Ar Satisfaction Mortgage Form

What is the AR Satisfaction Mortgage?

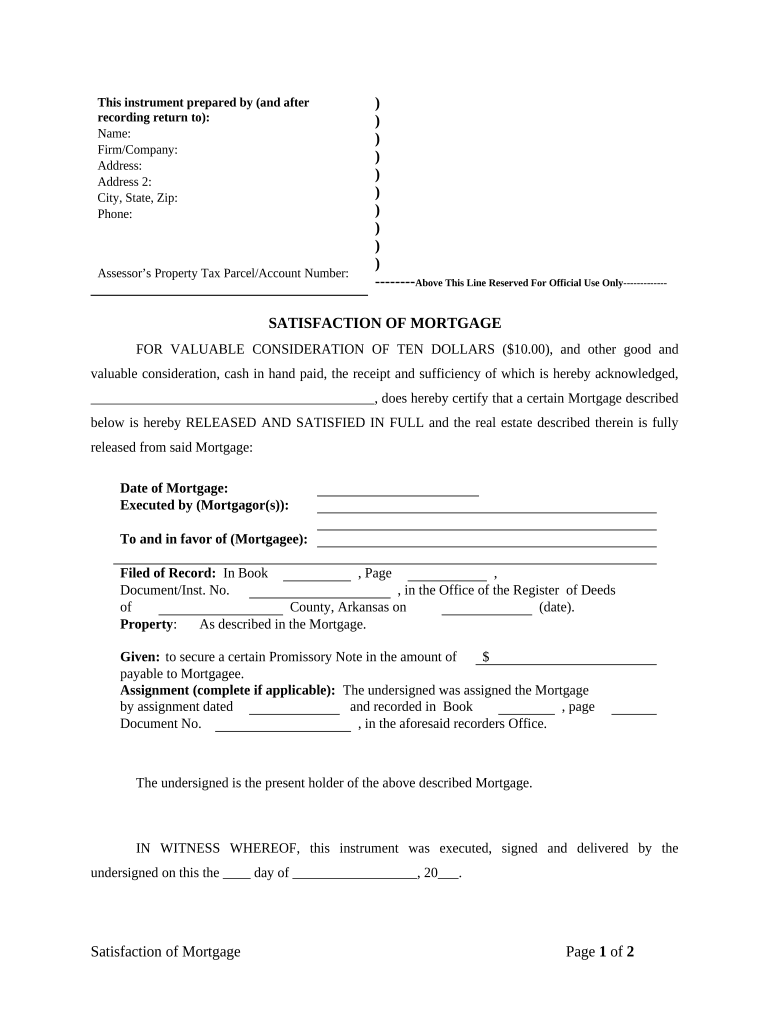

The AR Satisfaction Mortgage is a legal document used to confirm that a borrower has fulfilled their obligations under a mortgage agreement. This form serves as evidence that the lender has released their claim on the property, indicating that the mortgage has been satisfied. In the context of real estate transactions, it is crucial for homeowners to obtain this form to clear their title and ensure that they own their property free of any encumbrances.

How to Use the AR Satisfaction Mortgage

Using the AR Satisfaction Mortgage involves several steps to ensure proper completion and legal validity. First, the borrower must verify that all mortgage payments have been made in full. Once confirmed, the lender will complete the satisfaction form, which should include details such as the loan number, property address, and the date of satisfaction. After the form is filled out, it must be signed by the lender and then filed with the appropriate county clerk or recorder's office to officially document the mortgage satisfaction.

Steps to Complete the AR Satisfaction Mortgage

Completing the AR Satisfaction Mortgage requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including the mortgage account number and property details.

- Contact your lender to confirm that your mortgage is paid in full.

- Request the AR Satisfaction Mortgage form from your lender.

- Fill out the form accurately, ensuring all required fields are completed.

- Obtain the lender's signature on the document.

- File the completed form with your local county clerk or recorder's office.

Legal Use of the AR Satisfaction Mortgage

The AR Satisfaction Mortgage is legally binding once properly executed and filed. It serves to protect the homeowner's rights by providing official documentation that the mortgage has been satisfied. This form must comply with state laws and regulations, which may vary, so it is essential to ensure that all legal requirements are met during the filing process. Failure to complete this process may leave the property encumbered, potentially affecting future transactions.

Required Documents for the AR Satisfaction Mortgage

To complete the AR Satisfaction Mortgage, specific documents are typically required. These may include:

- The original mortgage agreement

- Proof of payment history or a payoff statement

- Identification documents for the borrower

- Any additional forms required by the local county clerk or recorder's office

State-Specific Rules for the AR Satisfaction Mortgage

Each state in the U.S. has its own rules regarding the AR Satisfaction Mortgage. These rules may dictate how the form should be completed, who must sign it, and where it must be filed. It is important to research the specific requirements for your state to ensure compliance. Some states may also have additional forms or fees associated with the filing process, which should be taken into account when preparing to submit your satisfaction mortgage.

Quick guide on how to complete ar satisfaction mortgage

Easily Prepare Ar Satisfaction Mortgage on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-conscious alternative to conventional printed and signed documentation, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Handle Ar Satisfaction Mortgage on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Modify and Electronically Sign Ar Satisfaction Mortgage Effortlessly

- Obtain Ar Satisfaction Mortgage and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important parts of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Alter and electronically sign Ar Satisfaction Mortgage while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an AR satisfaction mortgage?

An AR satisfaction mortgage is a loan that allows borrowers to satisfy their mortgage obligations while providing flexible payment options. Understanding this concept can help you navigate your mortgage choices more effectively.

-

How does airSlate SignNow facilitate the AR satisfaction mortgage process?

airSlate SignNow streamlines the AR satisfaction mortgage process by enabling digital document signing and management. This ensures that all necessary paperwork is completed efficiently and securely, reducing delays in your mortgage transactions.

-

What features does airSlate SignNow offer to assist with AR satisfaction mortgage documentation?

AirSlate SignNow offers features such as customizable templates, real-time tracking, and automated reminders for your AR satisfaction mortgage documents. These features enhance the borrowing experience by ensuring timely submissions and reducing the potential for errors.

-

What are the costs associated with using airSlate SignNow for AR satisfaction mortgages?

The pricing for airSlate SignNow is generally cost-effective, making it accessible for users managing AR satisfaction mortgage documents. Various plans are available, allowing users to choose an option that best fits their needs and budget.

-

Can I integrate airSlate SignNow with other tools for managing AR satisfaction mortgage workflows?

Yes, airSlate SignNow can be integrated with various CRM and document management systems, enhancing the workflow for AR satisfaction mortgage tasks. This integration helps in centralizing your operations and improving overall efficiency.

-

What benefits does airSlate SignNow provide for AR satisfaction mortgage management?

Using airSlate SignNow for your AR satisfaction mortgage management offers benefits such as increased speed, improved accuracy, and enhanced security in document handling. It provides a hassle-free experience for both lenders and borrowers alike.

-

Is airSlate SignNow suitable for businesses looking to handle AR satisfaction mortgages?

Absolutely! AirSlate SignNow is designed to cater to businesses of all sizes, making it an ideal solution for managing AR satisfaction mortgages efficiently. Its user-friendly interface and powerful features streamline the entire process, ensuring a smooth experience.

Get more for Ar Satisfaction Mortgage

- Sd 30 day notice form

- Sd corporation 497326230 form

- Sd release lien form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property south dakota form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497326234 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property south dakota form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential south dakota form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property south dakota form

Find out other Ar Satisfaction Mortgage

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure