Limited Power of Attorney for Stock Transactions and Corporate Powers Arkansas Form

What is the Limited Power Of Attorney For Stock Transactions And Corporate Powers Arkansas

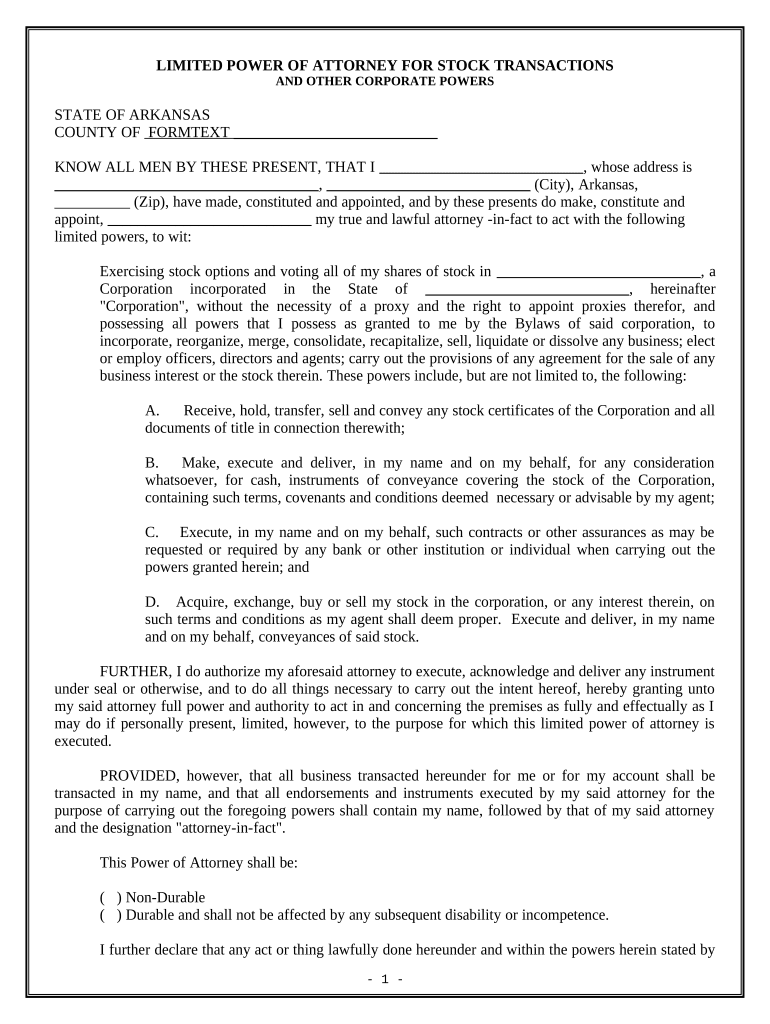

The Limited Power of Attorney for Stock Transactions and Corporate Powers in Arkansas is a legal document that grants an individual the authority to act on behalf of another person in specific financial matters related to stock transactions and corporate activities. This form is particularly useful for individuals who may not be able to manage their investments or corporate affairs personally due to time constraints or other commitments. The powers granted can include buying or selling stocks, managing accounts, and making decisions related to corporate governance.

How to Use the Limited Power Of Attorney For Stock Transactions And Corporate Powers Arkansas

To effectively use the Limited Power of Attorney for Stock Transactions and Corporate Powers in Arkansas, the principal must first complete the form accurately, specifying the powers being granted. It is essential to clearly outline the scope of authority to avoid any misunderstandings. Once completed, the document should be signed and dated by the principal, ideally in the presence of a notary public to enhance its legal standing. The designated agent can then use this document to perform the specified transactions on behalf of the principal.

Steps to Complete the Limited Power Of Attorney For Stock Transactions And Corporate Powers Arkansas

Completing the Limited Power of Attorney for Stock Transactions and Corporate Powers in Arkansas involves several key steps:

- Identify the principal and the agent: Clearly state the names and addresses of both parties.

- Define the powers: Specify the exact powers being granted, such as buying or selling stocks.

- Set the duration: Indicate how long the power of attorney will remain in effect, whether it is for a specific transaction or a longer period.

- Sign and date the document: The principal must sign the document, and it is advisable to have it notarized.

- Distribute copies: Provide copies to the agent and any financial institutions involved.

Legal Use of the Limited Power Of Attorney For Stock Transactions And Corporate Powers Arkansas

The legal use of the Limited Power of Attorney for Stock Transactions and Corporate Powers in Arkansas is governed by state laws. This document must comply with the Arkansas Uniform Power of Attorney Act, which outlines the necessary elements for validity. It is crucial that the principal is of sound mind and voluntarily grants authority to the agent. Additionally, the powers must be clearly defined to ensure that the agent acts within the limits set by the principal.

Key Elements of the Limited Power Of Attorney For Stock Transactions And Corporate Powers Arkansas

Key elements of the Limited Power of Attorney for Stock Transactions and Corporate Powers in Arkansas include:

- Principal's Information: Full name and address of the individual granting authority.

- Agent's Information: Full name and address of the individual receiving authority.

- Scope of Powers: A detailed description of the specific powers granted, such as managing stock transactions.

- Duration: The time frame during which the power of attorney is effective.

- Signatures: Signatures of the principal and, if applicable, the agent, along with a notary's acknowledgment.

State-Specific Rules for the Limited Power Of Attorney For Stock Transactions And Corporate Powers Arkansas

In Arkansas, the Limited Power of Attorney for Stock Transactions and Corporate Powers must adhere to specific state rules to be considered valid. These include the requirement for the principal to be of legal age and mentally competent at the time of signing. Additionally, the document must be signed in front of a notary public to ensure authenticity. It is also advisable to check for any additional requirements that may apply based on the nature of the transactions involved.

Quick guide on how to complete limited power of attorney for stock transactions and corporate powers arkansas

Effortlessly Prepare Limited Power Of Attorney For Stock Transactions And Corporate Powers Arkansas on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Limited Power Of Attorney For Stock Transactions And Corporate Powers Arkansas on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Limited Power Of Attorney For Stock Transactions And Corporate Powers Arkansas with Ease

- Locate Limited Power Of Attorney For Stock Transactions And Corporate Powers Arkansas and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Limited Power Of Attorney For Stock Transactions And Corporate Powers Arkansas and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Limited Power Of Attorney For Stock Transactions And Corporate Powers in Arkansas?

A Limited Power Of Attorney For Stock Transactions And Corporate Powers in Arkansas is a legal document that allows an individual to assign specific powers to another person to manage stock transactions and corporate decisions on their behalf. This document is crucial for individuals looking to authorize someone to act on their behalf in business matters.

-

How do I create a Limited Power Of Attorney For Stock Transactions And Corporate Powers in Arkansas?

To create a Limited Power Of Attorney For Stock Transactions And Corporate Powers in Arkansas, you can utilize the airSlate SignNow platform. Our user-friendly solution allows you to customize and generate the document legally and efficiently, ensuring all necessary details are included to meet Arkansas regulations.

-

What are the benefits of using airSlate SignNow for Limited Power Of Attorney For Stock Transactions And Corporate Powers?

Using airSlate SignNow for your Limited Power Of Attorney For Stock Transactions And Corporate Powers simplifies the process of document preparation and signing. Our platform not only provides templates but also offers secure storage, easy sharing, and fast eSigning capabilities, making it a cost-effective choice for businesses.

-

Is there a cost associated with preparing a Limited Power Of Attorney For Stock Transactions And Corporate Powers in Arkansas through airSlate SignNow?

Yes, airSlate SignNow offers several pricing plans tailored to fit various business needs. Depending on your requirements for creating a Limited Power Of Attorney For Stock Transactions And Corporate Powers in Arkansas, you can select a plan that provides the best value while ensuring access to all essential features.

-

Can I use airSlate SignNow to manage multiple Limited Power Of Attorney documents?

Absolutely! airSlate SignNow allows users to manage multiple Limited Power Of Attorney For Stock Transactions And Corporate Powers documents seamlessly. Our platform makes it easy to track, edit, and store all your legal documents in one secure place, ensuring you have access to them whenever needed.

-

How does airSlate SignNow ensure the security of my Limited Power Of Attorney documents?

airSlate SignNow prioritizes your document security by employing advanced encryption technologies and secure cloud storage. When you prepare a Limited Power Of Attorney For Stock Transactions And Corporate Powers in Arkansas, you can trust that your information is protected and that only authorized individuals have access to it.

-

What integrations does airSlate SignNow offer for managing Limited Power Of Attorney documents?

airSlate SignNow offers various integrations with popular apps such as Google Drive, Salesforce, and Dropbox, allowing you to streamline your workflow. This connectivity ensures that your Limited Power Of Attorney For Stock Transactions And Corporate Powers in Arkansas can be easily managed alongside other essential business tools.

Get more for Limited Power Of Attorney For Stock Transactions And Corporate Powers Arkansas

- Bill of sale for automobile or vehicle including odometer statement and promissory note tennessee form

- Promissory note in connection with sale of vehicle or automobile tennessee form

- Bill of sale for watercraft or boat tennessee form

- Bill of sale of automobile and odometer statement for as is sale tennessee form

- Construction contract cost plus or fixed fee tennessee form

- Painting contract for contractor tennessee form

- Trim carpenter contract for contractor tennessee form

- Fencing contract for contractor tennessee form

Find out other Limited Power Of Attorney For Stock Transactions And Corporate Powers Arkansas

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple