieve stress.

-

How does airSlate SignNow ensure the security of documents related to debt harassment?

Security is a top priority at airSlate SignNow. All documents, including those dealing with debt harassment, are encrypted and stored securely, ensuring that your sensitive information remains safe from unauthorized access.

-

Are there any integrations available for managing debt harassment documentation?

Yes, airSlate SignNow integrates seamlessly with various applications that aid in tracking debt harassment cases. This flexibility allows users to combine tools and streamline processes for enhanced efficiency.

Get more for Collector Abuse

- Idaho 3 day notice form

- Idaho assignment of deed of trust by individual mortgage holder form

- Idaho assignment of deed of trust by corporate mortgage holder form

- Idaho notice of default in payment of rent as warning prior to demand to pay or terminate for residential property form

- Idaho notice of creditors form

- Idaho waiver of accounting form

- Idaho revocation of living trust form

- Easement form sample

Find out other Collector Abuse

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online