Hawaii Hawaii Renunciation and Disclaimer of Property Received by Intestate Succession Form

What is the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession

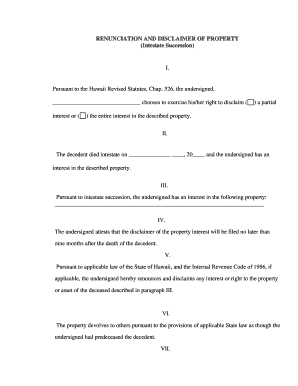

The Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession is a legal document that allows an individual to formally refuse any property or assets inherited through intestate succession, which occurs when a person dies without a valid will. This form is particularly relevant in situations where accepting the inheritance may not be beneficial for the recipient, such as incurring debts associated with the property or tax liabilities. By filing this document, the individual effectively relinquishes their rights to the property, allowing it to pass to the next eligible heir according to Hawaii's intestacy laws.

How to use the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession

To utilize the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession, an individual must complete the form accurately and submit it to the appropriate court or authority. The process typically involves gathering necessary information about the decedent, the property in question, and the relationship to the deceased. It is essential to ensure that the form is filled out in accordance with state laws, including any specific requirements for notarization or witness signatures, to ensure its validity.

Steps to complete the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession

Completing the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession involves several key steps:

- Obtain the form from a reliable source, such as a legal website or local court.

- Fill in the required information, including your name, the decedent's name, and details about the property.

- Review the form for accuracy and completeness.

- Sign the form in the presence of a notary public, if required.

- Submit the completed form to the appropriate court or authority within the specified time frame.

Legal use of the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession

The legal use of the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession is crucial for individuals wishing to refuse an inheritance. By executing this form, the individual ensures that their decision is recognized under Hawaii law, which can prevent potential disputes among heirs. It is important to understand that this renunciation is irrevocable; once filed, the individual cannot later claim the property they have disclaimed. Therefore, careful consideration should be given before proceeding with this legal action.

State-specific rules for the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession

Hawaii has specific regulations governing the renunciation and disclaimer of property received through intestate succession. These rules dictate the time frame within which the form must be filed, typically within a certain number of months following the decedent's death. Additionally, the form must comply with state statutes regarding the format and content. It is advisable to consult with a legal professional familiar with Hawaii's estate laws to ensure compliance and understand any potential implications of renouncing an inheritance.

Required Documents

When completing the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession, several documents may be required to support the process:

- The completed renunciation form.

- A copy of the decedent's death certificate.

- Documentation proving your relationship to the decedent, if applicable.

- Any relevant court documents related to the estate.

Quick guide on how to complete hawaii hawaii renunciation and disclaimer of property received by intestate succession

Effortlessly Prepare Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession on Any Device

Web-based document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly without any delays. Manage Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Modify and eSign Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession with Ease

- Find Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or disorganized files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your choice. Modify and eSign Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession?

The Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession is a legal document that allows an individual to renounce their rights to property received through intestate succession. This process can help clarify ownership and manage estate distribution according to state law, ensuring a smoother transition of assets.

-

How does airSlate SignNow facilitate the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession?

airSlate SignNow simplifies the process of creating and signing the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession by providing easy-to-use templates. Users can fill out the necessary information and send the document for eSignature, ensuring compliance and legal validity quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession?

Yes, airSlate SignNow offers various pricing plans that are tailored to meet the needs of businesses and individuals. These plans provide access to features that simplify the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession process, making it an affordable choice for your documentation needs.

-

What are the benefits of using airSlate SignNow for the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession?

Using airSlate SignNow for your Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession allows for a secure and legally binding way to manage your property disclaimers. The platform enhances efficiency, reduces paper waste, and provides users with real-time tracking of document status.

-

Can I integrate airSlate SignNow with other software for managing the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession?

Yes, airSlate SignNow offers seamless integrations with various business applications, allowing you to manage the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession within your existing workflows. This enhances productivity and ensures that your documentation process aligns with other operational tools.

-

How secure is the process of signing the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession with airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession. The platform uses advanced encryption and secure cloud storage, ensuring that your personal information and signed documents are protected at all times.

-

What features does airSlate SignNow offer for the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and automated reminders for the Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession. These tools streamline the documentation process, saving time and ensuring accuracy.

Get more for Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession

Find out other Hawaii Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now