Quitclaim Deed from Corporation to LLC Arizona Form

What is the Quitclaim Deed From Corporation To LLC Arizona

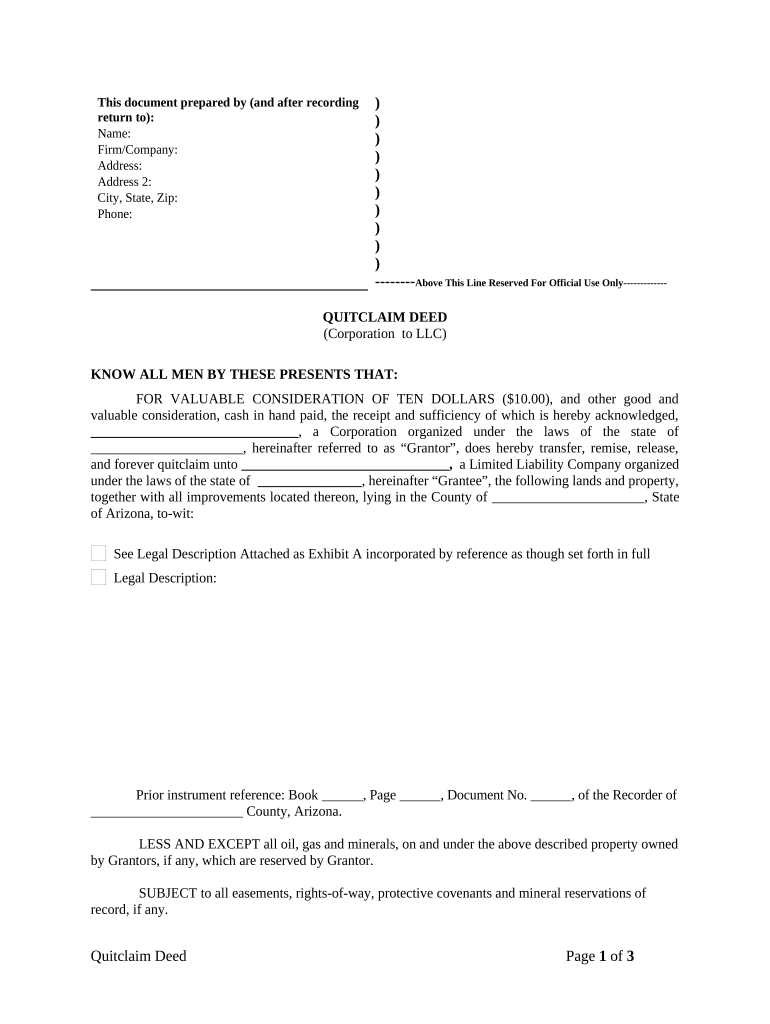

A quitclaim deed from a corporation to an LLC in Arizona is a legal document that facilitates the transfer of property ownership from a corporation to a limited liability company. Unlike other types of deeds, a quitclaim deed does not guarantee that the property title is clear; it simply conveys whatever interest the corporation has in the property. This type of deed is often used in business transactions where property ownership is being restructured or transferred as part of a corporate reorganization.

Steps to Complete the Quitclaim Deed From Corporation To LLC Arizona

Completing a quitclaim deed from a corporation to an LLC involves several key steps:

- Gather necessary information, including the legal description of the property and the names of the parties involved.

- Draft the quitclaim deed, ensuring it includes all required elements such as the date, grantor, grantee, and property description.

- Have the document signed by an authorized representative of the corporation.

- Notarize the quitclaim deed to ensure its legal validity.

- File the deed with the appropriate county recorder’s office to make the transfer official.

Key Elements of the Quitclaim Deed From Corporation To LLC Arizona

Several key elements must be included in a quitclaim deed from a corporation to an LLC in Arizona:

- Grantor and Grantee Information: Clearly state the names and addresses of the corporation (grantor) and the LLC (grantee).

- Property Description: Provide a detailed legal description of the property being transferred.

- Consideration: Indicate any consideration paid for the property, even if it is nominal.

- Signatures: Ensure the deed is signed by an authorized representative of the corporation.

- Notarization: Include a notary acknowledgment to validate the signatures.

Legal Use of the Quitclaim Deed From Corporation To LLC Arizona

The quitclaim deed from a corporation to an LLC is legally recognized in Arizona as a valid means of transferring property. This type of deed is particularly useful in business contexts where property ownership needs to be transferred quickly and without the need for extensive title searches. However, it is essential to ensure that the corporation has the legal authority to transfer the property and that the deed is executed correctly to avoid future disputes.

State-Specific Rules for the Quitclaim Deed From Corporation To LLC Arizona

In Arizona, specific rules govern the execution and filing of quitclaim deeds. These include:

- The deed must be in writing and signed by the grantor.

- It must be notarized to be considered valid.

- Filing must occur within a certain timeframe after execution to ensure the transfer is officially recorded.

- Any applicable transfer taxes should be paid at the time of filing.

How to Use the Quitclaim Deed From Corporation To LLC Arizona

Using a quitclaim deed from a corporation to an LLC involves several practical considerations. First, ensure all parties understand the implications of the transfer. It is advisable to consult with a legal professional to verify that the deed meets all legal requirements and that the transaction aligns with business objectives. Once the deed is executed, it should be filed promptly with the county recorder to protect the interests of the LLC and establish clear ownership.

Quick guide on how to complete quitclaim deed from corporation to llc arizona

Complete Quitclaim Deed From Corporation To LLC Arizona effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly and without delays. Manage Quitclaim Deed From Corporation To LLC Arizona on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Quitclaim Deed From Corporation To LLC Arizona seamlessly

- Locate Quitclaim Deed From Corporation To LLC Arizona and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Quitclaim Deed From Corporation To LLC Arizona to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To LLC Arizona?

A Quitclaim Deed From Corporation To LLC Arizona is a legal document used to transfer property ownership from a corporation to a limited liability company (LLC). This type of deed ensures that the corporation relinquishes any claim to the property, allowing the LLC to take full ownership. It's important to create this document correctly to ensure compliance with Arizona laws.

-

How do I prepare a Quitclaim Deed From Corporation To LLC Arizona?

Preparing a Quitclaim Deed From Corporation To LLC Arizona involves filling out the form accurately with the property details and both entities' information. You may also need to include a legal description of the property. Additionally, it's advisable to consult with a legal professional to ensure the deed meets local jurisdiction requirements.

-

What are the costs associated with a Quitclaim Deed From Corporation To LLC Arizona?

The costs associated with a Quitclaim Deed From Corporation To LLC Arizona typically include recording fees charged by the county and any attorney fees if legal assistance is sought. The recording fees vary by county, so it's essential to check with your local recorder's office for specific rates. airSlate SignNow offers competitive pricing for eSigning and document preparation, making the process affordable.

-

What benefits does using airSlate SignNow provide for a Quitclaim Deed From Corporation To LLC Arizona?

Using airSlate SignNow for a Quitclaim Deed From Corporation To LLC Arizona offers several benefits, including a streamlined eSigning process and easy document management. The platform enables quick electronic signatures, reducing the time needed for physical document handling. It also ensures your documents are securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other software for handling a Quitclaim Deed From Corporation To LLC Arizona?

Yes, airSlate SignNow seamlessly integrates with various software solutions, allowing you to streamline your document workflows. Whether you use CRMs, cloud storage, or accounting software, you can coordinate the management of a Quitclaim Deed From Corporation To LLC Arizona within your existing systems. This integration enhances efficiency and reduces errors.

-

Is it necessary to signNow a Quitclaim Deed From Corporation To LLC Arizona?

Yes, it is generally advisable to have a Quitclaim Deed From Corporation To LLC Arizona signNowd to validate the document's authenticity. Notarization helps prevent disputes regarding the deed's legitimacy and is often a requirement for recording the deed with the county. Make sure to check local regulations for specific notarization requirements.

-

How can I ensure compliance with Arizona laws when creating a Quitclaim Deed From Corporation To LLC?

To ensure compliance with Arizona laws when creating a Quitclaim Deed From Corporation To LLC, you should follow state-specific formatting requirements and include all necessary legal language. Consulting with a real estate attorney can provide guidance tailored to your unique situation and help avoid potential legal issues. airSlate SignNow's templates also include compliance considerations for Arizona.

Get more for Quitclaim Deed From Corporation To LLC Arizona

Find out other Quitclaim Deed From Corporation To LLC Arizona

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free