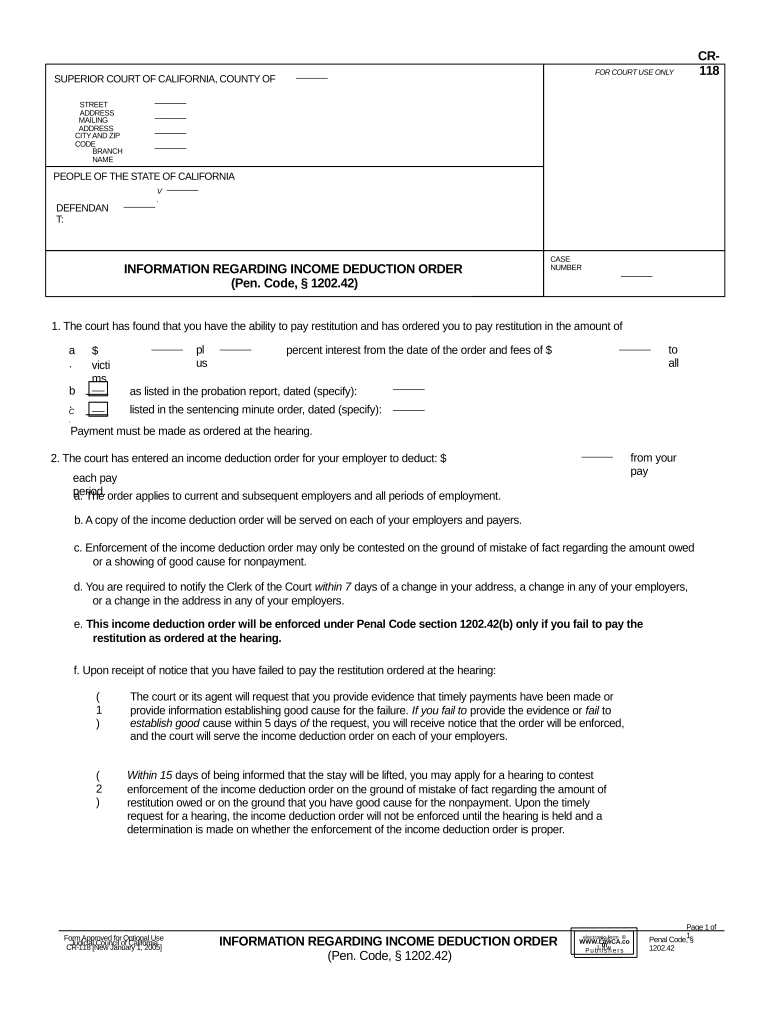

Ca Income Deduction Form

What is the CA Income Deduction

The CA income deduction refers to specific tax deductions available to residents of California when filing their state income taxes. These deductions can significantly reduce taxable income, thereby lowering the overall tax liability for individuals and businesses. The deductions may apply to various categories, including personal exemptions, standard deductions, and specific itemized deductions related to medical expenses, mortgage interest, and state taxes paid. Understanding the CA income deduction is essential for taxpayers looking to maximize their tax savings and ensure compliance with state tax laws.

Steps to Complete the CA Income Deduction

Completing the CA income deduction involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including W-2 forms, 1099 forms, and receipts for deductible expenses. Next, determine whether to take the standard deduction or itemize deductions based on your financial situation. If itemizing, list all eligible expenses and ensure they meet the state’s requirements. After calculating the total deductions, fill out the appropriate sections on your California tax return form. Finally, review the completed form for accuracy before submission.

Legal Use of the CA Income Deduction

The legal use of the CA income deduction is governed by California tax laws, which outline what qualifies as a deductible expense. Taxpayers must adhere to these regulations to ensure their deductions are valid. Common legal deductions include those for medical expenses exceeding a certain percentage of adjusted gross income, mortgage interest, and contributions to qualified retirement accounts. It is crucial to maintain proper documentation for all claimed deductions, as the California Franchise Tax Board may require proof during audits.

