Pennsylvania Income Tax Return PA 40 FormsPublications

What is the Pennsylvania Income Tax Return PA-40?

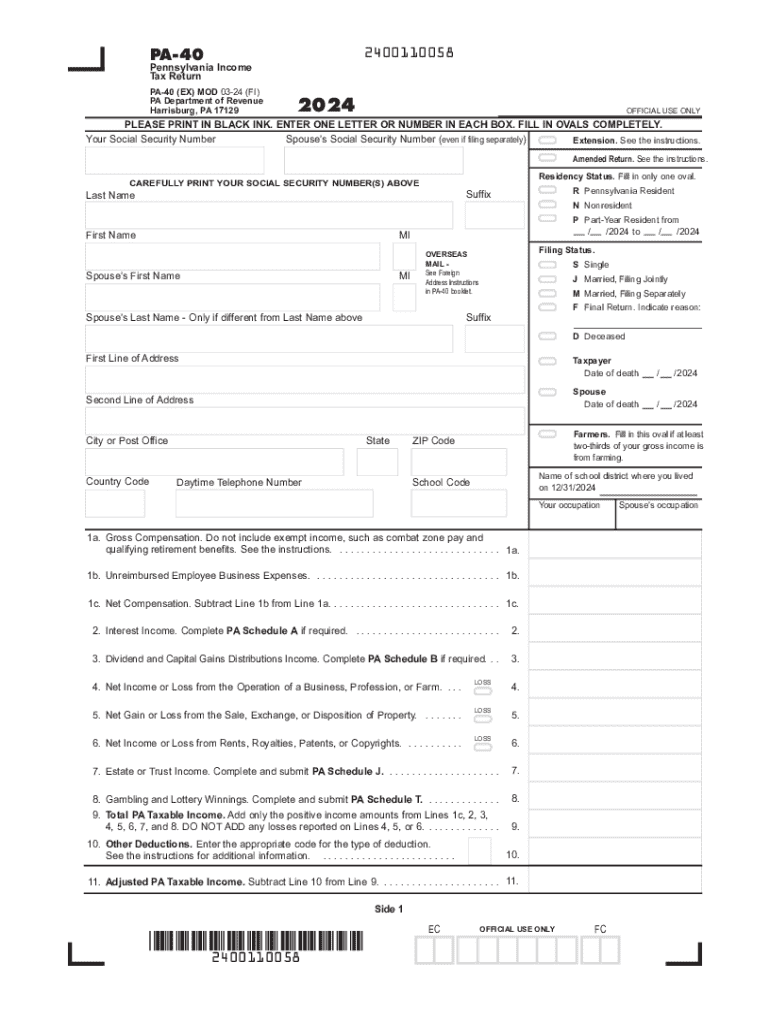

The Pennsylvania Income Tax Return PA-40 is a tax form used by residents of Pennsylvania to report their income and calculate their state tax liability. This form is essential for individuals who earn income in Pennsylvania, including wages, salaries, and other forms of compensation. The PA-40 is designed to ensure that taxpayers accurately report their earnings and pay the appropriate amount of state income tax. It is important for residents to understand the requirements and instructions associated with this form to ensure compliance with state tax laws.

Steps to Complete the Pennsylvania Income Tax Return PA-40

Completing the Pennsylvania Income Tax Return PA-40 involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Download the PA-40 form and instructions from the Pennsylvania Department of Revenue website or access the PA 40 2024 form printable.

- Fill out the form with your personal information, including your name, address, and Social Security number.

- Report your total income, deductions, and any applicable credits.

- Calculate your total tax liability based on the provided instructions.

- Review the completed form for accuracy before submission.

- Submit the form either electronically or by mail, following the guidelines for submission.

How to Obtain the Pennsylvania Income Tax Return PA-40

Taxpayers can obtain the Pennsylvania Income Tax Return PA-40 in several ways. The form is available for download as a PA 40 tax form printable from the official Pennsylvania Department of Revenue website. Additionally, physical copies of the form can be requested through local tax offices or by contacting the Department of Revenue directly. It is advisable to ensure you have the correct version of the form for the tax year, such as the PA 40 2024 edition, to avoid any issues during filing.

Key Elements of the Pennsylvania Income Tax Return PA-40

The PA-40 form consists of several key elements that taxpayers must complete:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: Taxpayers must report all sources of income, including wages, interest, and dividends.

- Deductions: The form allows for certain deductions, which can reduce taxable income.

- Tax Calculation: This section includes a calculation of the total tax owed based on the reported income and deductions.

- Signature: Taxpayers must sign the form to certify that the information provided is accurate.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the PA-40 form. Typically, the deadline for submitting the Pennsylvania Income Tax Return is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply and ensure they file on time to avoid penalties.

Form Submission Methods

Taxpayers have several options for submitting the Pennsylvania Income Tax Return PA-40:

- Online Submission: Taxpayers can file electronically through the Pennsylvania Department of Revenue's e-filing system.

- Mail: Completed forms can be mailed to the appropriate address listed in the instructions.

- In-Person: Some local tax offices may accept in-person submissions, although this option may be limited.

Handy tips for filling out Pennsylvania Income Tax Return PA 40 FormsPublications online

Quick steps to complete and e-sign Pennsylvania Income Tax Return PA 40 FormsPublications online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a HIPAA and GDPR compliant solution for optimum efficiency. Use signNow to electronically sign and send out Pennsylvania Income Tax Return PA 40 FormsPublications for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pennsylvania income tax return pa 40 formspublications 771983397

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA 40 2024 form printable?

The PA 40 2024 form printable is a tax form used by residents of Pennsylvania to file their personal income tax returns. It allows taxpayers to report their income, deductions, and credits for the tax year 2024. Using the printable version ensures you have a physical copy for your records.

-

How can I obtain the PA 40 2024 form printable?

You can easily obtain the PA 40 2024 form printable from the official Pennsylvania Department of Revenue website. Additionally, airSlate SignNow provides a convenient way to access and fill out this form digitally, ensuring you have the latest version available.

-

Is there a cost associated with the PA 40 2024 form printable?

The PA 40 2024 form printable itself is free to download from the Pennsylvania Department of Revenue website. However, if you choose to use airSlate SignNow for eSigning and document management, there may be associated costs depending on the plan you select.

-

What features does airSlate SignNow offer for the PA 40 2024 form printable?

airSlate SignNow offers a range of features for the PA 40 2024 form printable, including easy document editing, eSigning capabilities, and secure storage. These features streamline the filing process, making it easier to manage your tax documents efficiently.

-

Can I integrate airSlate SignNow with other applications for the PA 40 2024 form printable?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage your PA 40 2024 form printable alongside other tools you use. This integration enhances your workflow by enabling you to send, sign, and store documents in one place.

-

What are the benefits of using airSlate SignNow for the PA 40 2024 form printable?

Using airSlate SignNow for the PA 40 2024 form printable offers numerous benefits, including time savings, enhanced security, and ease of use. The platform simplifies the eSigning process, ensuring that you can complete your tax filings quickly and securely.

-

Is the PA 40 2024 form printable compatible with mobile devices?

Yes, the PA 40 2024 form printable can be accessed and filled out on mobile devices using airSlate SignNow. This mobile compatibility allows you to manage your tax documents on the go, making it convenient to complete your filings anytime, anywhere.

Get more for Pennsylvania Income Tax Return PA 40 FormsPublications

- Paypal pdf filler form

- Invasive species wanted poster template form

- Sample registration form oklahoma hospice

- Nwp 4 04 form

- Verification of binder deposit receipt nefar com form

- High school four year plan foundation with endorsement form

- Child abuse reporting form woodburn school district woodburnsd

- Public records request oregon city oregon form

Find out other Pennsylvania Income Tax Return PA 40 FormsPublications

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF