Arkansas Attachment to Form 990ez

What is the Arkansas Attachment to Form 990ez

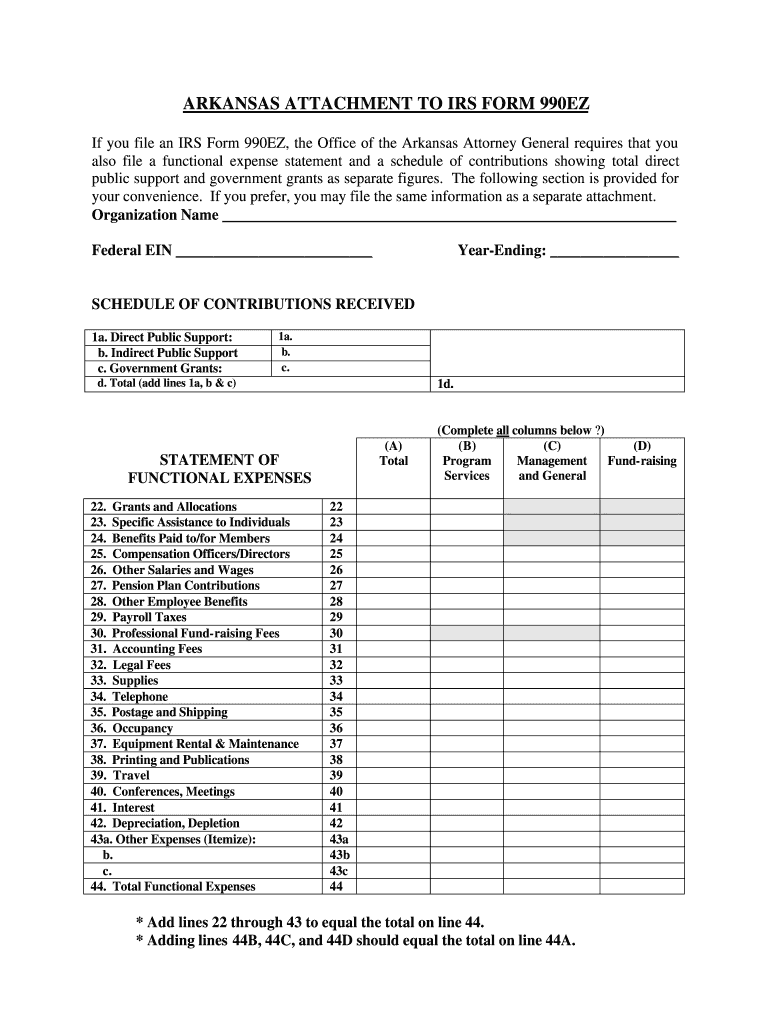

The Arkansas Attachment to Form 990ez is a supplemental document required for certain tax filings in Arkansas. This form is specifically designed for organizations that are exempt from federal income tax under Section 501(c) of the Internal Revenue Code. It provides additional information that the state requires to assess compliance with local tax regulations. The attachment is crucial for ensuring that organizations meet state-specific reporting standards, which may differ from federal requirements.

How to Obtain the Arkansas Attachment to Form 990ez

To obtain the Arkansas Attachment to Form 990ez, individuals can access the form through the Arkansas Department of Finance and Administration's official website. The form is available as a PDF, which can be downloaded and printed. Additionally, it may also be available through tax preparation software that supports Arkansas tax forms. Ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to Complete the Arkansas Attachment to Form 990ez

Completing the Arkansas Attachment to Form 990ez involves several steps:

- Download the Arkansas Attachment to Form 990ez from the official website or your tax software.

- Fill in the required fields, ensuring that all information is accurate and complete.

- Attach any necessary documentation that supports the information provided on the form.

- Review the completed form for errors or omissions.

- Sign and date the form, ensuring compliance with eSignature regulations if submitting electronically.

Key Elements of the Arkansas Attachment to Form 990ez

The Arkansas Attachment to Form 990ez includes several key elements that organizations must address:

- Organization Information: Name, address, and tax identification number.

- Financial Data: Details regarding revenue, expenses, and net assets.

- Program Services: Descriptions of the organization's primary activities and services provided.

- Governance: Information about the board of directors and governance structure.

Legal Use of the Arkansas Attachment to Form 990ez

The Arkansas Attachment to Form 990ez is legally binding when completed and submitted in accordance with state regulations. It is essential for organizations to ensure that all information is truthful and accurate to avoid potential penalties. The form must be filed annually, and failure to comply with submission requirements may result in fines or loss of tax-exempt status.

IRS Guidelines for the Arkansas Attachment to Form 990ez

While the Arkansas Attachment to Form 990ez is a state-specific form, it must also comply with IRS guidelines for tax-exempt organizations. This includes adhering to federal reporting requirements and ensuring that the information provided aligns with the organization's federal Form 990ez. Organizations should regularly consult IRS publications to remain informed about any changes in guidelines that may affect their filings.

Quick guide on how to complete arkansas attachment to irs form 990ez formsend

Your assistance manual on how to prepare your Arkansas Attachment To Form 990ez

If you’re wondering how to generate and submit your Arkansas Attachment To Form 990ez, here are some brief instructions on how to simplify the tax processing experience.

To begin, you simply need to create your airSlate SignNow account to transform the way you handle documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that allows you to modify, generate, and finalize your tax forms with ease. With its editor, you can toggle between text, check boxes, and electronic signatures and return to edit responses as necessary. Enhance your tax management with advanced PDF editing, electronic signing, and intuitive sharing.

Follow the steps below to finalize your Arkansas Attachment To Form 990ez in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Select Get form to load your Arkansas Attachment To Form 990ez in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding electronic signature (if needed).

- Examine your document and rectify any mistakes.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please be aware that submitting on paper can increase the likelihood of return errors and delay refunds. Naturally, before electronically filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

Do un-contracted workers have to fill out IRS W4 form?

I have no idea what an “un-contracted worker” is. I am not familiar with that term.Employees working in the U.S. complete a Form W-4.Independent contractors in the U.S. do not. Instead, they usually complete a Form W-9.If unclear on the difference between an employee or an independent contractor, see Independent Contractor Self Employed or Employee

-

Internal Revenue Service (IRS): How do you attach a W2 form to your tax return?

A number of answers — including one from a supposed IRS employee — say not to physically attach them, but just to include the W-2 in the envelope.In fact, the 1040 instructions say to “attach” the W-2 to the front of the return, and the Form 1040 itself —around midway down the left-hand side — says to “attach” Form W-2 here; throwing it in the envelope is not “attaching.” Anything but a staple risks having the forms become separated, just like connecting the multiple pages of the return, scheduled, etc.

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

Create this form in 5 minutes!

How to create an eSignature for the arkansas attachment to irs form 990ez formsend

How to create an electronic signature for the Arkansas Attachment To Irs Form 990ez Formsend in the online mode

How to generate an eSignature for your Arkansas Attachment To Irs Form 990ez Formsend in Chrome

How to generate an eSignature for signing the Arkansas Attachment To Irs Form 990ez Formsend in Gmail

How to generate an eSignature for the Arkansas Attachment To Irs Form 990ez Formsend from your mobile device

How to generate an electronic signature for the Arkansas Attachment To Irs Form 990ez Formsend on iOS

How to create an eSignature for the Arkansas Attachment To Irs Form 990ez Formsend on Android OS

People also ask

-

What is the 'Arkansas attachment form PDF' used for?

The Arkansas attachment form PDF is used for various official and legal purposes within the state of Arkansas. It allows users to attach additional documentation that supports submissions to state agencies or departments, ensuring compliance with local regulations.

-

How can I create an Arkansas attachment form PDF with airSlate SignNow?

Creating an Arkansas attachment form PDF with airSlate SignNow is simple. You can customize templates or upload your existing documents, and then easily convert them into a PDF format for signature handling. Our user-friendly interface makes it efficient for any user.

-

Is there a fee for using the Arkansas attachment form PDF feature?

Using the Arkansas attachment form PDF feature is part of our basic plan, which offers a range of pricing options. Each plan is designed to meet different business needs, providing cost-effective solutions for document management and electronic signatures.

-

Can I store my Arkansas attachment form PDF securely?

Absolutely! airSlate SignNow ensures that all documents, including your Arkansas attachment form PDF, are stored securely in our cloud. We use advanced encryption and security protocols to protect your sensitive information throughout its lifecycle.

-

Does airSlate SignNow integrate with other software for handling Arkansas attachment form PDFs?

Yes, airSlate SignNow offers seamless integration with numerous applications and software platforms. This means that you can easily manage your Arkansas attachment form PDFs alongside other tools like CRMs, making your workflow more efficient.

-

What are the benefits of using airSlate SignNow for Arkansas attachment form PDFs?

Using airSlate SignNow for Arkansas attachment form PDFs allows for quick and easy documentation processes. The platform streamlines eSigning and document sharing while enhancing collaboration among teams, all within a user-friendly environment.

-

Can I track the status of my Arkansas attachment form PDF?

Yes, with airSlate SignNow, you can easily track the status of your Arkansas attachment form PDF. The platform provides real-time notifications and updates so you can see when documents are viewed, signed, or completed.

Get more for Arkansas Attachment To Form 990ez

- Ask the readers what have you liked and disliked about form

- Hasbro redacted license agreement 41906 00033449 form

- End user license agreement wikipedia form

- Agreement to incorporate whereas company and form

- 8 opera terms that will raise your crossword solving game form

- Securities and exchange commission form 10 k annual

- Member maintenance forms chicago association of realtors

- Limited license video clips for form

Find out other Arkansas Attachment To Form 990ez

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast