Transfer Death Document Form

What is the Transfer Death Document

The Transfer Death Document, commonly referred to as a transfer on death (TOD) deed, is a legal instrument that allows property owners in Arkansas to designate beneficiaries who will inherit their real estate upon their death. This document bypasses the probate process, enabling a smoother transition of property ownership. By executing a transfer death deed, property owners can ensure that their assets are transferred directly to their chosen beneficiaries without the need for court intervention, making it a popular choice for estate planning.

Steps to Complete the Transfer Death Document

Completing the Transfer Death Document involves several key steps to ensure its validity and effectiveness. Begin by obtaining the appropriate form, which can typically be accessed through state resources or legal document providers. Next, fill in the required information, including the property description and the names of the beneficiaries. It is essential to sign the document in the presence of a notary public to validate the deed. Once notarized, record the deed with the county clerk's office where the property is located to make it legally binding. Following these steps ensures that the transfer death deed is properly executed and recognized under Arkansas law.

Legal Use of the Transfer Death Document

The Transfer Death Document is legally recognized in Arkansas and serves as a valid means of transferring property upon the owner's death. To be legally binding, the document must meet specific requirements, including proper execution and recording. It is crucial for property owners to understand that while this document simplifies the transfer process, it must be drafted and executed in compliance with state laws to avoid potential disputes among heirs. Consulting with a legal professional can help ensure that all legal aspects are adequately addressed.

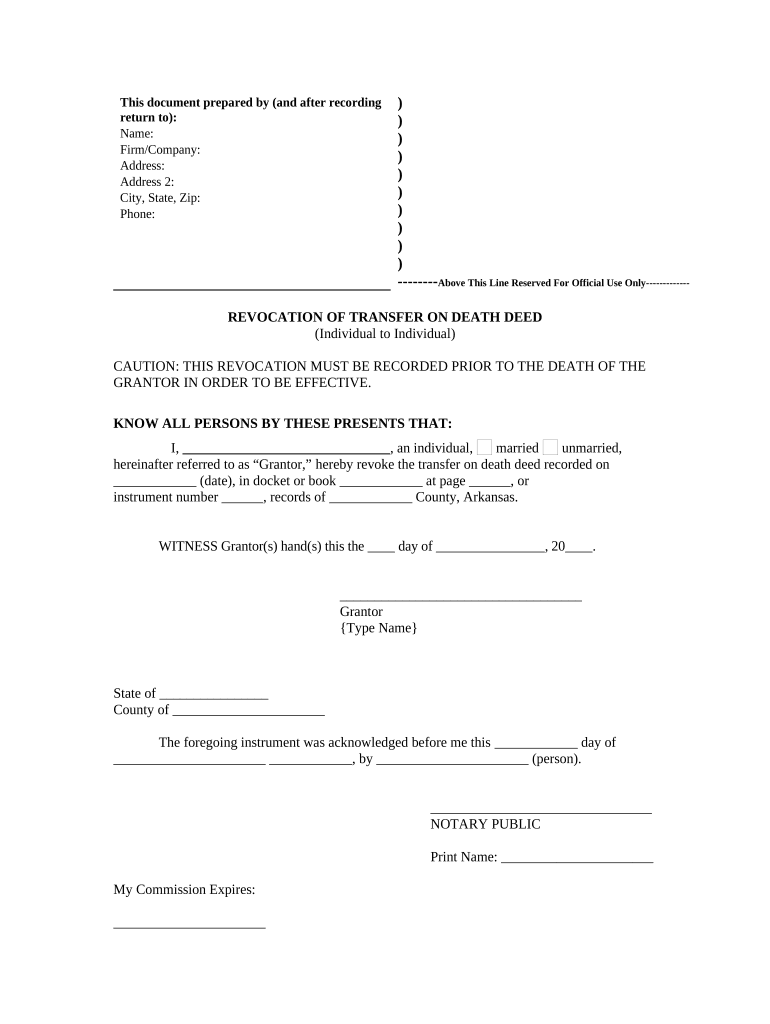

Key Elements of the Transfer Death Document

Several key elements must be included in the Transfer Death Document for it to be effective. These elements typically consist of:

- Property Description: A clear and detailed description of the property being transferred.

- Beneficiary Information: Names and identifying information of the beneficiaries who will inherit the property.

- Grantor's Signature: The signature of the property owner, indicating their intention to transfer the property upon death.

- Notary Acknowledgment: A notary public's acknowledgment to validate the authenticity of the signatures.

Including these elements ensures that the transfer death deed is legally sound and enforceable.

How to Obtain the Transfer Death Document

Obtaining the Transfer Death Document can be done through various means. Property owners can access the form online through state government websites or legal document services. Additionally, local county clerk offices may provide physical copies of the form. It is advisable to ensure that the form used is the most current version to comply with state regulations. If assistance is needed, consulting with an attorney specializing in estate planning can provide guidance on obtaining and completing the document correctly.

State-Specific Rules for the Transfer Death Document

Each state has specific rules governing the use of the Transfer Death Document, and Arkansas is no exception. In Arkansas, the transfer death deed must be recorded in the county where the property is located to be effective. Furthermore, the deed must comply with state laws regarding property transfers, including the requirement for notarization. Understanding these state-specific rules is essential for property owners to ensure that their transfer death deed is valid and enforceable, preventing potential legal issues in the future.

Quick guide on how to complete transfer death document

Complete Transfer Death Document effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents rapidly without interruptions. Manage Transfer Death Document on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Transfer Death Document seamlessly

- Find Transfer Death Document and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal significance as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from a device of your choice. Modify and eSign Transfer Death Document to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an AR deed?

An AR deed, or Arkansas deed, is a legal document that officially transfers ownership of property in Arkansas. Understanding its requirements is crucial for homeowners and real estate professionals. With airSlate SignNow, you can easily manage and eSign AR deeds to ensure a seamless transaction process.

-

How can airSlate SignNow help with AR deed transactions?

airSlate SignNow offers a user-friendly platform to create, send, and eSign AR deeds electronically. This simplifies the process, saving time and reducing paperwork. By leveraging airSlate SignNow, you can ensure all parties have access to the necessary documents quickly and securely.

-

Is there a cost associated with using airSlate SignNow for AR deeds?

Yes, airSlate SignNow provides various pricing plans to suit different business needs. Many users find that the cost-effectiveness of our service, especially for eSigning AR deeds, delivers substantial savings compared to traditional methods. Explore our plans to find the best fit for your requirements.

-

What features does airSlate SignNow offer for managing AR deeds?

airSlate SignNow includes features such as document templates, real-time collaboration, and secure cloud storage, making it ideal for managing AR deeds. These functionalities ensure that your paperwork is efficient and accessible. Additionally, you can track the status of documents and receive notifications for completed signatures.

-

Can I integrate airSlate SignNow with other software for managing AR deeds?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, enhancing your workflow for managing AR deeds. Whether you're using CRM tools or document management systems, these integrations ensure a smoother process and better data management.

-

What are the benefits of eSigning AR deeds with airSlate SignNow?

eSigning AR deeds with airSlate SignNow offers numerous benefits, including enhanced security and reduced turnaround time. This digital approach fully complies with legal standards, ensuring the validity of your documents. Additionally, it allows you to sign from anywhere, making transactions more flexible and convenient.

-

Is airSlate SignNow compliant with AR deed regulations?

Yes, airSlate SignNow complies with all relevant regulations governing the signing of AR deeds. Our platform ensures that every eSignature meets legal requirements, providing peace of mind for users. You can trust airSlate SignNow to handle your important documents in a compliant manner.

Get more for Transfer Death Document

- Quitclaim deed from individual to husband and wife oklahoma form

- Warranty deed from individual to husband and wife oklahoma form

- Quitclaim deed from corporation to husband and wife oklahoma form

- Warranty deed from corporation to husband and wife oklahoma form

- Quitclaim deed from corporation to individual oklahoma form

- Warranty deed individual 497322785 form

- Ok llc company 497322786 form

- Quitclaim deed from corporation to corporation oklahoma form

Find out other Transfer Death Document

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement