Ar Financing Form

What is the AR Financing?

The AR financing, or Accounts Receivable financing, is a financial arrangement that allows businesses to obtain immediate cash by leveraging their outstanding invoices. This form of financing is particularly beneficial for companies that experience cash flow challenges due to delayed payments from clients. By selling their receivables to a financing company, businesses can access funds quickly, which can be used for various operational needs, such as payroll, inventory purchases, or other expenses.

How to Use the AR Financing

To effectively utilize AR financing, businesses typically follow a straightforward process. First, they assess their outstanding invoices and determine which ones are eligible for financing. Next, they approach a financing company that specializes in AR financing. After submitting the necessary documentation, including the invoices and financial statements, the financing company evaluates the risk and offers a cash advance based on the value of the receivables. Once the agreement is in place, businesses receive the funds, usually within a few days, while the financing company takes over the collection of the invoices.

Steps to Complete the AR Financing

Completing the AR financing process involves several key steps:

- Evaluate outstanding invoices to identify eligible receivables.

- Research and select a reputable financing company.

- Gather necessary documentation, including invoices and financial records.

- Submit the application to the financing company.

- Review and sign the financing agreement.

- Receive the cash advance and allow the financing company to handle collections.

Legal Use of the AR Financing

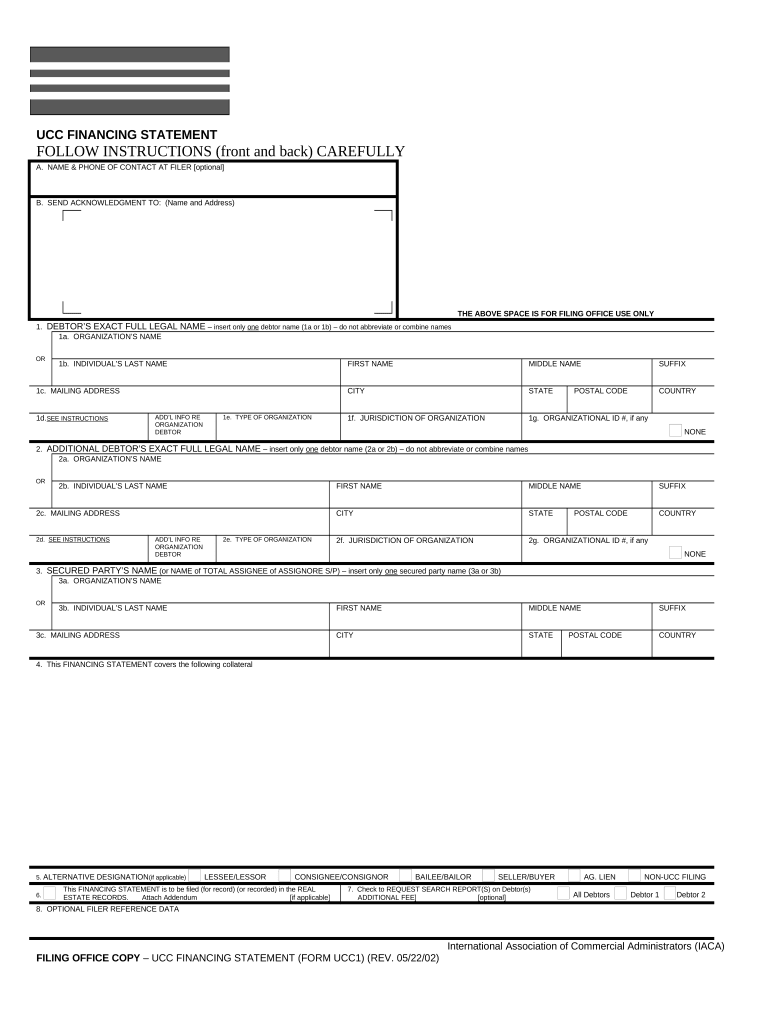

AR financing is governed by various legal regulations that ensure the protection of both the business and the financing company. It is essential for businesses to understand the terms of the financing agreement, including fees, repayment terms, and the responsibilities of each party. Compliance with applicable laws, such as the Uniform Commercial Code (UCC), is crucial to ensure that the financing arrangement is legally binding and enforceable.

Key Elements of the AR Financing

Several key elements define AR financing, including:

- Invoice eligibility: Not all invoices qualify for financing; typically, those that are less than 90 days old and issued to creditworthy clients are preferred.

- Advance rate: This is the percentage of the invoice value that the financing company will provide upfront, usually ranging from seventy to ninety percent.

- Fees: Financing companies may charge various fees, including service fees, discount rates, and other administrative costs.

- Collection responsibility: The financing company typically assumes the responsibility for collecting payments from clients.

Required Documents

To initiate the AR financing process, businesses need to prepare several documents, including:

- Outstanding invoices that are eligible for financing.

- Financial statements that provide insight into the company's financial health.

- Accounts receivable aging reports to show the status of outstanding invoices.

- Business identification documents, such as articles of incorporation or business licenses.

Quick guide on how to complete ar financing

Prepare Ar Financing seamlessly on any gadget

Digital document handling has become widespread among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the required format and securely archive it online. airSlate SignNow provides you with all the instruments you require to create, modify, and electronically sign your papers swiftly without delays. Manage Ar Financing on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Ar Financing effortlessly

- Locate Ar Financing and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark relevant sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your amendments.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign Ar Financing and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is AR financing and how can it benefit my business?

AR financing, or accounts receivable financing, is a way for businesses to access funds based on their outstanding invoices. By leveraging your accounts receivable, you can improve cash flow, invest in growth, and manage operational expenses more efficiently. With airSlate SignNow, you can streamline the document signing process associated with AR financing, making it quicker and hassle-free.

-

How does airSlate SignNow simplify the AR financing process?

airSlate SignNow simplifies AR financing by providing an intuitive platform for sending and eSigning necessary documents. With features like template creation and automated workflows, you can reduce the time spent on paperwork and focus on securing financing. This efficiency can signNowly enhance your ability to manage accounts receivable effectively.

-

What are the costs associated with using airSlate SignNow for AR financing?

The cost of using airSlate SignNow for AR financing varies based on the plan you choose, but it remains a cost-effective solution for businesses of all sizes. Subscription plans come with a range of features tailored to meet your financing needs without breaking the bank. By optimizing your document management for AR financing, you potentially save money on administrative costs.

-

Can I integrate airSlate SignNow with other financial software for AR financing?

Yes, airSlate SignNow offers integrations with various financial software solutions, enhancing your AR financing capabilities. By connecting with platforms like QuickBooks and Xero, you can streamline your invoicing and payment processes, allowing for quicker access to your funds. This integration ensures you can manage your documents and finances seamlessly.

-

What features of airSlate SignNow support AR financing?

Key features of airSlate SignNow that support AR financing include eSignature, document templates, and real-time tracking. These tools allow for fast execution of contracts and agreements related to your accounts receivable, ensuring no delays in your financing process. Utilizing these features maximizes your efficiency in managing AR financing.

-

Is airSlate SignNow secure for handling AR financing documents?

Absolutely, airSlate SignNow prioritizes security by employing robust encryption and compliance measures for all documents, including those related to AR financing. This ensures both your data and that of your clients are protected throughout the signing process. You can confidently send and receive sensitive information knowing that it is secure.

-

How can airSlate SignNow improve the speed of AR financing transactions?

By using airSlate SignNow, you can signNowly speed up AR financing transactions through quick document preparation and electronic signatures. With features like bulk sending and automated reminders, you can reduce turnaround times considerably. This efficiency allows you to close financing deals faster, ultimately benefiting your cash flow.

Get more for Ar Financing

- Commercial building or space lease south dakota form

- South dakota relative caretaker legal documents package south dakota form

- Sd guardian form

- South dakota forms

- Bill of sale with warranty by individual seller south dakota form

- Bill of sale with warranty for corporate seller south dakota form

- Bill of sale without warranty by individual seller south dakota form

- Bill of sale without warranty by corporate seller south dakota form

Find out other Ar Financing

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free