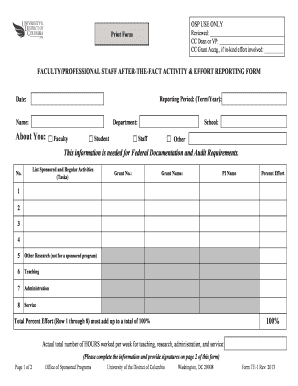

This Information is Needed for Federal Documentation and Audit

What is the information needed for federal documentation and audit

The information required for federal documentation and audit typically includes various personal and financial details that ensure compliance with federal regulations. This may encompass identification numbers, such as Social Security numbers or Employer Identification Numbers (EIN), as well as income statements, tax returns, and any supporting documentation related to deductions or credits claimed. Accurate and complete information is essential for audits, as it helps substantiate claims made on federal forms.

How to use the information needed for federal documentation and audit

To effectively use the information needed for federal documentation and audit, individuals and businesses should gather all relevant documents before starting the process. This includes tax returns, W-2s, 1099s, and any other financial records. Organizing these documents in a systematic manner can facilitate easier access during audits. It is also advisable to maintain digital copies of all documents, as electronic records can simplify the submission process and provide a backup in case of discrepancies.

Steps to complete the information needed for federal documentation and audit

Completing the information required for federal documentation and audit involves several key steps:

- Gather all necessary documents, including tax returns and financial statements.

- Ensure that all information is accurate and up-to-date.

- Organize documents by category, such as income, expenses, and deductions.

- Review the information for completeness before submission.

- Submit the documentation through the appropriate channels, whether online or via mail.

Key elements of the information needed for federal documentation and audit

Key elements that must be included in federal documentation and audit submissions generally consist of:

- Identification Information: This includes names, addresses, and Social Security numbers or EINs.

- Income Documentation: W-2 forms, 1099 forms, and any other relevant income statements.

- Expense Records: Receipts and invoices for deductible expenses.

- Tax Returns: Copies of filed federal and state tax returns for the relevant years.

- Supporting Documentation: Any additional documents that support claims made on tax returns.

Filing deadlines / Important dates

Filing deadlines for federal documentation and audit submissions are critical to ensure compliance and avoid penalties. Typically, individual tax returns are due on April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Businesses may have different deadlines based on their entity type. It is essential to stay informed about these dates to ensure timely submissions.

Penalties for non-compliance

Failure to provide the required information for federal documentation and audit can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal repercussions. In severe cases, non-compliance may lead to audits or investigations by federal authorities. Therefore, it is crucial to adhere to all documentation requirements and deadlines to minimize risk.

Quick guide on how to complete this information is needed for federal documentation and audit

Manage [SKS] seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure confidential information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to This Information Is Needed For Federal Documentation And Audit

Create this form in 5 minutes!

How to create an eSignature for the this information is needed for federal documentation and audit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it help with federal documentation?

airSlate SignNow is a user-friendly eSignature solution that enables businesses to send and sign documents electronically. This Information Is Needed For Federal Documentation And Audit, ensuring compliance and efficiency in your documentation processes.

-

How does airSlate SignNow ensure compliance with federal regulations?

airSlate SignNow is designed to meet federal compliance standards, making it a reliable choice for businesses. This Information Is Needed For Federal Documentation And Audit, as it provides secure and legally binding eSignatures that adhere to regulatory requirements.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs. By choosing the right plan, you can ensure that This Information Is Needed For Federal Documentation And Audit is managed effectively without overspending.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow. This Information Is Needed For Federal Documentation And Audit can be easily managed alongside your existing tools for improved efficiency.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features including customizable templates, automated workflows, and secure storage. These features ensure that This Information Is Needed For Federal Documentation And Audit is handled efficiently and securely.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can streamline their document signing processes, saving time and resources. This Information Is Needed For Federal Documentation And Audit is simplified, allowing you to focus on core business activities.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it ideal for small businesses. This Information Is Needed For Federal Documentation And Audit can be easily managed without the need for extensive resources.

Get more for This Information Is Needed For Federal Documentation And Audit

- To be kept by form

- The importance of a legal description in real estate contracts form

- Quitclaim grant and convey unto a limited liability company form

- Hereinafter referred to as grantor does hereby grant convey form

- Response to owners request corporation llc etc form

- San francisco sf dph form

- Objection to lien individual form

- Record if any form

Find out other This Information Is Needed For Federal Documentation And Audit

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online