Partial Release of Property from Mortgage for Corporation Alabama Form

Understanding the Blanket Deed of Trust Partial Release

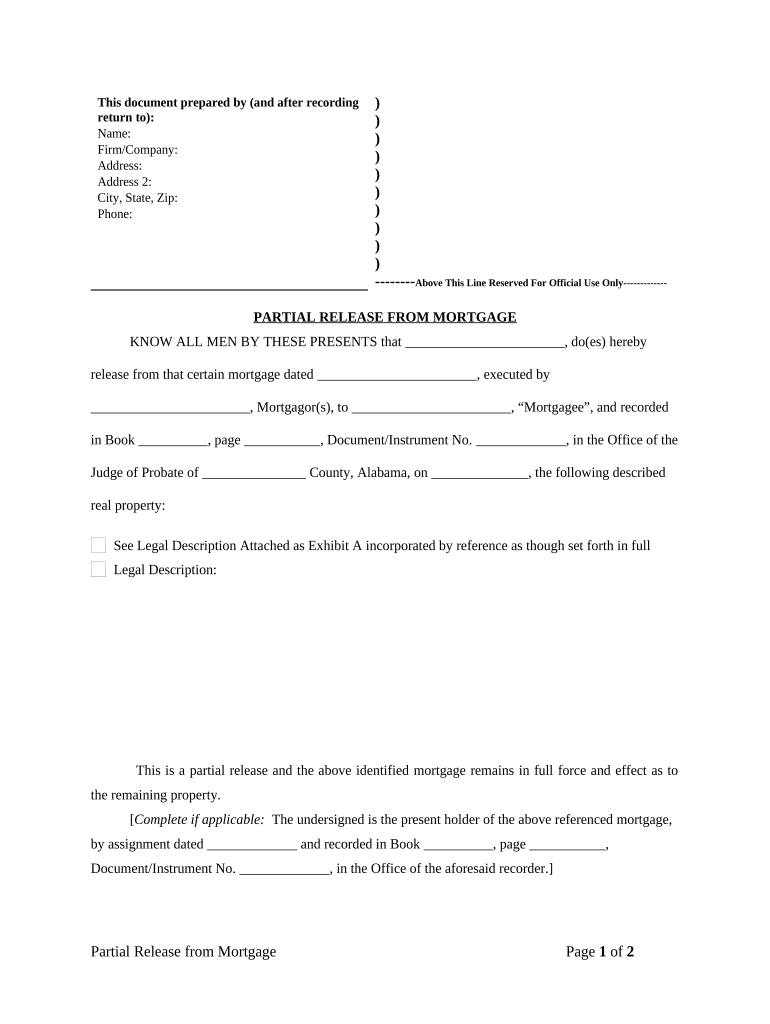

A blanket deed of trust partial release is a legal document that allows a borrower to release a portion of the property secured under a blanket deed of trust from the mortgage obligation. This process is often used when a borrower sells a part of the property or wishes to refinance a specific section without discharging the entire deed of trust. The partial release can help facilitate real estate transactions while maintaining the integrity of the remaining property as collateral.

Steps to Complete the Blanket Deed of Trust Partial Release

Completing a blanket deed of trust partial release involves several key steps:

- Review the original deed of trust: Understand the terms and conditions outlined in the initial agreement.

- Identify the property to be released: Clearly specify which portion of the property is subject to the partial release.

- Prepare the partial release document: Draft the document, including necessary details such as the legal description of the property and the parties involved.

- Obtain necessary signatures: Ensure that all relevant parties sign the document to validate the release.

- Record the partial release: Submit the completed document to the appropriate county recorder's office to make the release official.

Key Elements of the Blanket Deed of Trust Partial Release

Several essential components must be included in a blanket deed of trust partial release to ensure its validity:

- Legal description: A precise description of the property being released is crucial for clarity.

- Borrower and lender information: Include the names and addresses of both parties involved in the transaction.

- Effective date: Specify when the partial release takes effect.

- Signatures: Ensure all necessary parties sign the document to confirm their agreement.

- Notarization: Depending on state requirements, notarization may be necessary for the document to be legally binding.

Legal Use of the Blanket Deed of Trust Partial Release

The legal use of a blanket deed of trust partial release is governed by state laws, which can vary significantly. It is essential to comply with local regulations and ensure that the document meets all legal requirements. This may include filing the release with the appropriate government office and adhering to any specific state provisions regarding property transactions. Consulting with a legal professional can help ensure compliance and protect the interests of all parties involved.

Obtaining the Blanket Deed of Trust Partial Release

To obtain a blanket deed of trust partial release, borrowers typically need to follow these steps:

- Contact the lender: Reach out to the lender or financial institution that issued the original deed of trust to request a partial release.

- Provide necessary documentation: Submit any required documents, such as proof of sale or refinancing details, to support the request.

- Complete the required forms: Fill out any forms provided by the lender to initiate the partial release process.

- Await approval: The lender will review the request and either approve or deny the partial release based on their criteria.

State-Specific Rules for the Blanket Deed of Trust Partial Release

Each state has its own regulations regarding the blanket deed of trust partial release. It is important to research the specific requirements in your state, which may include:

- Filing fees: Some states require payment of a fee to record the partial release.

- Documentation requirements: States may have specific forms or additional documentation that must be submitted.

- Time limits: There may be deadlines for filing the partial release after the transaction occurs.

Quick guide on how to complete partial release of property from mortgage for corporation alabama

Easily Prepare Partial Release Of Property From Mortgage For Corporation Alabama on Any Device

Digital document management has gained traction among businesses and individuals. It presents an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents promptly without any hold-ups. Manage Partial Release Of Property From Mortgage For Corporation Alabama on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

Effortlessly Edit and eSign Partial Release Of Property From Mortgage For Corporation Alabama

- Find Partial Release Of Property From Mortgage For Corporation Alabama and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether via email, text message (SMS), or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Partial Release Of Property From Mortgage For Corporation Alabama and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a partial release of mortgage form?

A partial release of mortgage form is a legal document that allows a borrower to remove a portion of their mortgage lien from the title, typically when they have paid off part of the loan. This facilitates the transfer of ownership of that portion of the property. Using airSlate SignNow, you can create and eSign this document quickly and efficiently.

-

How much does it cost to use the partial release of mortgage form with airSlate SignNow?

airSlate SignNow offers various pricing plans, allowing you to select the best fit for your business needs. The cost of utilizing the partial release of mortgage form is included in your subscription. Find a plan that suits your budget and unlock features that simplify your document management.

-

What features does airSlate SignNow provide for the partial release of mortgage form?

airSlate SignNow provides features like customizable templates, real-time tracking, and secure storage for managing your partial release of mortgage form. You can also access a library of pre-made templates to streamline the eSigning process. These features save time and enhance workflow efficiency.

-

What are the benefits of using airSlate SignNow for the partial release of mortgage form?

Using airSlate SignNow for your partial release of mortgage form offers several benefits, such as simplified document management and increased security. The platform ensures that your documents are legally binding and securely transmitted. Additionally, you can easily track the status of your forms for peace of mind.

-

Can I integrate airSlate SignNow with other software for managing the partial release of mortgage form?

Yes, airSlate SignNow offers seamless integrations with various software applications, allowing for hassle-free management of your partial release of mortgage form. Whether you need to link to CRMs or cloud storage solutions, the integrations enhance workflow and productivity. This ensures you can maintain a cohesive system across your business operations.

-

Is eSigning the partial release of mortgage form legally binding?

Yes, eSigning the partial release of mortgage form through airSlate SignNow is legally binding and compliant with electronic signature laws. The platform uses advanced security measures to ensure authenticity and integrity of signed documents. This gives you confidence that your agreements are enforceable.

-

How can I ensure my partial release of mortgage form is completed correctly?

To ensure your partial release of mortgage form is completed correctly, utilize airSlate SignNow’s guidance features and template library. The platform provides step-by-step instructions and necessary fields to fill out. This minimizes errors and ensures compliance with all legal requirements.

Get more for Partial Release Of Property From Mortgage For Corporation Alabama

- Mutual wills package with last wills and testaments for married couple with adult children new york form

- New york married couple form

- New york married couple 497322032 form

- New york legal 497322033 form

- New york legal ny 497322034 form

- New york married form

- Ny amendments form

- Legal last will and testament form for married person with adult and minor children from prior marriage new york

Find out other Partial Release Of Property From Mortgage For Corporation Alabama

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later