Deed Trust between Form

What is the Deed Trust Between

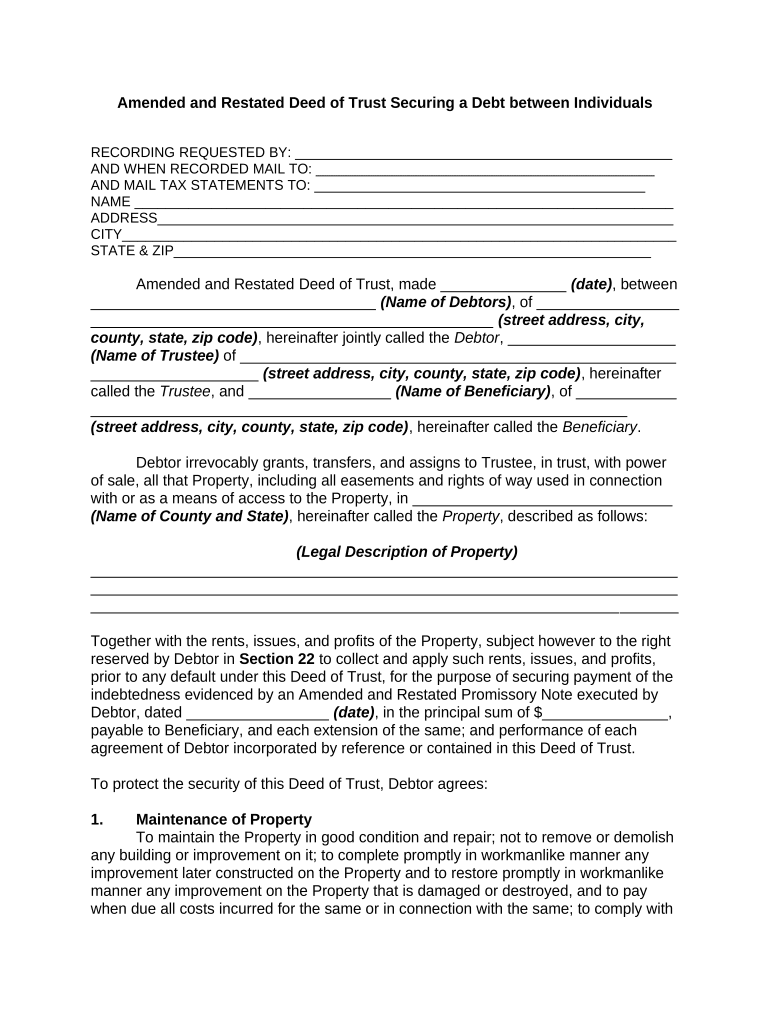

A deed trust between parties is a legal document that establishes a fiduciary relationship, often involving the management of property or assets. In the context of trust debt, this document outlines the responsibilities and rights of the trustee and the beneficiaries. The trustee holds the legal title to the property, while the beneficiaries enjoy the benefits of the property. This arrangement is commonly used in real estate transactions and estate planning, providing a structured way to manage assets and debts.

How to Use the Deed Trust Between

Utilizing a deed trust between parties involves several steps to ensure that all legal requirements are met. First, the parties involved must clearly define the terms of the trust, including the roles of the trustee and beneficiaries. Next, the deed trust document should be drafted, incorporating all necessary details such as property descriptions, obligations, and any specific instructions regarding the management of the trust. Once completed, the document must be signed and notarized to ensure its legality. Finally, it is advisable to record the deed trust with the appropriate local government office to provide public notice of the trust arrangement.

Key Elements of the Deed Trust Between

Several key elements are essential for a valid deed trust between parties. These include:

- Identification of Parties: Clearly state the names and addresses of the trustee and beneficiaries.

- Property Description: Provide a detailed description of the property or assets held in trust.

- Terms of the Trust: Outline the specific duties and powers of the trustee, as well as the rights of the beneficiaries.

- Duration of the Trust: Specify how long the trust will remain in effect and any conditions for termination.

- Signatures: Ensure that all parties sign the document in the presence of a notary public.

Steps to Complete the Deed Trust Between

Completing a deed trust between parties involves a systematic approach to ensure accuracy and compliance with legal standards. The following steps should be followed:

- Gather necessary information about the property and the parties involved.

- Draft the deed trust document, including all key elements and terms.

- Review the document for accuracy and completeness.

- Have all parties sign the document in front of a notary public.

- File the signed document with the appropriate local authority to formalize the trust.

Legal Use of the Deed Trust Between

The legal use of a deed trust between parties is governed by state laws, which can vary significantly. In the United States, it is crucial to ensure that the deed trust complies with local regulations regarding property ownership and fiduciary duties. This may include adhering to specific requirements for notarization, recording, and the handling of trust assets. Additionally, parties should be aware of any tax implications associated with the trust, as these can affect the overall management and distribution of trust assets.

Quick guide on how to complete deed trust between

Prepare Deed Trust Between effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the features you need to create, modify, and eSign your documents quickly without interruptions. Manage Deed Trust Between on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Deed Trust Between seamlessly

- Obtain Deed Trust Between and click Get Form to commence.

- Use the features we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and has the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign Deed Trust Between and ensure effective communication at every step of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is trust debt and how does it relate to eSigning documents?

Trust debt refers to the financial obligations that arise from trust agreements, which can include the signing of documents. Using airSlate SignNow, you can securely eSign these documents, ensuring legal compliance and proper record-keeping related to trust debt. This streamlines the process and reduces the risk of errors commonly associated with manual signing.

-

How does airSlate SignNow help in managing trust debt?

airSlate SignNow simplifies the management of trust debt by providing a platform to eSign and send necessary documents quickly. With its user-friendly interface and robust document tracking features, you can monitor all transactions related to trust debt, minimizing delays and ensuring that all parties are informed throughout the process.

-

What pricing plans does airSlate SignNow offer for businesses managing trust debt?

airSlate SignNow offers various pricing plans tailored to business needs, making it a cost-effective choice for managing trust debt. Each plan provides essential features needed for secure eSigning, including templates and API access, allowing you to choose one that fits your operational budget and requirements.

-

Can I integrate airSlate SignNow with other tools for trust debt management?

Yes, airSlate SignNow provides seamless integrations with numerous applications, facilitating effective management of trust debt. Whether you use CRM systems, document management platforms, or accounting software, you can easily connect airSlate SignNow to ensure that all your data flows smoothly and is accurately reflected in transactions related to trust debt.

-

What security measures does airSlate SignNow implement for trust debt documents?

Security is paramount when handling trust debt documents. airSlate SignNow employs advanced encryption, two-factor authentication, and compliance with major certifications to protect your documents. This ensures that all eSigned agreements related to trust debt are legally binding and secure against unauthorized access.

-

How quickly can I get started with airSlate SignNow for my trust debt needs?

Getting started with airSlate SignNow for trust debt needs is incredibly quick and easy. You can sign up for a free trial, explore the features, and begin sending documents for eSigning within minutes. This allows you to quickly address your trust debt management requirements without extensive setup time.

-

What are the benefits of using airSlate SignNow for trust debt compared to traditional signing methods?

Using airSlate SignNow for trust debt offers numerous benefits over traditional signing methods, such as saving time and reducing paper usage. With instant document delivery and electronic signatures, you can expedite processes related to trust debt, ensuring that all parties can act swiftly without unnecessary delays or logistical hassles.

Get more for Deed Trust Between

- Pa odometer statement 497324310 form

- Bill of sale for automobile or vehicle including odometer statement and promissory note pennsylvania form

- Promissory note in connection with sale of vehicle or automobile pennsylvania form

- Bill of sale for watercraft or boat pennsylvania form

- Pennsylvania bill sale automobile form

- Cost plus construction contract template 497324315 form

- Painting contract for contractor pennsylvania form

- Trim carpenter contract for contractor pennsylvania form

Find out other Deed Trust Between

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract