Letter Tax Sales Form

What is the Letter Tax Sales

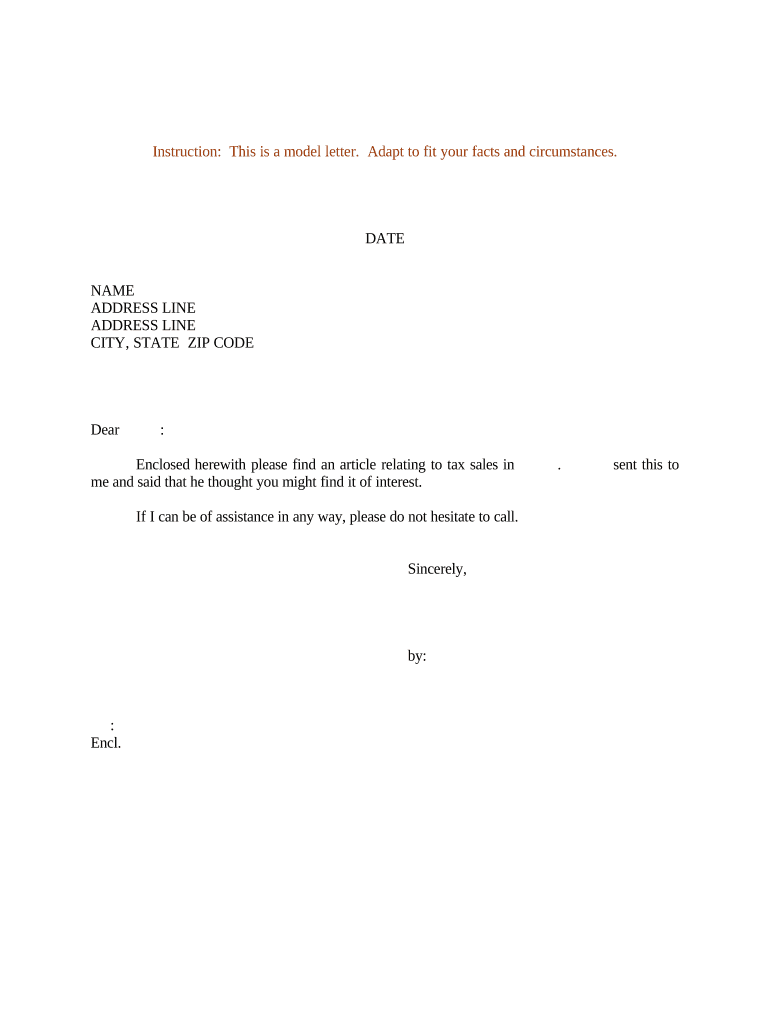

The letter tax sales is a formal document used primarily in the context of tax collection and compliance. It serves as a notification to taxpayers regarding their obligations related to sales tax, including any outstanding balances or exemptions. This letter is crucial for businesses and individuals to understand their tax responsibilities and avoid potential penalties. The letter may vary by state, reflecting local tax laws and regulations.

How to use the Letter Tax Sales

Using the letter tax sales involves several steps to ensure that it meets legal and compliance standards. First, identify the specific purpose of the letter, such as notifying a taxpayer of unpaid sales tax or informing them about sales tax exemption eligibility. Next, gather all necessary information, including taxpayer details, tax identification numbers, and relevant sales data. Finally, ensure that the letter is signed electronically to maintain its legal validity. Utilizing a reliable eSignature platform can facilitate this process.

Steps to complete the Letter Tax Sales

Completing the letter tax sales requires careful attention to detail. Follow these steps:

- Gather necessary information, such as taxpayer name, address, and tax identification number.

- Clearly state the purpose of the letter, whether it’s for unpaid sales tax or exemption notification.

- Include specific details about the tax amount due or the exemption criteria.

- Ensure compliance with state-specific regulations regarding the content and format of the letter.

- Sign the letter electronically to validate its authenticity.

Key elements of the Letter Tax Sales

Several key elements must be included in the letter tax sales to ensure its effectiveness:

- Taxpayer Information: Full name, address, and tax identification number.

- Purpose of the Letter: Clearly state whether it addresses unpaid sales tax or exemption details.

- Tax Amount: Specify the total amount due or the exemption amount.

- Legal References: Include any relevant state laws or regulations that apply.

- Signature: An electronic signature to authenticate the document.

Legal use of the Letter Tax Sales

The legal use of the letter tax sales is governed by various laws and regulations at both federal and state levels. To be considered valid, the letter must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic signatures and documents are legally binding. Additionally, it is essential to maintain a record of the letter for compliance and auditing purposes.

Examples of using the Letter Tax Sales

There are various scenarios where the letter tax sales can be utilized effectively:

- A business notifying a client of unpaid sales tax, prompting them to settle their account.

- A retailer informing customers about the requirement to provide a sales tax exemption certificate.

- A collection letter for sales tax sent to individuals or businesses that have not complied with tax obligations.

Quick guide on how to complete letter tax sales

Prepare Letter Tax Sales effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Letter Tax Sales on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Letter Tax Sales without hassle

- Find Letter Tax Sales and then click Get Form to begin.

- Employ the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Letter Tax Sales and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter tax sales in the context of real estate?

A letter tax sales is a formal notification sent to property owners regarding outstanding tax obligations. It outlines the amount due and the potential consequences, like property tax liens or sales. Understanding this is crucial for property owners to avoid losing their assets due to unpaid taxes.

-

How does airSlate SignNow assist with managing letter tax sales?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning letter tax sales documents. Our user-friendly interface ensures that you can easily manage all tax-related communications without hassle. By automating these processes, you save time and reduce the risk of errors.

-

What are the pricing options for using airSlate SignNow for letter tax sales?

airSlate SignNow offers flexible pricing plans to suit businesses of any size, making it cost-effective for managing letter tax sales. You can choose from monthly or annual subscriptions, tailoring your selection based on your needs. This pricing flexibility ensures that you only pay for the services you use.

-

Can I integrate airSlate SignNow with other software for letter tax sales management?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to enhance your letter tax sales management. Whether it's CRM systems or accounting software, our integrations help streamline your workflow. This interoperability ensures that your tax sales documentation remains organized and easily accessible.

-

What features does airSlate SignNow offer for creating letter tax sales documents?

airSlate SignNow offers robust features that simplify the creation of letter tax sales documents. You can use customizable templates and drag-and-drop tools for easy document design. Additionally, the platform supports electronic signatures, which enhances the efficiency of your tax sales process.

-

How can using airSlate SignNow improve the efficiency of letter tax sales processes?

Using airSlate SignNow can signNowly enhance the efficiency of your letter tax sales processes by automating document workflows. The platform reduces the time spent on paperwork, allowing you to focus more on addressing tax issues. Automated reminders and tracking further streamline communication with property owners.

-

Is airSlate SignNow secure for handling sensitive letter tax sales information?

Absolutely, airSlate SignNow prioritizes security and compliance when handling sensitive letter tax sales information. Our platform employs advanced encryption technologies to protect your data during transmission and storage. We also adhere to industry standards to ensure your documents remain confidential and secure.

Get more for Letter Tax Sales

Find out other Letter Tax Sales

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple