Chapter 13 Plan Alabama Form

What is the Chapter 13 Plan Alabama

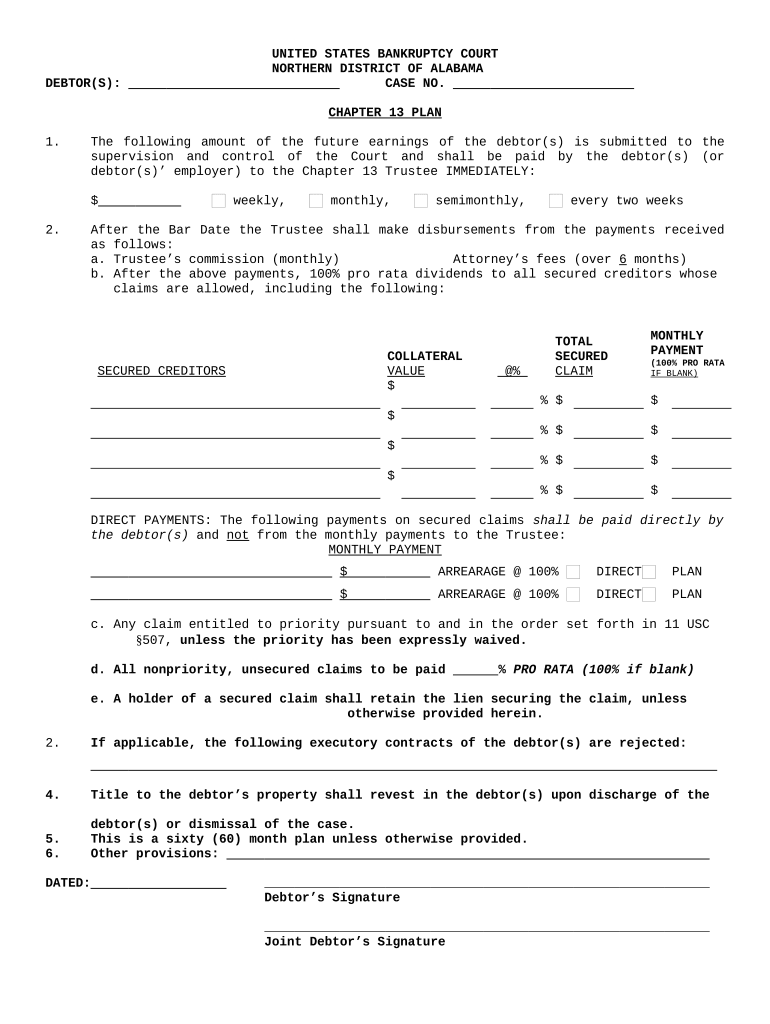

The Chapter 13 Plan in Alabama is a legal framework designed for individuals seeking to reorganize their debts while retaining their assets. This plan allows debtors to propose a repayment schedule to creditors over a period of three to five years. It is particularly beneficial for those who have a regular income and want to avoid foreclosure or repossession of property. The plan is submitted to the bankruptcy court, which reviews and approves it based on the debtor's financial situation and compliance with state laws.

How to use the Chapter 13 Plan Alabama

Using the Chapter 13 Plan involves several steps. First, individuals must assess their financial situation to determine eligibility. This includes reviewing income, expenses, and outstanding debts. Next, a repayment plan must be drafted, detailing how debts will be repaid over the specified period. Once the plan is prepared, it must be filed with the bankruptcy court. After filing, a confirmation hearing will be scheduled, where creditors can object to the plan. If approved, the debtor will begin making payments according to the plan.

Steps to complete the Chapter 13 Plan Alabama

Completing the Chapter 13 Plan in Alabama involves a series of methodical steps:

- Gather financial documents, including income statements, tax returns, and a list of debts.

- Determine eligibility based on income and debt limits set by federal guidelines.

- Draft a repayment plan that outlines how debts will be paid over three to five years.

- File the plan with the bankruptcy court along with required forms and fees.

- Attend the confirmation hearing to discuss the plan with the court and creditors.

- Begin making scheduled payments once the plan is confirmed.

Key elements of the Chapter 13 Plan Alabama

The Chapter 13 Plan includes several key elements that are crucial for its success:

- Repayment Schedule: Specifies the duration and amount of payments to creditors.

- Priority Debts: Certain debts, such as taxes and child support, must be paid in full.

- Disposable Income: The plan must allocate all disposable income towards debt repayment.

- Creditor Rights: Creditors have the right to review and object to the proposed plan.

State-specific rules for the Chapter 13 Plan Alabama

Alabama has specific rules that govern the Chapter 13 Plan. These include income limits, which are based on the median income for the state, and requirements for the repayment period, which can vary depending on the debtor's income level. Additionally, Alabama courts may have particular forms and procedures that must be followed when filing a Chapter 13 Plan. Understanding these state-specific regulations is essential for ensuring compliance and increasing the likelihood of plan approval.

Eligibility Criteria

To qualify for the Chapter 13 Plan in Alabama, individuals must meet certain eligibility criteria:

- Must have a regular income from employment or other sources.

- Total unsecured debts must be less than $419,275, and secured debts must be less than $1,257,850.

- Must not have filed for bankruptcy in the past 180 days if the previous case was dismissed due to failure to comply with court orders.

- Must complete credit counseling from an approved agency before filing.

Quick guide on how to complete chapter 13 plan alabama 497295908

Effortlessly prepare Chapter 13 Plan Alabama on any device

The management of documents online has gained increased popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any hurdles. Manage Chapter 13 Plan Alabama on any device using airSlate SignNow's Android or iOS applications and streamline any document-oriented task today.

Edit and electronically sign Chapter 13 Plan Alabama with ease

- Find Chapter 13 Plan Alabama and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive details with the tools available specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you’d like to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Chapter 13 Plan Alabama to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Chapter 13 Plan in Alabama?

A Chapter 13 Plan in Alabama is a legal procedure that allows individuals with a regular income to create a repayment plan to pay off their debts over three to five years. This plan helps borrowers catch up on missed payments while keeping their property. Understanding how a Chapter 13 Plan in Alabama works is essential for anyone looking to manage their debts effectively.

-

How much does it cost to file a Chapter 13 Plan in Alabama?

Filing a Chapter 13 Plan in Alabama typically incurs court fees and attorney fees, which can vary based on the complexity of your case. The total costs can range from a few hundred to several thousand dollars. It's crucial to consult with a bankruptcy attorney to understand the potential expenses associated with your Chapter 13 Plan in Alabama.

-

What are the benefits of a Chapter 13 Plan in Alabama?

The primary benefits of a Chapter 13 Plan in Alabama include protection from foreclosure and the ability to keep your property while paying off debts. Additionally, this plan can signNowly reduce the overall amount owed to creditors, making repayment more manageable. It also allows individuals to reorganize their debts, enhancing financial stability.

-

How long does a Chapter 13 Plan in Alabama last?

A Chapter 13 Plan in Alabama typically lasts between three to five years, depending on the individual's income level and the total amount of debt. During this period, debtors make regular payments to a trustee, who then distributes funds to creditors. Completing the plan successfully can lead to the discharge of remaining eligible debts.

-

Can I modify my Chapter 13 Plan in Alabama after filing?

Yes, it is possible to modify your Chapter 13 Plan in Alabama if your financial circumstances change. Common reasons for modifications include job loss, unexpected expenses, or changes in income. It's advisable to file a motion with the court and consult with your attorney for assistance in adjusting your plan.

-

What documents do I need for a Chapter 13 Plan in Alabama?

To file a Chapter 13 Plan in Alabama, you will need various documents, such as your income statements, tax returns, and a list of debts. Additionally, documentation of your monthly expenses and property assets may be required. Gathering these documents is crucial for the successful preparation of your Chapter 13 Plan in Alabama.

-

What happens if I miss a payment under my Chapter 13 Plan in Alabama?

Missing a payment under your Chapter 13 Plan in Alabama can lead to serious consequences, including the dismissal of your bankruptcy case. If you anticipate difficulties with making a payment, it's imperative to contact your trustee immediately to discuss potential solutions. Timely communication can help prevent adverse actions and maintain your plan's integrity.

Get more for Chapter 13 Plan Alabama

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective form

- Louisiana dissolve form

- Louisiana dissolution package to dissolve limited liability company llc louisiana form

- Louisiana petition for visitation rights of grandparents louisiana form

- Petition visitation child form

- Petition for visitation rights of grandparents louisiana form

- Living trust for husband and wife with no children louisiana form

- Living trust for individual as single divorced or widow or widower with no children louisiana form

Find out other Chapter 13 Plan Alabama

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF