Ct Exemption and Modification Claim Form 2010

What is the Ct Exemption And Modification Claim Form

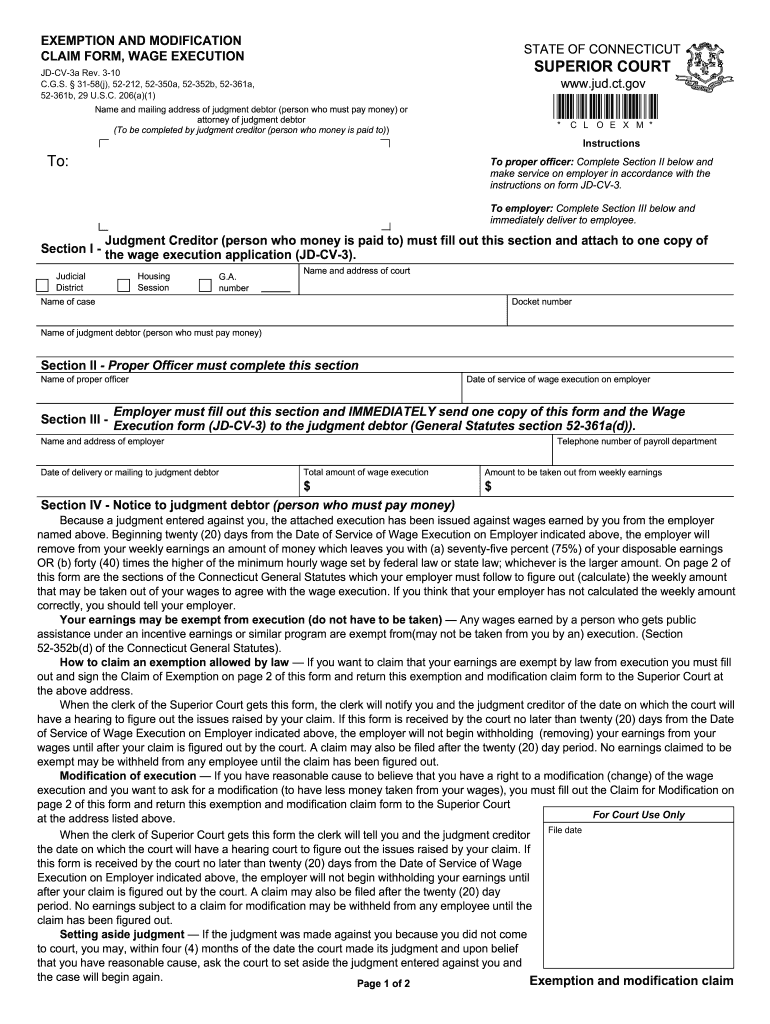

The Ct Exemption And Modification Claim Form is a legal document used primarily in the state of Connecticut. This form allows individuals or entities to claim exemptions or modifications related to property taxes or other financial obligations. Understanding this form is crucial for those looking to reduce their tax liabilities or adjust their financial responsibilities based on specific criteria set by state regulations.

How to use the Ct Exemption And Modification Claim Form

Using the Ct Exemption And Modification Claim Form involves a clear process. First, ensure that you meet the eligibility criteria for the exemption or modification you are seeking. Next, accurately fill out the required fields on the form, providing all necessary information, such as personal details and the specific exemption being claimed. After completing the form, it should be submitted to the appropriate local authority for review and approval.

Steps to complete the Ct Exemption And Modification Claim Form

Completing the Ct Exemption And Modification Claim Form requires careful attention to detail. Follow these steps:

- Gather all required documentation to support your claim, including proof of income or property ownership.

- Fill out the form with accurate information, ensuring that all fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the designated local government office by the specified deadline.

Key elements of the Ct Exemption And Modification Claim Form

Several key elements are essential when filling out the Ct Exemption And Modification Claim Form. These include:

- Personal Information: This section requires your name, address, and contact details.

- Exemption Type: Clearly specify the type of exemption or modification you are claiming.

- Supporting Documentation: Attach any necessary documents that validate your claim.

- Signature: Ensure that the form is signed and dated to confirm its authenticity.

Eligibility Criteria

To qualify for the exemptions or modifications outlined in the Ct Exemption And Modification Claim Form, applicants must meet specific eligibility criteria. Common requirements include:

- Residency in Connecticut.

- Proof of financial hardship or specific circumstances that warrant an exemption.

- Compliance with local regulations regarding property ownership or tax obligations.

Form Submission Methods

The Ct Exemption And Modification Claim Form can be submitted through various methods, depending on local regulations. Common submission methods include:

- Online Submission: Some municipalities may offer an online portal for electronic filing.

- Mail: You can send the completed form via postal service to the designated office.

- In-Person: Submitting the form directly at the local government office is also an option.

Quick guide on how to complete ct exemption and modification claim form 2010

Complete and submit your Ct Exemption And Modification Claim Form swiftly

Robust resources for digital document exchange and validation are essential for enhancing efficiency and the continuous improvement of your forms. When it comes to legal documentation and signing a Ct Exemption And Modification Claim Form, the proper signature system can save you signNow amounts of time and resources with each filing.

Locate, fill, modify, sign, and distribute your legal documents with airSlate SignNow. This service provides everything necessary to create streamlined paper submission processes. Its vast collection of legal forms and intuitive navigation can assist you in finding your Ct Exemption And Modification Claim Form instantly, while the editor featuring our signature capability will enable you to complete and authorize it immediately.

Authorize your Ct Exemption And Modification Claim Form in a few easy steps

- Locate the Ct Exemption And Modification Claim Form you need in our repository via search or catalog sections.

