PIT 110 NEW MEXICO ADJUSTMENTS to NEW FormSend 2003

What is the PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend

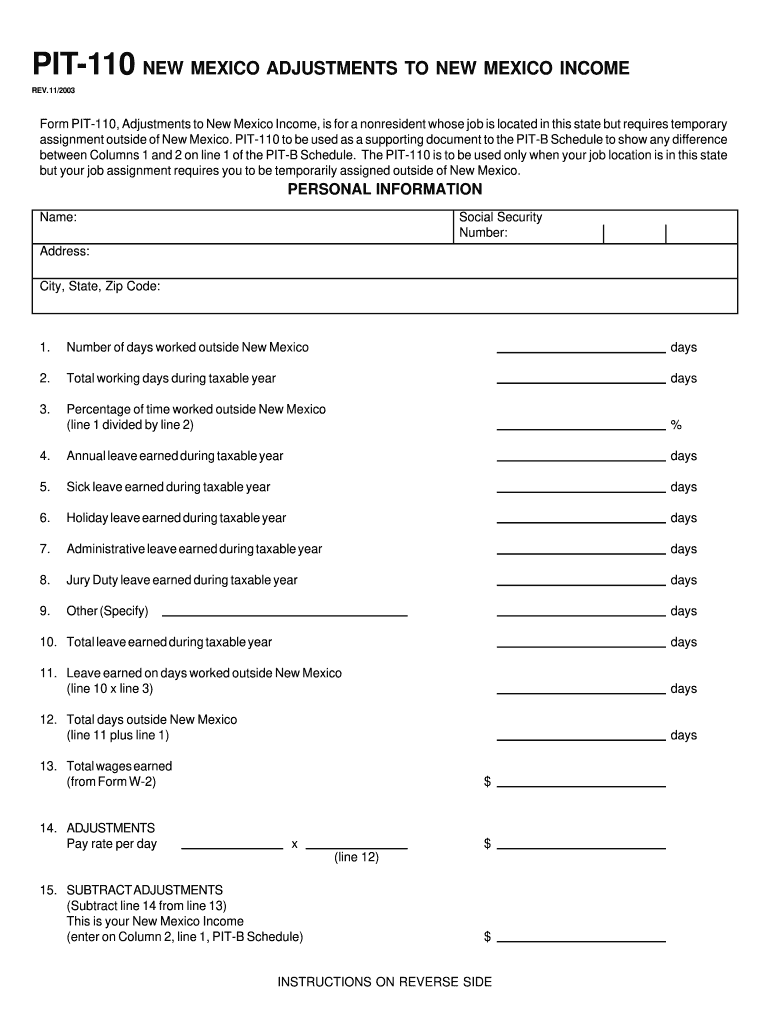

The PIT 110 New Mexico Adjustments to New FormSend is a tax form specifically designed for residents of New Mexico to report adjustments to their personal income tax. This form is essential for individuals who need to make changes to previously filed tax returns, ensuring that any discrepancies are addressed accurately. The PIT 110 serves as a means to communicate adjustments to the New Mexico Taxation and Revenue Department, allowing taxpayers to correct errors or update information related to their income, deductions, or credits.

How to use the PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend

Using the PIT 110 New Mexico Adjustments to New FormSend is straightforward. Taxpayers can access the form online, fill in the necessary fields, and submit it electronically. The form includes sections for personal information, the specific adjustments being made, and any supporting documentation required. It is important to follow the instructions carefully to ensure all information is accurate and complete. Utilizing a digital platform like signNow can enhance the process by providing secure eSignature capabilities, ensuring that submissions are timely and compliant with state regulations.

Steps to complete the PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend

Completing the PIT 110 involves several key steps:

- Access the form online through the New Mexico Taxation and Revenue Department website or a trusted eSignature platform.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the specific adjustments you are making, providing details for each item.

- Attach any required documentation that supports your adjustments.

- Review the completed form for accuracy before submitting it electronically.

Legal use of the PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend

The legal use of the PIT 110 New Mexico Adjustments to New FormSend is governed by state tax laws. It is essential for taxpayers to ensure that all information provided on the form is truthful and accurate, as any false statements can lead to penalties. The form must be submitted within the designated time frame to avoid late fees or interest charges. Utilizing an eSignature solution like signNow helps maintain compliance with legal standards, ensuring that the submission process is secure and meets all regulatory requirements.

Filing Deadlines / Important Dates

Filing deadlines for the PIT 110 New Mexico Adjustments to New FormSend typically align with the state income tax filing deadlines. It is crucial for taxpayers to be aware of these dates to avoid penalties. Generally, the deadline for submitting adjustments is the same as the due date for the original tax return, which is usually April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Keeping track of these important dates ensures timely compliance and helps avoid unnecessary complications.

Digital vs. Paper Version

The PIT 110 New Mexico Adjustments to New FormSend can be completed in both digital and paper formats. However, the digital version offers several advantages, including ease of access, reduced processing time, and enhanced security features. Submitting the form electronically through a platform like signNow allows for immediate confirmation of receipt and minimizes the risk of lost documents. In contrast, paper submissions may require additional time for processing and can be subject to delays in transit. Choosing the digital option is often the most efficient way to handle tax adjustments.

Quick guide on how to complete pit 110 new mexico adjustments to new formsend

Your assistance manual on how to prepare your PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend

If you’re curious about how to generate and dispatch your PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend, here are some concise guidelines on how to make tax filing easier.

To start, you simply need to establish your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document solution that enables you to modify, draft, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revert to edit details as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and easy sharing options.

Follow the instructions below to complete your PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend in just a few minutes:

- Set up your account and start managing PDFs within moments.

- Utilize our directory to access any IRS tax form; browse through various versions and schedules.

- Click Get form to access your PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend in our editor.

- Populate the required fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and amend any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Be aware that filing on paper may increase errors and delay refunds. Additionally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct pit 110 new mexico adjustments to new formsend

FAQs

-

How do I get started using Quora?

1. Quora works by having the community ask and answer questions. When you want to know more about something, Quora delivers you answers and content from people who know the answer - like real doctors, economists, screenwriters, police officers, and military veterans.Ask questions when you have them. Here is more info on how to get your questions answered: What are some good ways to get people to answer my questions on Quora?Answer questions when you can!2. Use your feed and tell Quora what you're interested in reading.Your feed is filled with stories that interest you. You can view your feed by going to the home page.Build a good feed by following topics and people, and taking actions in feed that tell Quora what you like. For more on this, see: How do I personalize my Quora feed?Topics: When you follow a topic, questions and answers tagged with that topic will appear in your feedPeople. When you follow people, you will see questions and answers posted by these people in your feed.The easiest first step: start by following some topics that you care about and some people who write about them.You can also read some interesting questions and popular answers to get a feel for the site.3. Upvote answers that you think are helpful.When you see a good answer on Quora, upvote it.Your votes help people see good answers and make Quora better.You can learn more here:What are some frequently asked questions for new Quora users?What does a good question on Quora look like?What does a good answer on Quora look like? What does it mean to "be helpful"?

-

How will Donald Trump make Mexico pay for the wall? Why does it make sense that Mexico will pay? Will Mexico do it?

Trump can absolutely do it if he wants to.He’s just passed an executive order mandating the building of the wall. Mexico has stated repeatedly that they will not pay for the wall. However, Trump can force Mexico to make this payment indirectly via taxes, tariffs and stopping of foreign aid.Here are a few steps Trump can take.a) Break NAFTA - This is going to be the big one. Donald Trump has stated repeatedly that NAFTA is "the single worst trade deal ever approved in [the United States]". He will make changes to it and renegotiate trade terms with Mexico. Expect a big tariff on Mexican goods and services soon (as high as 35%).This is terrible for the Mexican economy as Mexico sends 80% of its exports ($295 billion dollars) to the USA. A tariff on Mexican exports to the USA would decimate the Mexican economy, destroy relations and start a trade war. This would also cause the price of Mexican goods sold in the USA to shoot up. Indirectly, US citizens will pay for the wall by paying more money to Mexican companies who will use it to pay import tariffs. This would also hurt American companies like Ford who manufacture in Mexico and sell in the USA. However, it will generate enough funds to pay for the wall.b) Tax Remittances - Mexican citizens working in the USA send back $25 billion every year to Mexico as remittances. Trump has stated that he would put a tax on these remittances and use the tax to fund the wall. This would hurt Mexican citizens as most remittances are legally earned money sent by Mexican citizens in the US to poor families back home. However, this will again generate funds to pay for the wall.c) Stop aid to Mexico- A very interesting passage in the Executive order passed by Trump on the wall was this -Sec. 9. Foreign Aid Reporting Requirements. The head of each executive department and agency shall identify and quantify all sources of direct and indirect Federal aid or assistance to the Government of Mexico on an annual basis over the past five years, including all bilateral and multilateral development aid, economic assistance, humanitarian aid, and military aid.This means that the US government will probably stop foreign aid to Mexico soon. Foreign aid from the US to Mexico is currently $134.7 million . A large part of this aid is towards clean energy development, which is a low priority for Trump anyway. This would be diverted towards building the wall.An article from the MIT Technology Review estimates the cost of the wall at $40 billion. This is absolutely recoverable from Mexican companies or citizens if Trump decides to break NAFTA, tax remittances and stop aid to Mexico.Edit: A few hours after I wrote this, the Trump administration has suggested that they put a 20% import tariff on Mexican goods. This will be part of the funds used to build the wall.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How does a person go from growing up in New York City to moving out to New Mexico (I simply can't fathom such a thing)?

Perhaps you cannot fathom such a thing because you have a low level of adaptability and a less-than-average curiosity prefering the safety of the familiar. All good. Not everyone is like that.I could probably live anywhere. I am a New Yorker to the core but I’ve been around and have had a taste of different cultures, various climates and ways of living having traveled around a bit in 4 continents.Could I transition from 4 seasons to one? Sure.Could I transition to a quaint little town where everyone knows your name and business, where anonymity is a curse word? Absolutely.Could I go from sitting in front of two huge computer screens for 8 hours a day with an unlimited Seamless account to working with horses or tending vegetation for my nutrition? In a heart beat.I don’t have specific requirements for an optimal existence. I mean, aside from not wanting to live in a war torn town, I could live anywhere. I am of the mindset that people are people and wherever you are you will find friends and people to form positive relationships with. You will find amazing things to learn. You will find a new and exciting way to support yourself.New York is super diverse so less diversity would take getting used to but I don’t imagine it would be a difficult thing. New Mexico could be one fantastic adventure after the next to a painter and photographer (like me). The light, the forms in nature, the rocks and the climate would all inform new creations of fabulous artworks from the prespective and keen eye of this city girl. It might inspire a fabulous series of closeup photos of cacti. Maybe rock art! Who knows?!?!?Source: New Mexico Cacti pictures from New Mexico on pinterestI think it also has to do with having a need to feed a hunger to more deeply experience beyond ourselves and our familiar places in addition to adaptability. To learn about other cultures and ways of living and our history as people on earth.I know people who have barely left their ‘block’, let alone their town, for ANYTHING. I could not fathom that.

-

Will In-N-Out Burger expand to New Mexico?

Well, Raymond’s answer is just swell for Albuquerque, but I live in Las Cruces. I doubt any burger joint is worth a five-hour trip. I lived in San Diego and would really love an In-N-Out here. How about El Paso? That’s probably a better bet and only an hour away.

-

I am planning to do my MS in EE from New Mexico State University. How is the lifestyle in Las Cruces, New Mexico?

It is hot, dry, and the area is pretty dirty. If you are from the southwest, you will be used to this. If you are from anywhere green, it will be a huge change. The cost of living is not bad, you can get a pretty nice one or two bedroom apartment for about 600 or 700. Most of the town is nice, but there are (as anywhere) those areas you want to avoid. It is a border town, so there is quite a presence of border patrol. There is also a huge gang presence, so pretty much everything is tagged. I never ran into issues with this, but some friends have. Have a good water filter for your home, the water is not something you want to be drinking. They have to over chlorinate due to the potential Giardia presence. I am a lab tech, we saw it a lot down there. Also, TB has a higher frequency than in other states. The STD rate is rather astronomical as well, so make sure you take precautions if not in a committed relationship.If you are an outdoorsy person, there is a LOT to do. If you like history, you will never be bored. I lived in the area for about eight years, and still didnt get to see everything. Just north of you is White Sands. It was described to me as the worlds best beach, just no water. I would say that is accurate. I enjoyed my time there. I graduated in 2008. I was there again last year as my parents live about half an hour north of Cruces. There are a lot of really cool places to hang out and to go, you just have to look. Do not get discouraged by the plethora of really nasty rude folks. Get involved with some of the groups there at the college and they will steer you the right way for the places to avoid and those that are best.

Create this form in 5 minutes!

How to create an eSignature for the pit 110 new mexico adjustments to new formsend

How to generate an eSignature for the Pit 110 New Mexico Adjustments To New Formsend online

How to make an eSignature for the Pit 110 New Mexico Adjustments To New Formsend in Google Chrome

How to generate an electronic signature for putting it on the Pit 110 New Mexico Adjustments To New Formsend in Gmail

How to create an electronic signature for the Pit 110 New Mexico Adjustments To New Formsend straight from your mobile device

How to generate an electronic signature for the Pit 110 New Mexico Adjustments To New Formsend on iOS devices

How to make an electronic signature for the Pit 110 New Mexico Adjustments To New Formsend on Android

People also ask

-

What are the key features of the PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend?

The PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend offers features such as customizable templates, secure eSigning, and seamless document management. These capabilities allow users to streamline their adjustment submission processes while ensuring compliance with New Mexico regulations.

-

How does airSlate SignNow simplify the submission of PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend?

airSlate SignNow simplifies the PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend by providing an intuitive interface that guides users through each step. This clarity makes it easier to complete and submit adjustments, saving time and reducing errors.

-

What is the cost associated with using the PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend?

The pricing for using the PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend is competitive and designed to provide value for businesses of all sizes. Various subscription plans are available, ensuring that users can choose an option that aligns with their needs and budget.

-

Can I integrate the PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend with other software?

Yes, airSlate SignNow offers robust integrations with various software solutions, enabling users to incorporate the PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend into their existing workflows. This ensures a seamless experience across platforms for enhanced productivity.

-

What are the benefits of using airSlate SignNow for PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend?

Using airSlate SignNow for PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend provides multiple benefits, including improved efficiency, enhanced security, and simplified compliance. Businesses can quickly send, eSign, and manage their documents with confidence, ensuring they meet all regulatory requirements.

-

Is it easy to track submissions for PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend?

Absolutely! airSlate SignNow allows users to easily track the status of their PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend submissions. Users receive real-time updates and notifications, ensuring they stay informed throughout the submission process.

-

Are there any training resources available for the PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend?

Yes, airSlate SignNow offers comprehensive training resources and tutorials for users navigating the PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend. These resources help users to quickly learn how to utilize the platform's features effectively.

Get more for PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend

- Gutierrez v superior court california court of appeal form

- Greyhound corp v superior court supreme court of form

- Plaintiffs opposition to defendants motion in limine to form

- Plaintiffs motion to compel production of documents or in form

- Motion for continuance use this form when ingov

- Defendants motion for protective order form

- Rule 50 judgment as a matter of law in a jury trial related form

- Remand court procedure wikipedia form

Find out other PIT 110 NEW MEXICO ADJUSTMENTS TO NEW FormSend

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe