Verified Statement of Lien by Corporation or LLC Alabama Form

What is the Verified Statement Of Lien By Corporation Or LLC Alabama

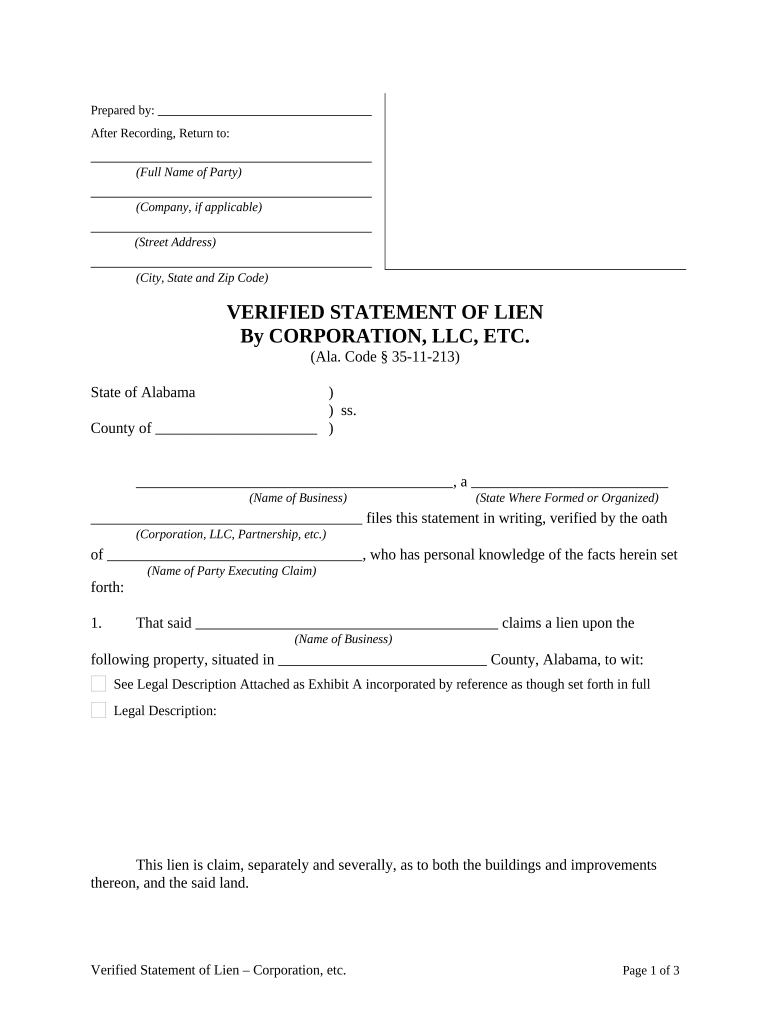

The Verified Statement of Lien by Corporation or LLC in Alabama is a legal document that serves to establish a lien against a property. This form is typically filed by corporations or limited liability companies (LLCs) to secure payment for services rendered or materials supplied. By filing this statement, the entity asserts its right to claim a portion of the property’s value should the debt remain unpaid. This document is essential for protecting the financial interests of businesses involved in construction, repair, or improvement of real property.

How to use the Verified Statement Of Lien By Corporation Or LLC Alabama

Using the Verified Statement of Lien involves several key steps. First, the corporation or LLC must gather relevant information, including the details of the debt, the property in question, and the parties involved. Next, the form must be accurately completed, ensuring all required fields are filled in correctly. After preparing the document, it should be signed by an authorized representative of the corporation or LLC. Finally, the completed form must be filed with the appropriate county office in Alabama to officially record the lien.

Steps to complete the Verified Statement Of Lien By Corporation Or LLC Alabama

Completing the Verified Statement of Lien involves a systematic approach:

- Gather necessary information, including the debtor's name, property description, and lien amount.

- Fill out the form accurately, ensuring all details are correct.

- Have the document signed by an authorized representative of the corporation or LLC.

- File the completed form with the appropriate county office in Alabama.

- Keep a copy of the filed document for your records.

Key elements of the Verified Statement Of Lien By Corporation Or LLC Alabama

The Verified Statement of Lien must include several critical elements to be considered valid:

- The name and address of the corporation or LLC filing the lien.

- A clear description of the property subject to the lien.

- The amount owed to the corporation or LLC.

- The name of the property owner or debtor.

- The date the debt was incurred and the date of filing.

Legal use of the Verified Statement Of Lien By Corporation Or LLC Alabama

The legal use of the Verified Statement of Lien is crucial for enforcing the rights of corporations and LLCs in Alabama. When filed correctly, this document provides legal notice to the property owner and other interested parties regarding the claim against the property. It can serve as a powerful tool in debt recovery, allowing the filing entity to pursue payment through legal channels if necessary. Compliance with state laws and regulations is essential to ensure the lien is enforceable.

State-specific rules for the Verified Statement Of Lien By Corporation Or LLC Alabama

In Alabama, specific rules govern the filing of the Verified Statement of Lien. These include:

- The lien must be filed within a certain timeframe after the debt is incurred, typically within six months.

- The form must be notarized before filing.

- It must be filed in the county where the property is located.

- Failure to comply with these regulations may result in the lien being deemed invalid.

Quick guide on how to complete verified statement of lien by corporation or llc alabama

Complete Verified Statement Of Lien By Corporation Or LLC Alabama effortlessly on any gadget

Online document administration has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the correct template and securely file it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents quickly without holdups. Manage Verified Statement Of Lien By Corporation Or LLC Alabama on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign Verified Statement Of Lien By Corporation Or LLC Alabama with ease

- Obtain Verified Statement Of Lien By Corporation Or LLC Alabama and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Mark important sections of your documents or obscure sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method to distribute your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about misplaced or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choosing. Alter and eSign Verified Statement Of Lien By Corporation Or LLC Alabama and guarantee effective communication at every phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Verified Statement Of Lien By Corporation Or LLC Alabama?

A Verified Statement Of Lien By Corporation Or LLC Alabama is a legal document that establishes a lien on property, securing payment for debts owed by a corporation or LLC. This statement must be filed with the appropriate state authorities to be effective, protecting the institution’s financial interests.

-

How does airSlate SignNow help with the Verified Statement Of Lien By Corporation Or LLC Alabama?

airSlate SignNow simplifies the process of creating and signing a Verified Statement Of Lien By Corporation Or LLC Alabama. Users can easily prepare, eSign, and send this important document securely from any device, ensuring compliance with legal standards.

-

What are the benefits of using airSlate SignNow for lien documents?

Using airSlate SignNow for documents like the Verified Statement Of Lien By Corporation Or LLC Alabama provides numerous benefits, including enhanced security, streamlined workflows, and the ability to track document status in real-time. This efficiency helps businesses save time and reduce operational costs.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore its features, including those for handling the Verified Statement Of Lien By Corporation Or LLC Alabama. This free trial enables you to evaluate how the platform can meet your needs before committing to a paid plan.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers several pricing plans to fit various business needs, starting from basic options for small businesses to more advanced packages for larger corporations. Each plan provides essential features for handling documents like the Verified Statement Of Lien By Corporation Or LLC Alabama without breaking the bank.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports integrations with various popular applications, enabling users to streamline their workflow when dealing with documents like the Verified Statement Of Lien By Corporation Or LLC Alabama. This flexibility ensures that you can connect your eSigning processes with your existing business tools.

-

How secure is the airSlate SignNow platform?

The airSlate SignNow platform prioritizes security, employing advanced encryption and robust authentication measures to protect documents, including the Verified Statement Of Lien By Corporation Or LLC Alabama. Your data is kept safe throughout the signing process, ensuring compliance with regulatory standards.

Get more for Verified Statement Of Lien By Corporation Or LLC Alabama

- Essential legal life documents for new parents nebraska form

- Ne attorney form

- Nebraska business form

- Company employment policies and procedures package nebraska form

- Ne attorney 497318322 form

- Newly divorced individuals package nebraska form

- Nebraska statutory general power of attorney nebraska form

- Contractors forms package nebraska

Find out other Verified Statement Of Lien By Corporation Or LLC Alabama

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word