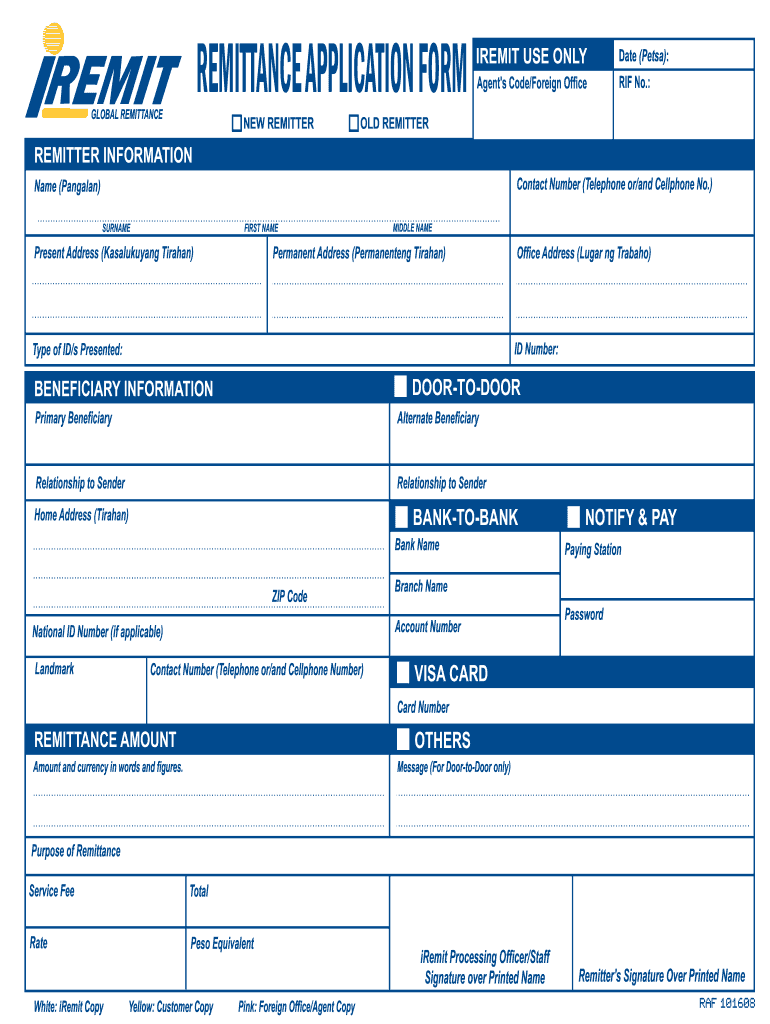

Iremit Form

What is the Iremit?

The Iremit is a digital remittance service designed to facilitate money transfers, particularly for individuals sending funds internationally. It offers a user-friendly platform that allows users to send money quickly and securely. The service is especially popular among expatriates and individuals who need to support family members or friends abroad. By utilizing the Iremit, users can benefit from competitive exchange rates and low transaction fees, making it an attractive option for remitting funds.

How to use the Iremit

Using the Iremit is straightforward. First, users need to create an account on the platform. This involves providing personal information and verifying identity. Once the account is set up, users can initiate a transfer by entering the recipient's details, including their bank account information. Users can choose the amount to send and review the transaction details before confirming the transfer. After submission, users receive a reference number, which is essential for tracking the transaction.

Steps to complete the Iremit

Completing a remittance through the Iremit involves several key steps:

- Create an account by providing necessary personal details.

- Verify your identity as per the platform's requirements.

- Enter the recipient's information, including their bank account details.

- Select the amount to send and review the transaction fees.

- Confirm the transaction and obtain your reference number for tracking.

Following these steps ensures a smooth remittance process, allowing users to send money with confidence.

Legal use of the Iremit

The Iremit operates within the legal frameworks established for money transfers and remittances. Users must comply with regulations that govern financial transactions, including anti-money laundering laws and know-your-customer (KYC) requirements. Ensuring that all transactions are legal not only protects the sender and recipient but also upholds the integrity of the financial system. Users should familiarize themselves with these regulations to ensure compliance when using the Iremit.

Key elements of the Iremit

Several key elements define the Iremit service:

- Security: The platform employs advanced encryption and security measures to protect user data and transactions.

- Speed: Transfers are typically processed quickly, allowing recipients to access funds in a timely manner.

- Cost-effectiveness: Competitive exchange rates and low fees make it an economical choice for users.

- User-friendly interface: The platform is designed for ease of use, making it accessible to individuals with varying levels of tech-savviness.

Examples of using the Iremit

Individuals can use the Iremit for various purposes, such as:

- Sending money to family members living abroad for support.

- Paying for educational expenses for children studying overseas.

- Transferring funds for business transactions with international partners.

These examples illustrate the versatility of the Iremit in meeting different remittance needs.

Quick guide on how to complete i remit online form

Easily Prepare Iremit on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It presents an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any holdups. Handle Iremit on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Edit and Electronically Sign Iremit Effortlessly

- Obtain Iremit and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or conceal sensitive data using the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Iremit and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I buy Tesla shares from India?

Apple, Microsoft, Amazon, Facebook. We all have grown up using these companies’ products/services. Obviously everyone’s interested in stock market would like to invest there too.But wait, since they won’t be listed on Indian stock exchange, how to do it?There are basically 3 ways you can invest in Tesla,Open an account with Indian Brokerage firm who has a tie-up with foreign broker. Like ICICIdirect, HDFC sec, Reliance Money etc.. They provides the service where you can open your overseas trading account with their foreign brokerage partner.Open account with foreign brokers. Some international brokers are out there who permits Indian citizen to open account and trade in US market like Interactive Brokers, TD Ameritrade, Charles Schwab International Account.Buy Indian MF(Mutual Fund)/ETF(Exchange Traded fund) with global equities. Mutual Fund basically invests in stock market, Government bonds and other securities. There are few firms which invest in international market. You can invest indirectly there but you will never know if your money went in Tesla or not. But this is probably safest option I know because you will not have to open Overseas trading account plus you will save the minimum deposit roughly $10,000. Here are few popular mutual funds who trade in global market, ICICI Pru US Bluechip Equity – D (G), Motilal MOSt Oswal NASDAQ 100 ETF, Reliance US Equity Opp. Fund DP (G), Edelweiss Greater China Eqty-Direct andKotak US Equity Fund – Direct (G).Now that you know the ways to invest, here are some food for thoughts.The reason why people invest in foreign stock exchanges.People want to invest in their favorite companies, of course Elon Musk/Steve Job are everyone’s idol. We all believe in them, their vision. Also Google, Amazon, Twitter, Facebook are darlings of this generation.Diversification - Investing in foreign companies helps in diversification. Investing in foreign companies mitigate the risk when Indian market gets crash.Bigger Opportunities - The point is there are thousands of better companies out there. There is no boundary anymore.Investors believe that foreign companies have better resources, facility, government cooperation. That makes them high rated.Some Critical Points to know before you invest in TeslaUp to $2,50,000 can be invested overseas by Indian resident as per RBI. That is roughly 1.7 crores. That’s enough, right?High Charges - Here you will be transecting in foreign money. You will be paying brokerage charges in their currency that is USD (1 USD~68.5 INR). So, will the AMC(annual Maintenance charges).Profit are subjected to currency exchange rate - Price of INR against USD will constantly change, so suppose you invested when it was 1$=₹68 , so when you sell the stock maybe the price changes to 1$=₹60. In such case you already lost 11.7%. That’s why when you invest in foreign stocks, profits are always subjected to the currency exchange rate.To know more about such topics please visit, Blog - Trade Brainsor Join Pundits of Stock market at Indian Stock Market Tribe- TRADE BRAINS.

-

How do I fill out an Indian passport form online?

You need to be careful while filling up the Passport form online. If is better if you download the Passport form and fill it up offline. You can upload the form again after you completely fill it up. You can check the complete procedure to know : How to Apply for Indian Passport Online ?

-

What is the procedure for filling out the CPT registration form online?

CHECK-LIST FOR FILLING-UP CPT JUNE - 2017 EXAMINATION APPLICATION FORM1 - BEFORE FILLING UP THE FORM, PLEASE DETERMINE YOUR ELIGIBILITY AS PER DETAILS GIVEN AT PARA 1.3 (IGNORE FILLING UP THE FORM IN CASE YOU DO NOT COMPLY WITH THE ELIGIBILITY REQUIREMENTS).2 - ENSURE THAT ALL COLUMNS OF THE FORM ARE FILLED UP/SELECTED CORRECTLY AND ARE CORRECTLY APPEARING IN THE PDF.3 - CENTRE IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF. (FOR REFERENCE SEE APPENDIX-A).4 - MEDIUM OF THE EXAMINATION IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.5 - THE SCANNED COPY OF THE DECLARATION UPLOADED PERTAINS TO THE CURRENT EXAM CYCLE.6 - ENSURE THAT PHOTOGRAPHS AND SIGNATURES HAVE BEEN AFFIXED (If the same are not appearing in the pdf) AT APPROPRIATE COLUMNS OF THE PRINTOUT OF THE EXAM FORM.7 - ADDRESS HAS BEEN RECORDED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.8 - IN CASE THE PDF IS NOT CONTAINING THE PHOTO/SIGNATURE THEN CANDIDATE HAS TO GET THE DECLARATION SIGNED AND PDF IS GOT ATTESTED.9 - RETAIN A COPY OF THE PDF/FILLED-IN FORM FOR YOUR FUTURE REFERENCE.10 - IN CASE THE PHOTO/SIGN IS NOT APPEARING IN THE PDF, PLEASE TAKE ATTESTATIONS AND SEND THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION BY SPEED POST/REGISTERED POST ONLY.11 - KEEP IN SAFE CUSTODY THE SPEED POST/REGISTERED POST RECEIPT ISSUED BY POSTAL AUTHORITY FOR SENDING THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION FORM TO THE INSTITUTE/ RECEIPT ISSUED BY ICAI IN CASE THE APPLICATION IS DEPOSITED BY HAND.Regards,Scholar For CA089773 13131Like us on facebookScholar for ca,cma,cs https://m.facebook.com/scholarca...Sambamurthy Nagar, 5th Street, Kakinada, Andhra Pradesh 533003https://g.co/kgs/VaK6g0

-

How do I fill out the online form on Mymoneysage?

Hi…If you are referring to eCAN form, then please find the below details for your reference.The CAN is a new mutual fund investment identification number using which investor can hold schemes from different AMCs. To utilise the services of Mymoneysage (Client)for investing in direct plans of mutual funds, you require a CAN. If you want to invest as a single holder in some schemes and as joint holders in others, then you will need two CANs to do so.For eCAN, you need to provide some basic details in the form like1) CAN holder type2) Demographic Details3) Bank details (in which you want to transact with)4) And Nominee details.Applying eCAN is completely Free.To apply one please visit Log In

Create this form in 5 minutes!

How to create an eSignature for the i remit online form

How to create an eSignature for the I Remit Online Form online

How to create an electronic signature for your I Remit Online Form in Chrome

How to make an eSignature for signing the I Remit Online Form in Gmail

How to create an electronic signature for the I Remit Online Form right from your mobile device

How to generate an eSignature for the I Remit Online Form on iOS devices

How to generate an electronic signature for the I Remit Online Form on Android

People also ask

-

What is a Remitly reference number sample?

A Remitly reference number sample is a unique identifier assigned to each transaction made through Remitly. This number helps track and manage your money transfers efficiently, ensuring that you can easily reference specific transactions when needed.

-

How can I obtain my Remitly reference number?

You can obtain your Remitly reference number after completing a money transfer through the Remitly platform. The reference number will be displayed on your confirmation screen and can also be found in your email receipt, making it easy to access when needed.

-

Are there any charges for using Remitly services?

Yes, Remitly charges fees depending on the type of transfer and the delivery option chosen. For transparent pricing, you can review the cost details, including the fees associated with obtaining your Remitly reference number sample, directly on their website.

-

What features does Remitly offer for tracking payments?

Remitly provides several features for tracking payments, including real-time status updates on your transfers and the ability to view a Remitly reference number sample. You can also receive notifications via email or SMS to stay updated on your transaction progress.

-

Can I use Remitly for international transfers?

Yes, Remitly is designed for international transfers, allowing users to send money to various countries. When you complete an international transfer, you will receive a Remitly reference number sample that helps track your transaction seamlessly across borders.

-

How does airSlate SignNow integrate with Remitly?

airSlate SignNow can integrate with Remitly to streamline document management related to your money transfers. By using airSlate SignNow, you can easily eSign documents requiring your Remitly reference number sample, enhancing efficiency in processing financial transactions.

-

What are the benefits of using Remitly for my transfers?

Using Remitly offers several benefits, including competitive exchange rates, diverse delivery options, and a user-friendly interface. Additionally, each transaction includes a Remitly reference number sample that allows for easy tracking and management of your funds.

Get more for Iremit

- 6 messages to the court clerk that could help your filingone form

- On behalf of organization i would like to thank you for donating your time and energy form

- Enclosed herewith please find a notice of filing orderentry of judgment relative to your case form

- Form of agreement of limited partnership secgov

- Condolence death of a loved one from a colleague form

- 26 us code152 dependent definedus codeus form

- Partnership agreement template free download on form

- Sample letter for b2 to f1 dispatchd form

Find out other Iremit

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors