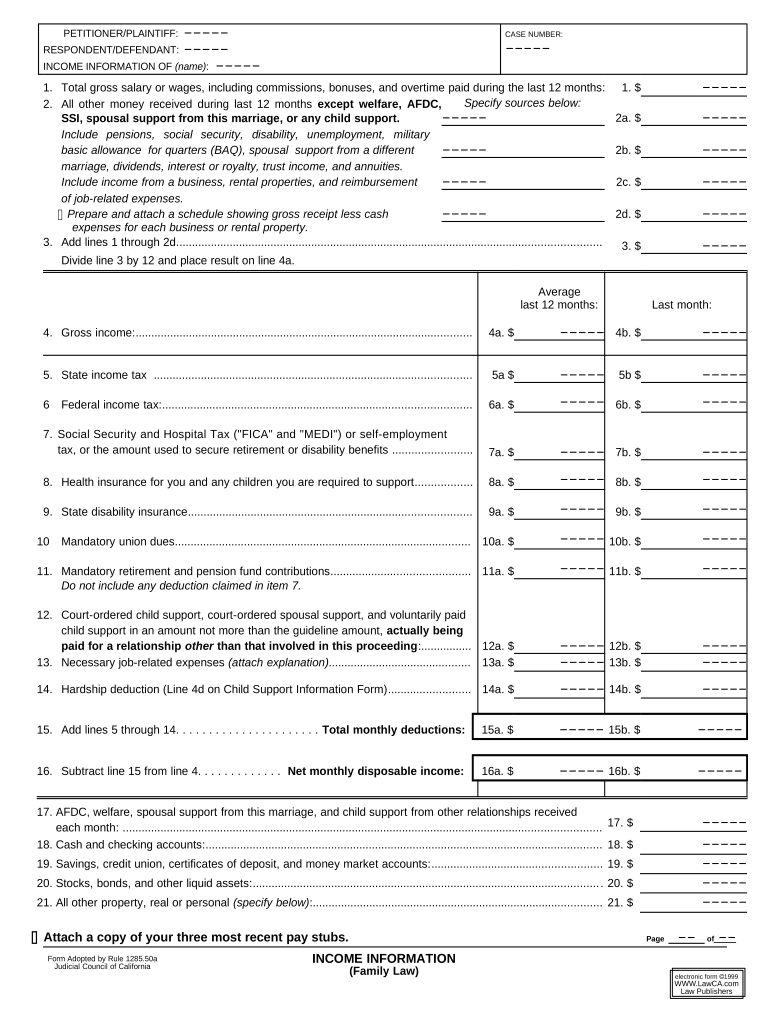

California Family Law Form

Understanding California Income Law

California income law encompasses various regulations and statutes that govern income taxation within the state. It is essential for residents and businesses to understand these laws to ensure compliance and avoid penalties. The law includes provisions related to income tax rates, deductions, credits, and filing requirements. California operates under a progressive tax system, meaning that higher income levels are taxed at higher rates. This structure aims to distribute the tax burden more equitably among residents.

Steps to Complete California Income Law Forms

Completing forms related to California income law involves several clear steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, determine your filing status, which can impact your tax rate and eligibility for certain credits. After that, use the appropriate form, such as the California Resident Income Tax Return (Form 540), to report your income and calculate your tax liability. Ensure that you include all deductions and credits for which you qualify. Finally, review your completed form for accuracy before submitting it electronically or via mail.

Key Elements of California Income Law

Several key elements define California income law. These include the tax brackets, which determine the percentage of income that must be paid in taxes, as well as various deductions that can lower taxable income. Common deductions include those for mortgage interest, property taxes, and certain medical expenses. Additionally, California offers various tax credits, such as the California Earned Income Tax Credit (CalEITC), which provides financial relief to low-income families. Understanding these elements is crucial for effective tax planning and compliance.

Filing Deadlines and Important Dates

Staying aware of filing deadlines is vital for compliance with California income law. Typically, the deadline for filing individual income tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be aware of estimated tax payment deadlines, which occur quarterly for those who expect to owe tax. Missing these deadlines can result in penalties and interest on unpaid taxes.

Required Documents for California Income Law Forms

When preparing to file under California income law, specific documents are required. Key documents include proof of income, such as W-2 forms from employers and 1099 forms for independent contractors. Taxpayers should also gather documentation for any deductions or credits claimed, including receipts for medical expenses, property tax statements, and records of contributions to retirement accounts. Having these documents organized will facilitate a smoother filing process.

Legal Use of California Income Law Forms

California income law forms must be used in accordance with state regulations to ensure they are legally binding. This means that all information reported must be accurate and complete, reflecting true income and expenses. Additionally, electronic filing options are available, which comply with the state's legal standards for eSignature and document submission. Utilizing a reliable eSigning solution can enhance the security and validity of the submitted forms.

Quick guide on how to complete california family law

Complete California Family Law with ease on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources you require to create, edit, and electronically sign your documents promptly without any delays. Manage California Family Law on any platform using airSlate SignNow’s Android or iOS applications and streamline your document-based processes today.

The easiest method to edit and eSign California Family Law effortlessly

- Obtain California Family Law and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred delivery method for your form, whether it's by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to the hassles of lost or misplaced documents, tedious form searching, and errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and eSign California Family Law and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is California income law?

California income law refers to the regulations and statutes that govern how personal and business income is taxed within the state. Understanding these laws is crucial for individuals and businesses alike to ensure compliance and optimal tax strategies.

-

How can airSlate SignNow help with California income law documentation?

airSlate SignNow provides an efficient platform to manage and eSign documents related to California income law. With features like templates and automated workflows, you can streamline the process of preparing tax-related documents while ensuring compliance with state regulations.

-

What pricing plans does airSlate SignNow offer for businesses dealing with California income law?

airSlate SignNow offers several pricing plans designed to cater to businesses of all sizes managing California income law documentation. By providing a cost-effective solution, businesses can easily adopt eSigning capabilities without exceeding their budgets.

-

What features does airSlate SignNow offer that cater specifically to California income law needs?

airSlate SignNow offers features such as customizable templates for tax documents, advanced security measures, and mobile accessibility, all of which help users comply with California income law efficiently. These tools help ensure that businesses maintain compliance while saving time and resources.

-

How does airSlate SignNow ensure compliance with California income law?

airSlate SignNow ensures compliance with California income law through customizable workflows and secure eSigning solutions. The platform is designed to adapt to local regulations, allowing businesses to maintain legal compliance when managing their documents.

-

Can airSlate SignNow integrate with other tools related to California income law?

Yes, airSlate SignNow seamlessly integrates with popular accounting and tax software, providing users with a comprehensive solution to handle their California income law documentation. This integration helps streamline workflows and keep all financial records organized.

-

What are the benefits of using airSlate SignNow for California income law?

Using airSlate SignNow for California income law offers numerous benefits, including time savings, improved accuracy, and enhanced document security. These advantages help businesses navigate tax-related documents efficiently while minimizing the risk of errors.

Get more for California Family Law

Find out other California Family Law

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors