Information Lien

What is the Information Lien

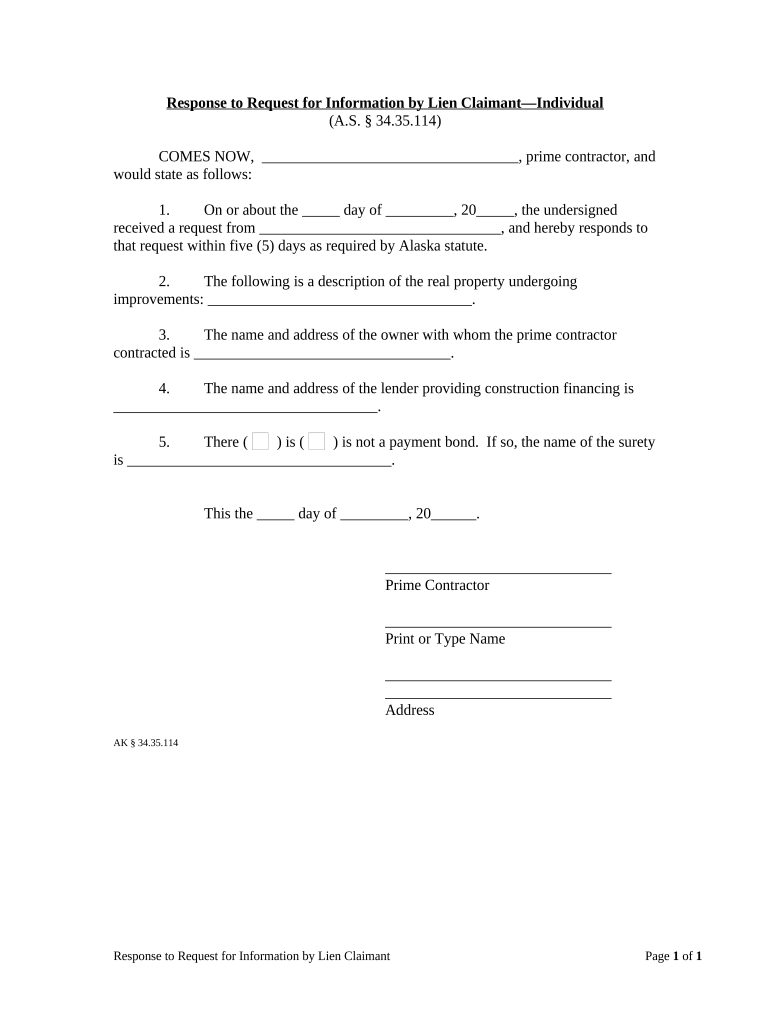

The information lien is a legal claim against an individual's or business's property, typically used to secure the payment of a debt or obligation. This document serves as a notification to other parties that a claim exists, which can affect the ability to sell or transfer the property until the debt is resolved. Information liens are often utilized in various contexts, including tax obligations, unpaid bills, or other financial responsibilities. Understanding the nature of this lien is crucial for both creditors and debtors, as it can have significant implications for financial transactions and property ownership.

How to use the Information Lien

Utilizing the information lien involves several steps to ensure that it is properly executed and recognized. First, it is essential to gather all relevant information about the debt or obligation, including the amount owed and the parties involved. Next, the lien must be drafted according to state-specific regulations, which may require specific language or formatting. Once completed, the document should be filed with the appropriate government agency, such as a county recorder's office or state department, to ensure it is officially recognized. Keeping copies of the filed lien is important for future reference and compliance.

Steps to complete the Information Lien

Completing the information lien involves a systematic approach to ensure accuracy and compliance with legal requirements. The following steps outline the process:

- Gather necessary information about the debt, including the debtor's details and the amount owed.

- Draft the lien document, ensuring it includes all required elements such as the names of the parties, the nature of the obligation, and any pertinent dates.

- Review state-specific regulations to confirm that the document meets legal standards.

- File the completed lien with the appropriate authority, ensuring that it is recorded in the public records.

- Retain copies of the filed lien for your records and future reference.

Legal use of the Information Lien

The legal use of the information lien is governed by state laws, which outline how and when a lien can be placed on property. It is important to understand that the lien must be based on a legitimate debt or obligation, and the debtor must be notified of the lien's existence. Failure to comply with legal requirements can result in the lien being deemed invalid. Additionally, the lien may need to be renewed or released once the debt is paid, which involves further legal steps to ensure that the property is cleared of any claims.

Required Documents

To complete the information lien process, several documents are typically required. These may include:

- A completed lien form, which must include detailed information about the debtor and the obligation.

- Proof of the debt, such as invoices, contracts, or other documentation that supports the claim.

- Identification documents for the creditor, which may be necessary for filing purposes.

- Any additional state-specific forms that may be required for the filing process.

Penalties for Non-Compliance

Failing to comply with the legal requirements surrounding the information lien can lead to several consequences. These may include the invalidation of the lien, which would prevent the creditor from enforcing their claim against the property. Additionally, there may be financial penalties imposed by the state for improper filing or failure to notify the debtor. In some cases, creditors may also face legal action from debtors if the lien is deemed to have been filed in bad faith or without sufficient grounds.

Quick guide on how to complete information lien

Complete Information Lien seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can locate the suitable form and securely store it online. airSlate SignNow equips you with all the necessities to create, modify, and eSign your papers promptly without delays. Handle Information Lien on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Information Lien effortlessly

- Locate Information Lien and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, arduous form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Information Lien and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an information lien and how does it work with airSlate SignNow?

An information lien is a legal claim against a property or asset until certain obligations are fulfilled. With airSlate SignNow, you can easily create and send documents related to information liens, ensuring that all necessary signatures are collected swiftly and securely.

-

How can airSlate SignNow help me manage my information lien documents?

airSlate SignNow provides a user-friendly platform to organize, send, and track your information lien documents. You can streamline your workflow with templates, ensuring that every document required for a lien is efficiently handled throughout the process.

-

What are the pricing options for using airSlate SignNow for information lien documentation?

airSlate SignNow offers flexible pricing plans, allowing businesses to choose a solution that matches their needs for handling information liens. Whether you're a small business or a larger enterprise, you’ll find a plan that fits your budget while enabling comprehensive document management.

-

Is it secure to use airSlate SignNow for processing information lien documents?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards to protect your information lien records. You can confidently send and receive documents knowing your sensitive data is safeguarded.

-

Can I integrate airSlate SignNow with other applications for managing information liens?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as CRM systems and cloud storage services, enhancing your operational efficiency. This ensures that your information lien documentation is easily accessible and well-coordinated with your existing tools.

-

What features specifically support handling information liens in airSlate SignNow?

airSlate SignNow offers features tailored for managing information liens, including customizable templates, automated workflows, and real-time tracking of document status. These tools simplify the creation and management of your lien documents, making the process more efficient.

-

How does eSigning work for information lien documents in airSlate SignNow?

eSigning your information lien documents with airSlate SignNow is straightforward. After creating your document, simply upload it, add signers, and send it for signing. Signers can review and sign from any device, speeding up the process considerably.

Get more for Information Lien

Find out other Information Lien

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document