Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate Form

What is the Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate

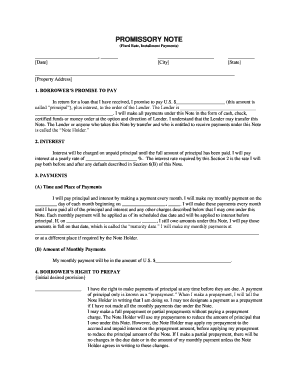

The Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document used in real estate transactions. It serves as a written promise by the borrower to repay a specified amount of money to the lender over a defined period, usually through regular installments. This type of promissory note is secured by the residential property itself, meaning that if the borrower defaults on the loan, the lender has the right to take possession of the property. The fixed rate aspect indicates that the interest rate remains constant throughout the repayment term, providing predictability for both parties involved.

How to use the Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Using the Massachusetts Installments Fixed Rate Promissory Note involves several steps. First, both the borrower and lender must agree on the loan terms, including the principal amount, interest rate, and repayment schedule. Once these details are finalized, the borrower fills out the promissory note, ensuring all required information is accurate. After completing the document, both parties must sign it to make it legally binding. It is advisable to keep a copy for personal records and to provide a copy to the lender for their records as well.

Steps to complete the Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Completing the Massachusetts Installments Fixed Rate Promissory Note involves a systematic approach:

- Gather necessary information, including borrower and lender details, loan amount, and property information.

- Determine the fixed interest rate and repayment terms.

- Fill out the promissory note, ensuring all fields are completed accurately.

- Review the document for any errors or omissions.

- Sign the document in the presence of a notary public, if required.

- Distribute copies to all parties involved for their records.

Key elements of the Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Several key elements are essential in the Massachusetts Installments Fixed Rate Promissory Note:

- Principal Amount: The total amount borrowed by the borrower.

- Interest Rate: The fixed rate at which interest will accrue on the principal amount.

- Repayment Schedule: The timeline for making payments, typically monthly or bi-weekly.

- Security Clause: A statement indicating that the loan is secured by the residential property.

- Signatures: Signatures of both the borrower and lender, which make the document legally binding.

Legal use of the Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate

The legal use of the Massachusetts Installments Fixed Rate Promissory Note is crucial for ensuring that both parties' rights are protected. This document must comply with state laws governing promissory notes and real estate transactions. It is important that the terms outlined in the note are clear and unambiguous to avoid disputes later on. Additionally, the note should be executed properly, including signatures and, if necessary, notarization to enhance its legal validity.

State-specific rules for the Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate

In Massachusetts, specific rules govern the use of promissory notes secured by real estate. These include compliance with state lending laws, which dictate the maximum interest rates and required disclosures. The document must also adhere to the Uniform Commercial Code (UCC) as applicable in Massachusetts. It is advisable for both parties to consult legal professionals to ensure that the promissory note meets all state requirements and protects their interests.

Quick guide on how to complete massachusetts massachusetts installments fixed rate promissory note secured by residential real estate

Effortlessly Prepare Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents quickly and efficiently. Manage Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate Without Effort

- Obtain Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate and click Get Form to begin.

- Utilize the features we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the specialized tools offered by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

A Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that ensures repayment of a loan in fixed monthly installments, backed by a residential property. This type of note provides lenders with security and borrowers with manageable payment options.

-

How can airSlate SignNow help me create a Massachusetts Massachusetts Installments Fixed Rate Promissory Note?

airSlate SignNow offers a user-friendly platform for crafting a Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate. With customizable templates and the ability to eSign documents easily, businesses can streamline the creation process and ensure compliance.

-

What are the benefits of using a Massachusetts Massachusetts Installments Fixed Rate Promissory Note?

Using a Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate provides clarity and security for both parties in a financial transaction. It outlines specific payment terms and conditions, reducing the risk of misunderstandings and ensuring a smooth repayment process.

-

Are there any associated costs with creating a Massachusetts Massachusetts Installments Fixed Rate Promissory Note using airSlate SignNow?

While the cost of creating a Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate via airSlate SignNow is signNowly lower than traditional legal fees, there may be subscription costs depending on your usage. Check our pricing plans to find the right fit for your needs.

-

Can I integrate airSlate SignNow with other software for managing my Massachusetts Massachusetts Installments Fixed Rate Promissory Note?

Yes, airSlate SignNow allows for integrations with various business software tools, making it easier to manage your Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate alongside other financial documents. This creates a seamless workflow for your business.

-

What features should I look for in a Massachusetts Massachusetts Installments Fixed Rate Promissory Note?

When creating a Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate, look for features that allow for customization, eSignature capabilities, and secure document storage. These elements ensure legal compliance and ease of access for all parties involved.

-

Is a Massachusetts Massachusetts Installments Fixed Rate Promissory Note enforceable in court?

Yes, a Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate is legally enforceable in court when properly executed. It provides a binding agreement that can be upheld by law, provided all legal requirements are met.

Get more for Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- Mi tenant form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession michigan form

- Letter from tenant to landlord about illegal entry by landlord michigan form

- Letter from landlord to tenant about time of intent to enter premises michigan form

- Letter from tenant to landlord containing notice to cease unjustified nonacceptance of rent michigan form

- Letter from tenant to landlord about sexual harassment michigan form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children michigan form

- Michigan letter tenant landlord 497311402 form

Find out other Massachusetts Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP