Form W 4 Employee's Withholding Allowance Certificate

What is the Form W-4 Employee's Withholding Allowance Certificate

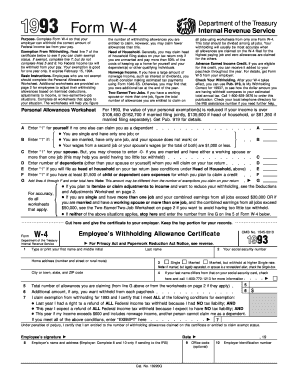

The Form W-4 Employee's Withholding Allowance Certificate is a crucial document used by employees in the United States to inform their employers about their tax withholding preferences. This form helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck. By accurately completing the W-4, employees can ensure that they pay the right amount of taxes throughout the year, potentially avoiding a large tax bill or refund when filing their annual tax return.

How to use the Form W-4 Employee's Withholding Allowance Certificate

To use the Form W-4, employees should first obtain the latest version of the form from the IRS website or their employer. Once they have the form, they need to fill it out with accurate personal information, including their filing status and the number of allowances they wish to claim. Employees may also choose to have additional amounts withheld if they anticipate owing more taxes. After completing the form, employees should submit it to their employer, who will then adjust their withholding accordingly.

Steps to complete the Form W-4 Employee's Withholding Allowance Certificate

Completing the Form W-4 involves several key steps:

- Begin by entering your personal information, including your name, address, Social Security number, and filing status.

- Next, determine the number of allowances you wish to claim. This can depend on your personal situation, such as dependents and other deductions.

- If applicable, indicate any additional amount you want withheld from each paycheck.

- Finally, sign and date the form before submitting it to your employer.

Key elements of the Form W-4 Employee's Withholding Allowance Certificate

The key elements of the Form W-4 include:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married filing jointly, married filing separately, or head of household.

- Allowances: The number of allowances claimed, which affects the withholding amount.

- Additional Withholding: An option to specify any extra amount to be withheld from paychecks.

Legal use of the Form W-4 Employee's Withholding Allowance Certificate

The Form W-4 is legally recognized by the IRS as the official document for employees to declare their withholding preferences. Employers are required to use the information provided on the form to calculate the appropriate federal tax withholding. It is important for employees to ensure that the information is accurate to comply with tax laws and avoid potential penalties.

Filing Deadlines / Important Dates

While there are no specific deadlines for submitting the Form W-4, employees should complete it as soon as they start a new job or experience a significant life change, such as marriage or the birth of a child. Additionally, employees can update their W-4 at any time during the year if their financial situation changes, which can affect their tax withholding.

Quick guide on how to complete form w 4 employees withholding allowance certificate 5550897

Complete [SKS] effortlessly on any device

Web-based document management has gained traction with businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-oriented task today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your adjustments.

- Select how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiring form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form W 4 Employee's Withholding Allowance Certificate

Create this form in 5 minutes!

How to create an eSignature for the form w 4 employees withholding allowance certificate 5550897

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 4 Employee's Withholding Allowance Certificate?

The Form W 4 Employee's Withholding Allowance Certificate is a form that employees use to inform their employers about their tax situation. This form helps determine the amount of federal income tax that should be withheld from your paycheck, making it essential for accurate tax withholding. Utilizing airSlate SignNow can streamline the process of filling out and submitting your Form W 4.

-

How does airSlate SignNow help with the Form W 4 Employee's Withholding Allowance Certificate?

airSlate SignNow simplifies the process of eSigning and sending the Form W 4 Employee's Withholding Allowance Certificate. Our platform allows users to create, customize, and securely send this form directly to their employers. This not only saves time but also reduces the likelihood of errors.

-

What are the pricing plans for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to fit all business sizes and needs, including options for single users and larger teams. Each plan provides access to features like eSigning and document management, including the ability to handle Form W 4 Employee's Withholding Allowance Certificates efficiently. Visit our pricing page for detailed information on which plan is right for you.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow provides robust features for document management, including templates, advanced eSigning capabilities, and secure storage. Specifically for forms like the Form W 4 Employee's Withholding Allowance Certificate, our platform ensures all documents are easily accessible and manageable. These features enhance productivity and help businesses keep track of important paperwork.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow can seamlessly integrate with various software applications, enhancing workflow efficiency. Integrating with payroll systems, HR software, or accounting tools allows for smooth handling of documents like the Form W 4 Employee's Withholding Allowance Certificate. Check our integrations page to discover all compatible applications.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, such as the Form W 4 Employee's Withholding Allowance Certificate, offers several key benefits. It ensures faster processing times due to the digital signing capability and reduces paper usage, contributing to eco-friendly practices. Furthermore, our solution provides enhanced security measures, keeping your sensitive information safe.

-

Is airSlate SignNow compliant with legal standards for eSigning?

Yes, airSlate SignNow complies with all relevant legal standards for eSigning, including the ESIGN Act and UETA. This compliance ensures that your Form W 4 Employee's Withholding Allowance Certificate signed through our platform is legally recognized. We prioritize security and legal standards to give our users peace of mind.

Get more for Form W 4 Employee's Withholding Allowance Certificate

- Application for farmland assessment form fa 1

- Da form 3779 location placard

- Edqol form

- Msds for odoban form

- Sewing machine form

- Sample letter to va for hearing loss form

- Hillsborough county tree removal form

- Nace standard rp0177 nace standard rp0177 mitigation of alternating current and lightning effects on metallic structures and 448637322 form

Find out other Form W 4 Employee's Withholding Allowance Certificate

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself