Deed Secure Debt Georgia Form

What is the Georgia Deed Secure Debt?

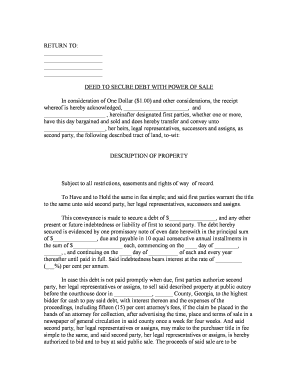

The Georgia deed secure debt is a legal document that allows a borrower to secure a loan using real property as collateral. This type of deed is often used in situations where a borrower may not qualify for traditional financing. It provides lenders with a legal claim to the property until the debt is repaid. The deed secure debt is particularly relevant in Georgia, where specific laws govern its execution and enforcement.

How to Use the Georgia Deed Secure Debt

Utilizing the Georgia deed secure debt involves several steps. First, the borrower and lender must agree on the terms of the loan, including the amount, interest rate, and repayment schedule. Once these details are established, the deed must be drafted, ensuring that it complies with Georgia's legal requirements. The borrower then signs the deed, and it should be recorded with the county clerk's office to make it enforceable. This recording provides public notice of the lender's interest in the property.

Steps to Complete the Georgia Deed Secure Debt

Completing the Georgia deed secure debt involves a series of important steps:

- Determine the loan amount and terms with the lender.

- Draft the deed secure debt document, including all necessary details.

- Have both parties sign the document in the presence of a notary public.

- Record the signed deed with the appropriate county office to ensure legal validity.

Key Elements of the Georgia Deed Secure Debt

The key elements of a Georgia deed secure debt include:

- The names and addresses of the borrower and lender.

- A clear description of the property being used as collateral.

- The loan amount and repayment terms.

- Signatures of both parties and a notary acknowledgment.

Legal Use of the Georgia Deed Secure Debt

The legal use of the Georgia deed secure debt is governed by state laws. It is essential for both parties to understand their rights and obligations under the deed. The lender has the right to foreclose on the property if the borrower defaults on the loan. To ensure compliance with Georgia law, it is advisable to consult with a legal professional when drafting or executing this document.

State-Specific Rules for the Georgia Deed Secure Debt

Georgia has specific rules that govern the execution and enforcement of deed secure debts. These rules include the requirement for notarization and recording of the deed. Additionally, the state mandates that the deed must contain certain disclosures to protect the rights of both parties. Familiarity with these regulations is crucial for ensuring the deed's validity and enforceability.

Quick guide on how to complete deed secure debt georgia

Complete Deed Secure Debt Georgia effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an outstanding eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the right form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Deed Secure Debt Georgia on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest method to modify and eSign Deed Secure Debt Georgia without stress

- Obtain Deed Secure Debt Georgia and click Get Form to begin.

- Make use of the tools we provide to finalize your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to the computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors needing fresh document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Modify and eSign Deed Secure Debt Georgia and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Georgia deed secure?

Georgia deed secure is an innovative electronic document signing solution designed to streamline the process of signing and managing real estate deeds in Georgia. With airSlate SignNow, you can ensure that your deed documents are securely signed, verified, and stored for easy retrieval.

-

How does airSlate SignNow ensure the security of Georgia deed documents?

airSlate SignNow employs industry-leading encryption and authentication protocols to secure your Georgia deed documents. By utilizing multi-factor authentication and audit trails, we ensure that all transactions involving your deeds are secure and tamper-proof.

-

What are the pricing options for airSlate SignNow related to Georgia deed secure?

Our pricing for airSlate SignNow's Georgia deed secure solution is designed to be cost-effective, catering to businesses of all sizes. We offer flexible subscription plans that allow you to choose the best option based on your document signing needs, with no hidden fees.

-

What features does airSlate SignNow offer for managing Georgia deeds?

airSlate SignNow provides a suite of features for managing Georgia deeds, including customizable templates, electronic signatures, real-time tracking, and easy document sharing. These tools are designed to enhance efficiency while ensuring your Georgia deed documents are securely handled.

-

Can I integrate airSlate SignNow with other tools for Georgia deed management?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms that enhance Georgia deed management. You can easily connect with CRM systems, cloud storage services, and other business applications to streamline your workflow.

-

How does airSlate SignNow benefit real estate professionals in Georgia?

For real estate professionals in Georgia, airSlate SignNow simplifies the process of managing deed documents, making transactions faster and more efficient. Our secure eSigning solution helps you close deals quicker while ensuring compliance with legal requirements.

-

Is airSlate SignNow compliant with Georgia's electronic signature laws?

Yes, airSlate SignNow complies with Georgia's electronic signature laws, ensuring that all Georgia deed documents signed through our platform are legally binding. This compliance provides peace of mind that your electronic transactions are valid and recognized under state law.

Get more for Deed Secure Debt Georgia

Find out other Deed Secure Debt Georgia

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document