Individual Credit Application Alabama Form

What is the Individual Credit Application Alabama

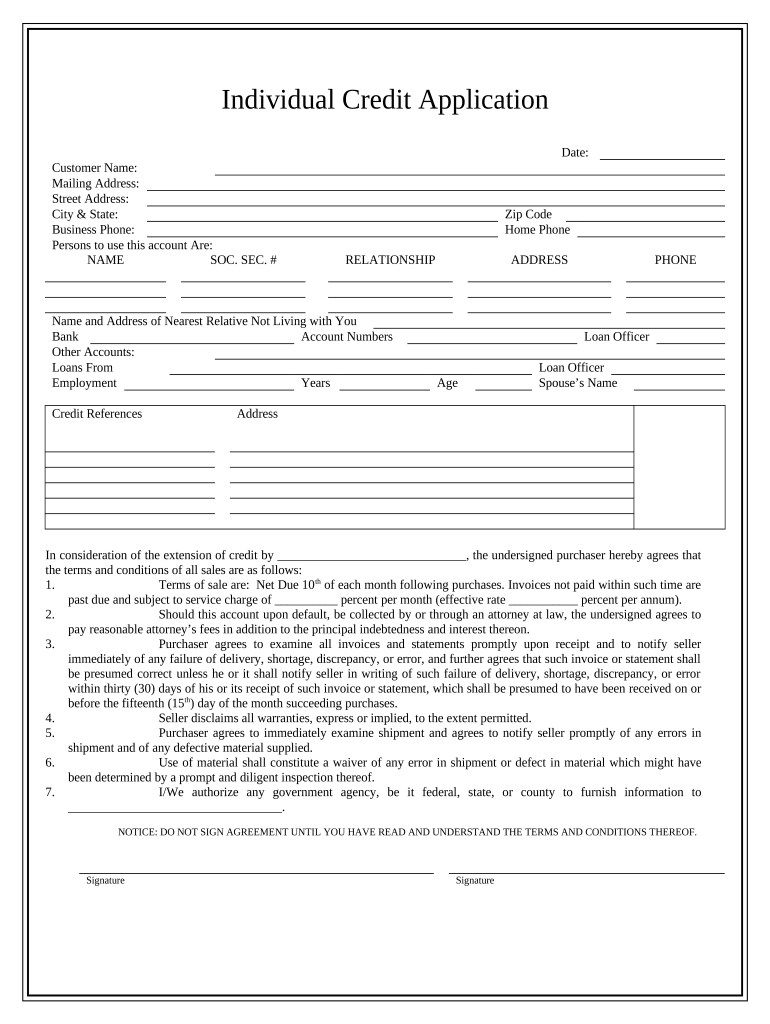

The Individual Credit Application Alabama is a formal document used by individuals seeking credit from financial institutions or lenders in Alabama. This application collects essential personal and financial information to assess the applicant's creditworthiness. It typically includes details such as the applicant's name, address, social security number, employment information, and income. The purpose of this form is to enable lenders to make informed decisions regarding loan approvals and credit limits.

Steps to complete the Individual Credit Application Alabama

Completing the Individual Credit Application Alabama involves several key steps to ensure accuracy and compliance. Here is a straightforward guide:

- Gather necessary documents: Collect your identification, proof of income, and any other financial documents required by the lender.

- Fill out personal information: Provide your full name, address, date of birth, and social security number.

- Detail employment information: Include your current employer's name, address, position, and length of employment.

- Disclose financial information: Enter your monthly income, existing debts, and any other financial obligations.

- Review the application: Check all entries for accuracy and completeness before submission.

- Submit the application: Follow the lender's instructions for submitting the form, whether electronically or via mail.

Legal use of the Individual Credit Application Alabama

The Individual Credit Application Alabama must adhere to specific legal standards to be considered valid. It is essential for the application to comply with federal and state regulations regarding privacy and data protection. The use of electronic signatures is permissible under the ESIGN Act and UETA, provided that the signer gives consent and the process meets certain criteria. Additionally, lenders must ensure that the information collected is used solely for the purpose of evaluating creditworthiness and is stored securely.

Key elements of the Individual Credit Application Alabama

Several critical components make up the Individual Credit Application Alabama. Understanding these elements can help applicants prepare effectively:

- Personal Identification: Essential for verifying the applicant's identity.

- Employment Details: Helps lenders assess job stability and income reliability.

- Financial Information: Includes income, debts, and assets, which are crucial for credit evaluation.

- Credit History Consent: Applicants often need to authorize lenders to check their credit reports.

How to use the Individual Credit Application Alabama

Using the Individual Credit Application Alabama involves understanding its purpose and the steps for effective completion. Applicants can utilize this form to apply for various types of credit, including personal loans, credit cards, and mortgages. It is important to ensure that all information provided is accurate and up-to-date, as discrepancies can lead to delays or denials in the credit approval process. Once completed, the application can be submitted electronically or in paper form, depending on the lender's requirements.

Eligibility Criteria

To complete the Individual Credit Application Alabama, applicants must meet certain eligibility criteria set by lenders. Typically, these criteria include:

- Being at least eighteen years old.

- Having a valid social security number.

- Demonstrating a stable source of income.

- Having a satisfactory credit history, though some lenders may consider applicants with limited or poor credit.

Quick guide on how to complete individual credit application alabama

Execute Individual Credit Application Alabama smoothly on any gadget

Web-based document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, since you can obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents swiftly without delays. Manage Individual Credit Application Alabama on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Individual Credit Application Alabama effortlessly

- Locate Individual Credit Application Alabama and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize relevant portions of the documents or conceal sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device of your preference. Modify and eSign Individual Credit Application Alabama and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Individual Credit Application Alabama?

The Individual Credit Application Alabama is a streamlined online form that allows residents to apply for credit efficiently and securely. This digital application simplifies the process of submitting necessary financial information, making it faster for both applicants and lenders.

-

How does airSlate SignNow support the Individual Credit Application Alabama?

airSlate SignNow enhances the Individual Credit Application Alabama by providing an intuitive eSigning platform. This ensures that users can sign their applications electronically, saving time and resources while maintaining compliance and security.

-

Is there a cost associated with using the Individual Credit Application Alabama on airSlate SignNow?

While airSlate SignNow offers various pricing plans, the costs for implementing the Individual Credit Application Alabama may vary based on features needed. It’s best to visit our pricing page to explore the options that fit your business needs.

-

What are the key features of the Individual Credit Application Alabama?

The Individual Credit Application Alabama includes features such as electronic signatures, document templates, and secure data storage. Additionally, it supports real-time tracking of application statuses, ensuring transparency throughout the process.

-

How can I integrate the Individual Credit Application Alabama into my existing system?

Integrating the Individual Credit Application Alabama with your existing systems is seamless through airSlate SignNow's API. This allows you to automate workflows and enhance your credit application process, saving time and minimizing errors.

-

What benefits do businesses gain from using the Individual Credit Application Alabama?

Using the Individual Credit Application Alabama can signNowly reduce paperwork while improving efficiency and compliance. Businesses benefit from faster turnaround times and better customer satisfaction due to the simplified application process.

-

Is the Individual Credit Application Alabama compliant with local regulations?

Yes, the Individual Credit Application Alabama is designed to comply with local laws and regulations governing credit applications. airSlate SignNow takes data security seriously, ensuring that all electronic signatures and transmissions meet compliance standards.

Get more for Individual Credit Application Alabama

Find out other Individual Credit Application Alabama

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself