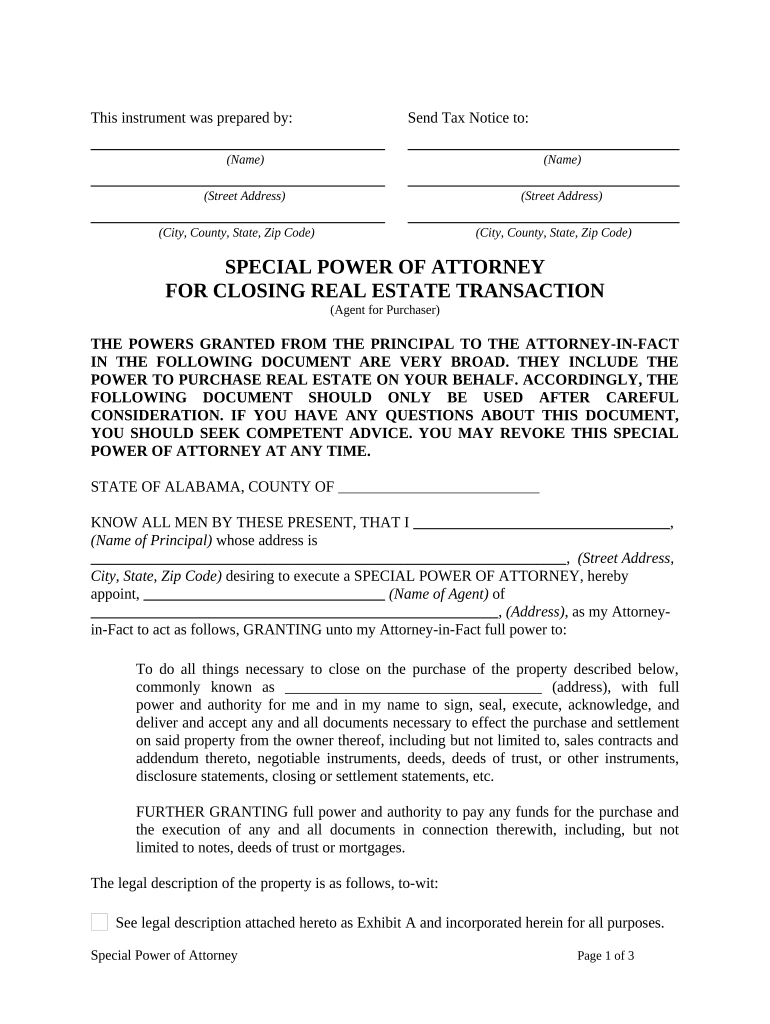

Closing Estate Transaction Form

What is the closing estate transaction?

The closing estate transaction is a critical legal process that finalizes the transfer of property ownership following the death of an individual. This process involves settling the deceased's debts, distributing assets to beneficiaries, and ensuring compliance with state laws. It typically requires the completion of various legal documents, including the closing estate transaction form, which serves as a record of the transfer and the conditions under which it occurs.

Steps to complete the closing estate transaction

Completing a closing estate transaction involves several key steps to ensure legality and accuracy:

- Gather necessary documents: Collect all relevant documents, such as the will, death certificate, and any property deeds.

- Notify beneficiaries: Inform all beneficiaries about the estate proceedings and their rights.

- Settle debts: Pay off any outstanding debts or taxes owed by the deceased to avoid future complications.

- Complete the closing estate transaction form: Fill out the form accurately, ensuring all details are correct and complete.

- Obtain signatures: Secure the necessary signatures from all relevant parties, which may include the executor and beneficiaries.

- File with the court: Submit the completed form and any additional required documents to the appropriate court for approval.

Legal use of the closing estate transaction

The closing estate transaction must adhere to specific legal standards to be considered valid. Compliance with state laws is essential, as each state may have different requirements regarding the probate process and the documentation needed. The closing estate transaction form must be signed by the executor and may require notarization to ensure authenticity. Furthermore, understanding the legal implications of the form is crucial for all parties involved, as it serves as a binding agreement regarding the distribution of the estate.

Key elements of the closing estate transaction

Several key elements are essential to the closing estate transaction:

- Identification of parties: Clearly identify the deceased, the executor, and all beneficiaries involved in the transaction.

- Property description: Provide a detailed description of the property being transferred, including its legal description.

- Debt settlement: Include information regarding any debts that have been settled or remain outstanding.

- Distribution of assets: Outline how the remaining assets will be distributed among the beneficiaries.

- Signatures: Ensure that all required parties sign the document to validate the transaction.

How to obtain the closing estate transaction

Obtaining the closing estate transaction form typically involves contacting the probate court in the jurisdiction where the deceased resided. Many courts provide downloadable forms on their websites, while others may require individuals to visit in person to obtain the necessary paperwork. It is important to ensure that the correct version of the form is used, as variations may exist based on state requirements.

State-specific rules for the closing estate transaction

Each state in the U.S. has its own regulations governing the closing estate transaction. These rules can dictate the required documentation, the probate process, and the timeline for completing the transaction. It is crucial for executors and beneficiaries to familiarize themselves with their state’s specific laws to ensure compliance and avoid delays. Consulting with a legal professional who specializes in estate law can provide valuable guidance tailored to the specific jurisdiction.

Quick guide on how to complete closing estate transaction

Complete Closing Estate Transaction with ease on any gadget

Digital document management has become increasingly prevalent among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to retrieve the necessary form and securely archive it online. airSlate SignNow provides all the tools necessary for you to create, modify, and eSign your documents swiftly and efficiently. Manage Closing Estate Transaction on any gadget using airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The simplest method to modify and eSign Closing Estate Transaction effortlessly

- Locate Closing Estate Transaction and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method for delivering your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Closing Estate Transaction to ensure seamless communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for closing an estate transaction with airSlate SignNow?

Closing an estate transaction with airSlate SignNow involves preparing your documents, sending them to required parties for signatures, and tracking the progress in real-time. Our intuitive platform simplifies each step, ensuring that all signatures are gathered efficiently. With airSlate SignNow, you can close estate transactions faster while maintaining compliance with legal requirements.

-

How much does airSlate SignNow cost for closing estate transactions?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solutions make it affordable to manage and close estate transactions electronically. You can choose a plan that best fits your needs, ensuring you get the most value while achieving seamless document management.

-

What features does airSlate SignNow offer for estate transaction management?

airSlate SignNow provides a range of features that streamline the closing estate transaction process. These include customizable templates, automated workflows, and advanced tracking options. Our platform also ensures secure storage and easy access to all documents involved in the estate transaction, enhancing productivity and reducing errors.

-

Can airSlate SignNow integrate with other tools to assist in closing estate transactions?

Yes, airSlate SignNow integrates seamlessly with popular tools such as Google Drive, Salesforce, and Dropbox. This integration capability allows you to manage all aspects of your closing estate transaction from a single platform. By connecting your existing systems, you can enhance efficiency and ensure a smoother transaction experience.

-

Is airSlate SignNow compliant with legal standards for closing estate transactions?

Absolutely, airSlate SignNow complies with all relevant legal standards for electronic signatures and document management. We adhere to laws such as the ESIGN Act and UETA, ensuring that your closing estate transaction is legally binding. This compliance provides peace of mind and reinforces the validity of your transactions.

-

How can airSlate SignNow enhance collaboration during an estate transaction?

airSlate SignNow enhances collaboration during the closing estate transaction by allowing multiple parties to review and sign documents from anywhere. Our platform features real-time notifications and status updates, so everyone stays informed throughout the process. This collaborative approach signNowly reduces delays and misunderstandings.

-

What benefits does airSlate SignNow provide for real estate agents during estate transactions?

For real estate agents, airSlate SignNow offers numerous benefits when closing estate transactions, including time savings and reduced paperwork. Agents can send documents quickly, track their status, and receive electronic signatures without unnecessary delays. Our platform empowers agents to provide better service to clients while streamlining their operational processes.

Get more for Closing Estate Transaction

Find out other Closing Estate Transaction

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF