Arizona Secured Form

What is the Arizona Secured?

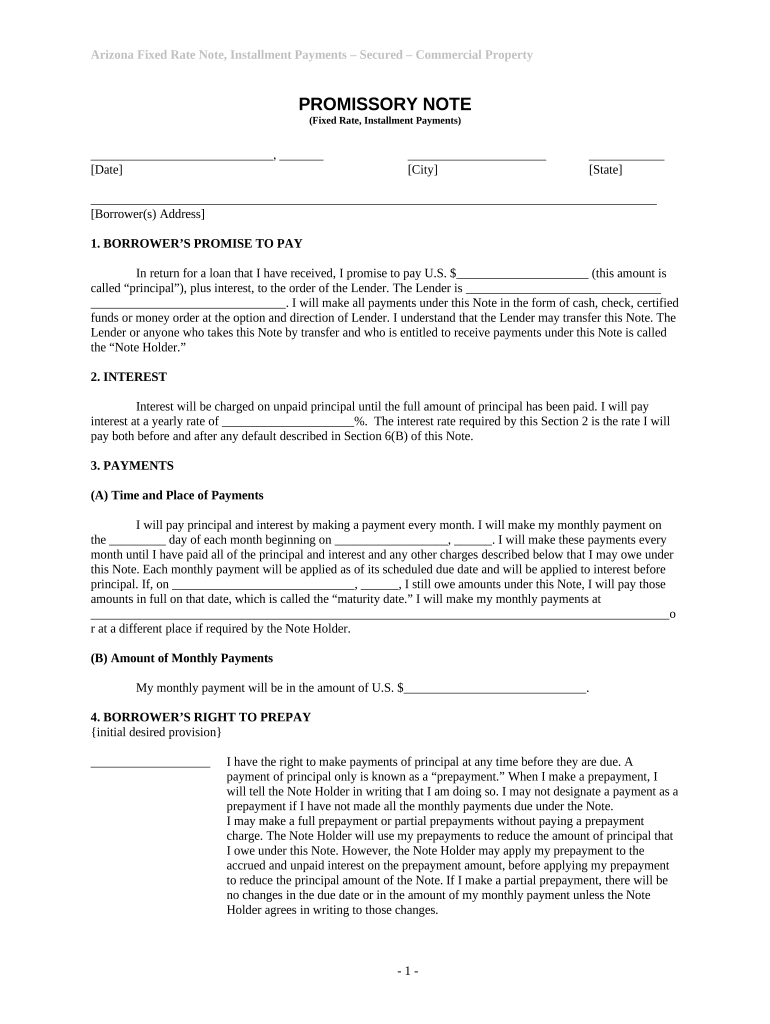

The Arizona secured form is a legally binding document that establishes a loan agreement between a borrower and a lender, where the loan is backed by collateral. This collateral can be any asset of value, such as real estate, vehicles, or other personal property. In the event of default, the lender has the right to seize the collateral to recover the owed amount. Understanding the specific terms and conditions outlined in the Arizona secured form is crucial for both parties to ensure clarity and legal protection.

How to use the Arizona Secured

Using the Arizona secured form involves several key steps to ensure that the document is properly filled out and executed. First, both the borrower and lender should review the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payments. Next, both parties need to provide their personal information, including names, addresses, and contact details. It is also essential to clearly describe the collateral being used to secure the loan. Once completed, both parties should sign the document in the presence of a notary public to ensure its legality.

Steps to complete the Arizona Secured

Completing the Arizona secured form requires careful attention to detail. Follow these steps:

- Gather necessary information, including personal details of both parties and a description of the collateral.

- Clearly outline the loan terms, including the amount, interest rate, and repayment schedule.

- Include any additional clauses that may be relevant, such as default conditions and remedies.

- Both parties should review the document for accuracy and completeness.

- Sign the document in front of a notary public to validate the agreement.

Legal use of the Arizona Secured

The Arizona secured form is legally enforceable as long as it complies with state laws regarding secured transactions. It should include essential elements such as the identification of the parties, a clear description of the collateral, and the terms of the loan. Additionally, both parties must sign the document, and it is advisable to have it notarized to prevent disputes. By adhering to these legal requirements, the Arizona secured form can be used effectively to protect the interests of both the borrower and lender.

Key elements of the Arizona Secured

Several key elements must be included in the Arizona secured form to ensure its effectiveness and legal standing:

- Identification of Parties: Full names and contact information of both the borrower and lender.

- Description of Collateral: A detailed description of the asset securing the loan.

- Loan Terms: The principal amount, interest rate, repayment schedule, and any fees or penalties.

- Signatures: Signatures of both parties, ideally witnessed by a notary public.

- Default Conditions: Clear terms outlining what constitutes a default and the remedies available to the lender.

State-specific rules for the Arizona Secured

In Arizona, specific rules govern the use of secured promissory notes. These rules include compliance with the Uniform Commercial Code (UCC), which outlines the requirements for secured transactions. It is important for both parties to be aware of any state-specific regulations that may affect the enforceability of the Arizona secured form. This includes understanding the rights and responsibilities of both the borrower and lender, as well as any legal remedies available in case of default.

Quick guide on how to complete arizona secured

Prepare Arizona Secured effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Arizona Secured on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Arizona Secured seamlessly

- Obtain Arizona Secured and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form: by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Arizona Secured and guarantee outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a promissory note secured?

A promissory note secured is a financial document that outlines a borrower's promise to repay a loan, backed by collateral. This type of note provides lenders with added security, as it allows them to claim the collateral if the borrower defaults. Using airSlate SignNow, you can easily create and manage your promissory note secured with eSigning features.

-

How does airSlate SignNow help with creating a promissory note secured?

airSlate SignNow provides templates and guided workflows that simplify the creation of promissory note secured documents. With our user-friendly interface, you can customize terms, add collateral details, and ensure compliance with legal requirements. This streamlines the borrowing process for both lenders and borrowers.

-

What are the benefits of using airSlate SignNow for a promissory note secured?

Using airSlate SignNow for your promissory note secured offers several benefits including speed, security, and convenience. You can eSign documents in minutes, ensuring a quick turnaround, and our encryption keeps your sensitive information safe. Plus, our cloud storage provides easy access to your documents whenever needed.

-

Is there a cost associated with using airSlate SignNow for a promissory note secured?

Yes, airSlate SignNow offers various pricing plans to suit different needs when creating a promissory note secured. We provide a cost-effective solution that includes essential features for signing, sending, and tracking documents. You can choose a plan that fits your budget while still getting comprehensive document management tools.

-

Can I integrate airSlate SignNow with other applications while managing a promissory note secured?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications, making it easy to manage your promissory note secured along with other business processes. Whether it’s CRM systems, cloud storage, or financial tools, these integrations enhance workflow and improve efficiency.

-

What type of security does airSlate SignNow provide for a promissory note secured?

airSlate SignNow employs advanced security measures to protect your promissory note secured. Our platform uses bank-level encryption, secure access protocols, and regular audits to ensure data integrity and confidentiality. This allows users to sign and save sensitive documents with peace of mind.

-

How can airSlate SignNow improve my business transactions involving a promissory note secured?

By using airSlate SignNow for your promissory note secured, you can enhance transaction efficiency and reduce turnaround times. The platform allows for quick signing and real-time tracking of document status, minimizing delays in processes. This leads to an overall improved experience for both lenders and borrowers.

Get more for Arizona Secured

Find out other Arizona Secured

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free