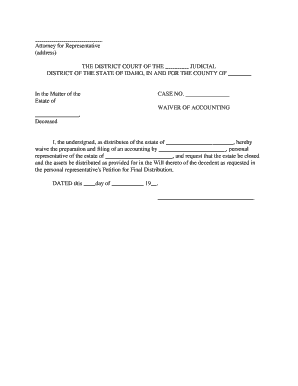

Idaho Waiver of Accounting Form

What is the Idaho Waiver Of Accounting

The Idaho Waiver Of Accounting is a legal document that allows a personal representative or trustee to waive the requirement of providing a detailed accounting of their financial activities to the beneficiaries of an estate or trust. This waiver can streamline the process of estate administration by reducing the administrative burden on the personal representative while ensuring that beneficiaries are still informed about the management of the estate or trust. It is particularly useful in situations where beneficiaries trust the personal representative's management and do not require detailed financial disclosures.

How to use the Idaho Waiver Of Accounting

To use the Idaho Waiver Of Accounting, the personal representative or trustee must first ensure that all beneficiaries are in agreement. This document is typically signed by all beneficiaries, indicating their consent to waive the accounting requirement. The completed waiver should then be filed with the appropriate court or retained with the estate records. It is important to keep a copy for personal records, as it serves as proof of the beneficiaries' agreement.

Steps to complete the Idaho Waiver Of Accounting

Completing the Idaho Waiver Of Accounting involves several key steps:

- Gather necessary information about the estate or trust, including details about the beneficiaries.

- Draft the waiver document, ensuring it includes all required information, such as the names of the personal representative and beneficiaries.

- Have all beneficiaries review the document and provide their signatures, indicating their consent.

- File the signed waiver with the appropriate court or retain it with estate documentation.

Legal use of the Idaho Waiver Of Accounting

The Idaho Waiver Of Accounting is legally binding when executed properly. It must be signed by all beneficiaries who are entitled to receive information about the estate or trust. This document helps protect the personal representative from potential claims of mismanagement, as it shows that beneficiaries have consented to waive their right to detailed financial disclosures. However, it is crucial that beneficiaries fully understand the implications of signing the waiver.

Key elements of the Idaho Waiver Of Accounting

Key elements of the Idaho Waiver Of Accounting include:

- Identification of parties: Clearly state the names of the personal representative and all beneficiaries.

- Statement of waiver: A clear declaration that beneficiaries waive their right to an accounting.

- Signatures: All beneficiaries must sign the document, indicating their consent.

- Date: The date of signing should be included to establish a timeline.

State-specific rules for the Idaho Waiver Of Accounting

In Idaho, specific rules govern the use of the Waiver Of Accounting. It is essential to ensure that the waiver complies with Idaho state laws regarding estate administration. This includes understanding the rights of beneficiaries and any legal requirements for the personal representative. Consulting with a legal professional familiar with Idaho estate law can provide guidance on the proper use of this document.

Quick guide on how to complete idaho waiver of accounting

Complete Idaho Waiver Of Accounting effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Idaho Waiver Of Accounting on any platform using airSlate SignNow Android or iOS applications and enhance any document-oriented task today.

Steps to modify and eSign Idaho Waiver Of Accounting with ease

- Obtain Idaho Waiver Of Accounting and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you'd like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Idaho Waiver Of Accounting and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Idaho Waiver Of Accounting?

The Idaho Waiver Of Accounting is a legal document that allows an executor or personal representative to waive formal accounting requirements in probate matters. By using this waiver, the estate can avoid lengthy accounting processes, making it simpler and more efficient for all parties involved.

-

How does airSlate SignNow facilitate the Idaho Waiver Of Accounting process?

airSlate SignNow streamlines the Idaho Waiver Of Accounting process by providing a user-friendly platform for document creation, signing, and management. You can easily generate the waiver, get it eSigned, and store it securely, ensuring that all necessary legal steps are taken efficiently and effectively.

-

What are the pricing options for using airSlate SignNow for the Idaho Waiver Of Accounting?

airSlate SignNow offers various pricing plans to accommodate different business needs, including an affordable option for individual users handling documents like the Idaho Waiver Of Accounting. Each plan includes access to essential features that help streamline the eSigning process at competitive rates.

-

Are there any features specifically designed for handling legal documents like the Idaho Waiver Of Accounting?

Yes, airSlate SignNow provides features tailored for legal documents, including templates, customizable workflows, and secure eSigning options. These features ensure that your Idaho Waiver Of Accounting is completed accurately and in compliance with legal standards.

-

What benefits does airSlate SignNow offer when preparing an Idaho Waiver Of Accounting?

Using airSlate SignNow for your Idaho Waiver Of Accounting means less paperwork and quicker turnaround times. The platform enables you to save time, reduce errors, and ensure that your documents are legally binding, all while maintaining a straightforward user experience.

-

Can I integrate airSlate SignNow with other tools I use for managing the Idaho Waiver Of Accounting?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM systems, cloud storage services, and project management tools. This integration capability allows you to manage your Idaho Waiver Of Accounting within your existing workflow without any disruption.

-

Is airSlate SignNow secure for handling sensitive documents like the Idaho Waiver Of Accounting?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your documents, including the Idaho Waiver Of Accounting, are protected with advanced encryption and secure access controls. This commitment helps you handle sensitive information with confidence.

Get more for Idaho Waiver Of Accounting

- Employment employee personnel file package massachusetts form

- Assignment of mortgage package massachusetts form

- Assignment of lease package massachusetts form

- Massachusetts purchase form

- Satisfaction cancellation or release of mortgage package massachusetts form

- Premarital agreements package massachusetts form

- Painting contractor package massachusetts form

- Framing contractor package massachusetts form

Find out other Idaho Waiver Of Accounting

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word