Illinois Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate Form

What is the Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate

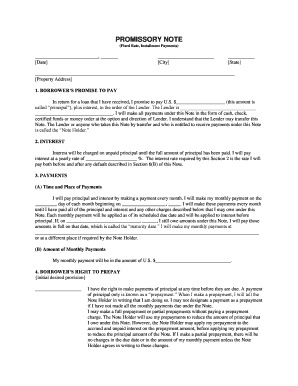

The Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines a borrower's promise to repay a loan over a specified period with fixed interest. This type of promissory note is secured by residential real estate, meaning the property serves as collateral for the loan. If the borrower defaults, the lender has the right to take possession of the property to recover the owed amount. This document is essential in real estate transactions where financing is involved, providing clarity and security for both parties.

Key Elements of the Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Understanding the key elements of this promissory note is crucial for both borrowers and lenders. The main components typically include:

- Loan Amount: The total amount borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the loan.

- Repayment Schedule: Details on how and when payments will be made, including the frequency (monthly, quarterly, etc.).

- Collateral Description: A clear description of the residential real estate securing the loan.

- Default Terms: Conditions under which the borrower may be considered in default and the lender's rights in such cases.

- Signatures: The signatures of both the borrower and lender, which validate the agreement.

Steps to Complete the Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Completing the promissory note involves several steps to ensure accuracy and legality:

- Gather Necessary Information: Collect all relevant details about the loan, including the amount, interest rate, and repayment terms.

- Draft the Document: Use a template or legal software to create the promissory note, ensuring all key elements are included.

- Review the Terms: Both parties should carefully review the terms and conditions to ensure understanding and agreement.

- Sign the Document: Both the borrower and lender must sign the note. Digital signatures are valid if executed through a compliant eSignature platform.

- Store the Document Safely: Keep a copy of the signed promissory note in a secure location for future reference.

Legal Use of the Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate

This promissory note is legally binding when executed properly. To ensure its enforceability, it must comply with state laws and regulations governing promissory notes and secured transactions. Important legal considerations include:

- The document must be clear and unambiguous.

- It should be signed by both parties, with witnesses if required by state law.

- Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is essential for digital signatures.

How to Use the Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Using this promissory note involves several practical applications. It can be utilized in various scenarios, such as:

- Real estate transactions where financing is necessary.

- Private lending arrangements between individuals.

- Refinancing existing loans secured by residential properties.

By following the outlined steps and ensuring compliance with legal standards, both borrowers and lenders can effectively use this document to facilitate secure financial transactions.

Quick guide on how to complete illinois illinois installments fixed rate promissory note secured by residential real estate

Complete Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without any delays. Handle Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate without trouble

- Find Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate and click on Get Form to start.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate and ensure effective communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

An Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legally binding document that outlines the terms of a loan that is secured by residential property in Illinois. This note specifies the repayment schedule, interest rates, and conditions under which the loan is extended. It ensures both parties are aware of their rights and obligations.

-

How do I create an Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate using airSlate SignNow?

To create an Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate, simply log into airSlate SignNow and select the document template for promissory notes. Customize the document with your specific terms and conditions, and then use our eSigning feature to share it with involved parties for quick and secure signing.

-

What are the benefits of using airSlate SignNow for my Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Using airSlate SignNow for your Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate provides several benefits including efficiency, security, and ease of use. With our platform, you can automate the signing process, ensure compliance, and have secure storage for your documents. This ultimately saves you time and resources.

-

Are there any costs associated with drafting an Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate on airSlate SignNow?

While airSlate SignNow offers various pricing plans, the cost of drafting an Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate can vary. We provide a cost-effective solution ranging from basic plans to advanced features suited to your business needs. Sign up for a free trial to explore our offerings.

-

Can I integrate airSlate SignNow with other tools for my Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Yes, airSlate SignNow supports integration with various tools and platforms. You can easily connect our services with your CRM, project management software, or other essential applications to streamline the process of managing your Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate. This enhances overall workflow efficiency.

-

What features does airSlate SignNow offer for enhancing my Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate experience?

AirSlate SignNow provides features such as customizable templates, automated workflows, and digital signatures to optimize your Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate process. We also offer tracking and notification systems to keep you updated on the signing status, ensuring a smooth transaction for all parties involved.

-

Is it safe to use airSlate SignNow for my Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Absolutely! AirSlate SignNow employs advanced security measures, including encryption and secure data storage, to protect your Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate. Our platform complies with industry standards to ensure that your documents remain confidential and secure throughout the signing process.

Get more for Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- Maryland confidentiality form

- Md bylaws form

- Corporate records maintenance package for existing corporations maryland form

- Articles incorporation corporation 497310117 form

- Maryland nonstock corporation form

- Maryland limited liability company llc formation package maryland

- Maryland llc 497310120 form

- Md llc form

Find out other Illinois Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form