- Review the form specifications and preview it to ensure it meets your requirements and legal stipulations.

- Hit Get form to access it for modification.

- Complete the form utilizing the extensive toolbar.

- Verify the information you've provided and click the Sign button to finalize your document.

- Select one of three options to append your signature.

- Conclude your edits, save the document in your storage, and then download it onto your device or share it right away.

Optimize each phase of your document preparation and approval with airSlate SignNow. Experience a more effective online solution that addresses every aspect of managing your documents.

Create this form in 5 minutes or less

Find and fill out the correct ct exemption and modification claim form 2010

FAQs

-

Why is it so hard to figure out how many exemptions and allowances one should claim on tax forms? Why isn't this specified clearly?

You should only filed the number of exemptions and/or allowances truly reflected in your household. If you are single, check Single, then it's one exemption, you. If you are Married filing Jointly, that is two exemptions(2 people) plus one exemption for each child). Or other person considered a dependent.Hope that helps. Exemptions are based on number of people in your household you can legally claim as dependents. Allowances are item that come off your taxable income for things like retirement places, childcare, etc.If you have further questions, it's best to contact a tax professional in your area. Most do free consultation, charging only for work we do for clients.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

Will the NEET 2018 give admission in paramedical courses and Ayush courses too? If yes, how do you fill out the form to claim a seat if scored well?

wait for notifications.

-

I’ve been staying out of India for 2 years. I have an NRI/NRO account in India and my form showed TDS deduction of Rs. 1 lakh. Which form should I fill out to claim that?

The nature of your income on which TDS has been deducted will decide the type of ITR to be furnished by you for claiming refund of excess TDS. ITR for FY 2017–18 only can be filed now with a penalty of Rs. 5000/- till 31.12.2018 and Rs. 10,000/- from 01.01.2019 to 31.03.2019. So if your TDS relates to any previous year, then just forget the refund.

-

I need help with my W4 form. I'm filling paperwork for a job and I don't know what to answer. This will be my first job. I am not exempt and need to claim allowances or I claim exemption from withholding for this year.

The IRS really likes for you to be somewhere close to correct for this so they actually provide calculators to help you out. IRS Withholding CalculatorA Beginner’s Guide to Filling out Your W-4 is a good alternative that is friendly to those new to taxes. If this is just a part time gig for some side cash, you can mark yourself as exempt if you expect to make less than $6,000 this year and nothing needs to be withheld. The link goes into the details.Welcome to the working world.

-

Do the HIPAA laws prohibit Health Insurance companies from allowing members to fill out and submit medical claim forms on line?

No, nothing in HIPAA precludes collecting the claim information online.However, the information needs to be protected at rest as well as in-flight. This is typically done by encrypting the connection (HTTPS) as well the storage media

Create this form in 5 minutes!

How to create an eSignature for the ct exemption and modification claim form 2010

How to make an eSignature for the Ct Exemption And Modification Claim Form 2010 in the online mode

How to make an eSignature for your Ct Exemption And Modification Claim Form 2010 in Chrome

How to generate an eSignature for putting it on the Ct Exemption And Modification Claim Form 2010 in Gmail

How to make an electronic signature for the Ct Exemption And Modification Claim Form 2010 straight from your smartphone

How to make an eSignature for the Ct Exemption And Modification Claim Form 2010 on iOS

How to make an electronic signature for the Ct Exemption And Modification Claim Form 2010 on Android devices

People also ask

-

What is the Ct Exemption And Modification Claim Form?

The Ct Exemption And Modification Claim Form is a document used to request exemptions or modifications for certain tax liabilities in Connecticut. This form helps businesses and individuals demonstrate their eligibility for tax relief or adjustments, ensuring compliance with state regulations.

-

How can airSlate SignNow help with the Ct Exemption And Modification Claim Form?

AirSlate SignNow simplifies the process of completing and submitting the Ct Exemption And Modification Claim Form. With our easy-to-use platform, you can quickly fill out, eSign, and send the form electronically, saving you time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for the Ct Exemption And Modification Claim Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. While there is a cost for accessing our eSignature features, the efficiency gained in managing the Ct Exemption And Modification Claim Form often outweighs the expenses.

-

Can I integrate airSlate SignNow with other applications when submitting the Ct Exemption And Modification Claim Form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, making it easy to manage your documents and workflows. This means you can connect with your existing tools while processing the Ct Exemption And Modification Claim Form efficiently.

-

What are the benefits of using airSlate SignNow for the Ct Exemption And Modification Claim Form?

Using airSlate SignNow for the Ct Exemption And Modification Claim Form provides numerous benefits, including enhanced efficiency and reduced turnaround time. Our platform ensures that your forms are completed accurately and securely, streamlining your tax exemption processes.

-

Is airSlate SignNow secure for handling the Ct Exemption And Modification Claim Form?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance measures. When handling sensitive information on the Ct Exemption And Modification Claim Form, you can trust that your data is protected and handled with the utmost care.

-

How do I get started with airSlate SignNow for the Ct Exemption And Modification Claim Form?

Getting started with airSlate SignNow is simple! Sign up for an account, and you can begin creating, editing, and sending the Ct Exemption And Modification Claim Form in just a few clicks. Our user-friendly interface ensures a smooth experience.

Get more for Ct Exemption And Modification Claim Form

- Chapter 10 license law real estate agency relationships form

- Sample independent sales representative agreement form

- Developers agreement this agreement entered into this day form

- Agreement for sale of used equipment form

- Source code license agreement template get free sample form

- Agreement to acquire literary material form

- Software license agreement austin peay state university form

- Inventory rider to purchasing agreement entered into november form

Find out other Ct Exemption And Modification Claim Form

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template