Az Debt Form

What is the AZ Debt?

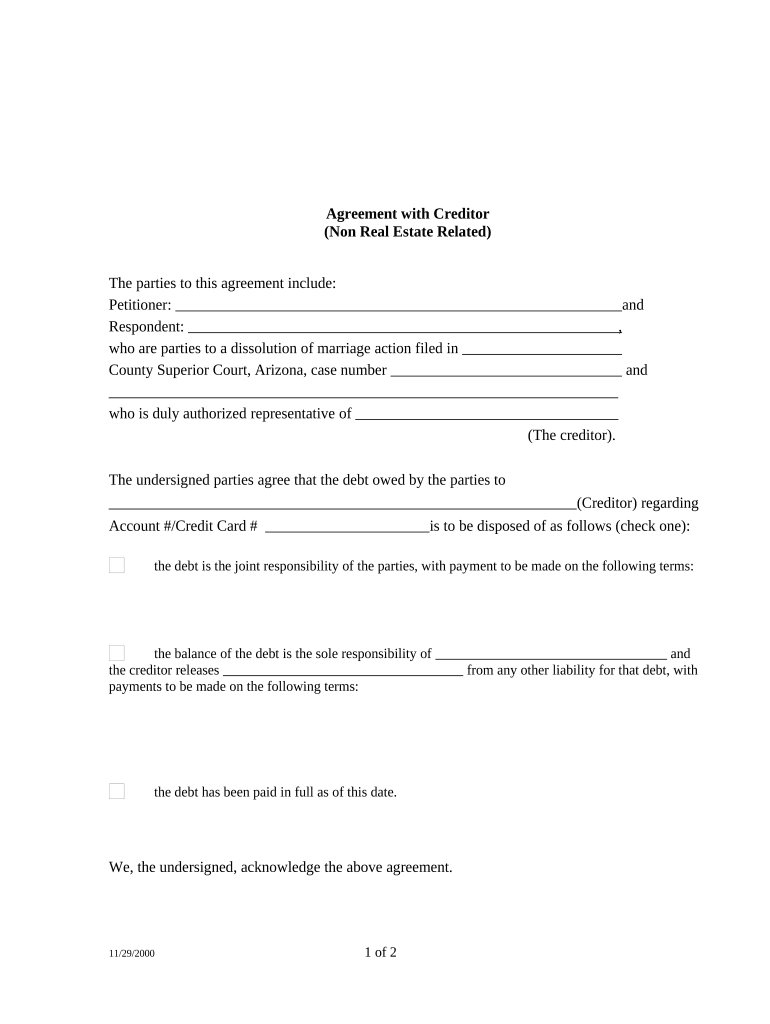

The AZ Debt form is a legal document used to formalize an agreement between a debtor and a creditor in the state of Arizona. This form outlines the terms of the debt repayment, including the amount owed, interest rates, and repayment schedule. It serves as a binding contract that protects the rights of both parties involved. Understanding the AZ Debt form is crucial for anyone looking to manage their debts responsibly and ensure compliance with state laws.

How to Use the AZ Debt

Using the AZ Debt form involves several steps to ensure that all necessary information is accurately captured. First, gather all relevant financial information, including the total debt amount and any agreed-upon terms with the creditor. Next, fill out the form by providing detailed information about both the debtor and the creditor. Ensure that all signatures are obtained, as this validates the agreement. Finally, retain a copy of the completed form for your records, as it may be needed for future reference or legal purposes.

Steps to Complete the AZ Debt

Completing the AZ Debt form requires careful attention to detail. Follow these steps:

- Collect all necessary information, including personal details of both parties.

- Clearly state the total amount of debt and any applicable interest rates.

- Outline the repayment terms, including deadlines and payment methods.

- Ensure both parties sign the document, which may require notarization for added legal protection.

- Keep copies of the signed form for both the debtor and creditor.

Legal Use of the AZ Debt

The AZ Debt form is legally binding when completed correctly and in compliance with Arizona state laws. It is essential to ensure that all terms are clear and agreed upon by both parties to avoid future disputes. The form must be signed by both the debtor and creditor, and in some cases, notarization may be required to enhance its legal standing. Familiarizing yourself with state-specific regulations can help ensure that the form is used appropriately.

Key Elements of the AZ Debt

Several key elements must be included in the AZ Debt form to ensure its validity:

- Debtor Information: Full name, address, and contact details of the debtor.

- Creditor Information: Full name, address, and contact details of the creditor.

- Debt Amount: The total amount owed by the debtor.

- Interest Rate: Any applicable interest rates on the debt.

- Repayment Terms: Detailed description of the repayment schedule and methods.

Examples of Using the AZ Debt

There are various scenarios in which the AZ Debt form may be utilized. For instance, an individual may use it to formalize a loan agreement with a friend or family member. Businesses may also employ this form to document debts owed by clients or customers. By clearly outlining the terms of the agreement, both parties can avoid misunderstandings and ensure that the debt is repaid according to the agreed-upon conditions.

Quick guide on how to complete az debt

Complete Az Debt effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed papers, as you can find the right template and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents quickly and efficiently. Manage Az Debt on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and electronically sign Az Debt with ease

- Find Az Debt and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose your preferred method to send your form, whether it is by email, text message (SMS), or invite link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you prefer. Edit and electronically sign Az Debt and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to az debt?

airSlate SignNow is an efficient eSigning solution designed to streamline document workflows. When handling az debt-related documents, businesses can easily send, sign, and manage contracts securely and efficiently.

-

How much does airSlate SignNow cost for managing az debt documents?

The pricing for airSlate SignNow is competitive and varies based on the plan you select. Depending on your business needs related to az debt, you can choose from various subscription options that fit your budget and feature requirements.

-

What features does airSlate SignNow offer for az debt management?

airSlate SignNow includes features like document templates, customizable workflows, and automated reminders, making it ideal for managing az debt documents. These features ensure that the signing process is efficient and compliant.

-

Is airSlate SignNow secure for handling sensitive az debt information?

Yes, airSlate SignNow prioritizes security. It utilizes advanced encryption and complies with global security standards, ensuring that all az debt documents are handled with the utmost confidentiality and safety.

-

Can airSlate SignNow integrate with other tools for az debt processing?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to manage az debt within your existing workflows. This includes popular tools for CRM, accounting, and document management systems.

-

How does airSlate SignNow enhance productivity for az debt teams?

By automating document workflows, airSlate SignNow signNowly enhances productivity for teams dealing with az debt. Users can quickly send out contracts for eSigning, track their status, and receive timely notifications, reducing turnaround times.

-

What industries benefit most from using airSlate SignNow for az debt documentation?

Various industries, including finance, legal, and real estate, benefit from using airSlate SignNow for az debt documentation. Its versatility makes it a perfect solution for businesses handling contracts and agreements related to debt.

Get more for Az Debt

Find out other Az Debt

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online