Required Documents

To successfully claim the CA income deduction, taxpayers need to prepare various documents. Essential documents include:

- W-2 forms from employers, detailing wages and taxes withheld

- 1099 forms for other income sources, such as freelance work or interest

- Receipts for deductible expenses, including medical bills and charitable contributions

- Records of state taxes paid, which may also be deductible

- Any relevant documentation for itemized deductions, such as mortgage statements

Organizing these documents ahead of time can streamline the filing process and help ensure all eligible deductions are claimed.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the CA income deduction is critical for compliance and avoiding penalties. Generally, California state income tax returns are due on April 15 each year, aligning with federal tax deadlines. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an automatic extension, typically allowing an additional six months to file, although any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Examples of Using the CA Income Deduction

Examples of the CA income deduction in practice can help clarify how these deductions work. For instance, a self-employed individual may deduct business expenses, such as office supplies and travel costs, which directly relate to their income-generating activities. A homeowner may deduct mortgage interest paid on their primary residence, while a taxpayer with significant medical expenses may claim deductions for costs exceeding a specified percentage of their income. Each scenario illustrates how the CA income deduction can effectively reduce taxable income and overall tax liability.

Quick guide on how to complete ca income deduction

Effortlessly Prepare Ca Income Deduction on Any Device

Managing documents online has gained traction among both organizations and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it in the cloud. airSlate SignNow provides you with all the tools necessary to quickly create, modify, and eSign your documents without any holdups. Handle Ca Income Deduction on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Modify and eSign Ca Income Deduction Seamlessly

- Locate Ca Income Deduction and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Ca Income Deduction and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CA income deduction and how can it affect my business?

A CA income deduction refers to the allowable subtractions from your income when calculating California state taxes. Understanding CA income deductions can signNowly affect your business's tax liabilities and ultimately improve your financial health. It's crucial to leverage these deductions to maximize savings and ensure compliance with state tax laws.

-

How can airSlate SignNow help with CA income deduction documentation?

airSlate SignNow streamlines the process of preparing and signing documents related to CA income deductions. With our platform, you can easily manage tax forms and contracts that may qualify for deductions, ensuring that all necessary documentation is securely stored and accessible. This saves time and reduces errors in tax preparation.

-

What features does airSlate SignNow offer to assist with CA income deductions?

airSlate SignNow offers features like customizable templates for tax-related documents, secure electronic signatures, and integration with popular accounting software. These tools help simplify the documentation process related to CA income deductions, making it easier for businesses to track and manage their tax obligations. Additionally, our user-friendly interface enhances efficiency.

-

Is there a pricing model for airSlate SignNow that accommodates small businesses focusing on CA income deductions?

Yes, airSlate SignNow offers flexible pricing plans suitable for small businesses looking to optimize their CA income deductions. Our cost-effective solutions provide essential features without overwhelming your budget, allowing you to effectively manage and sign tax-related documents with ease. Contact our sales team for more information on custom plans.

-

Can airSlate SignNow integrate with accounting software to manage CA income deductions?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, enhancing your ability to manage CA income deductions efficiently. This integration allows for automatic updates to tax documentation and financial records, ensuring that you stay organized and compliant with all tax regulations.

-

What benefits can businesses gain from using airSlate SignNow for their CA income deductions?

Using airSlate SignNow helps businesses save time and reduce costs associated with paper-based document management for CA income deductions. The instant access to secure electronic signatures and a centralized document repository promotes better organization and faster processing. Ultimately, this leads to improved compliance and maximized tax savings.

-

Does airSlate SignNow offer customer support for questions related to CA income deductions?

Yes, airSlate SignNow provides comprehensive customer support to assist you with any questions related to CA income deductions. Our knowledgeable support team is available to guide you through the features of our platform and ensure that you can optimize your processes for tax documentation. We aim to empower you to make the most of your deductions.

Get more for Ca Income Deduction

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497427324 form

- Utah corporation form

- Ut corporation 497427326 form

- Pre incorporation form

- Bylaws 497427328 form

- Corporate records maintenance package for existing corporations utah form

- Ut llc form

- Limited liability company llc operating agreement utah form

Find out other Ca Income Deduction

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo