Pit 110 2019-2026

What is the Pit 110

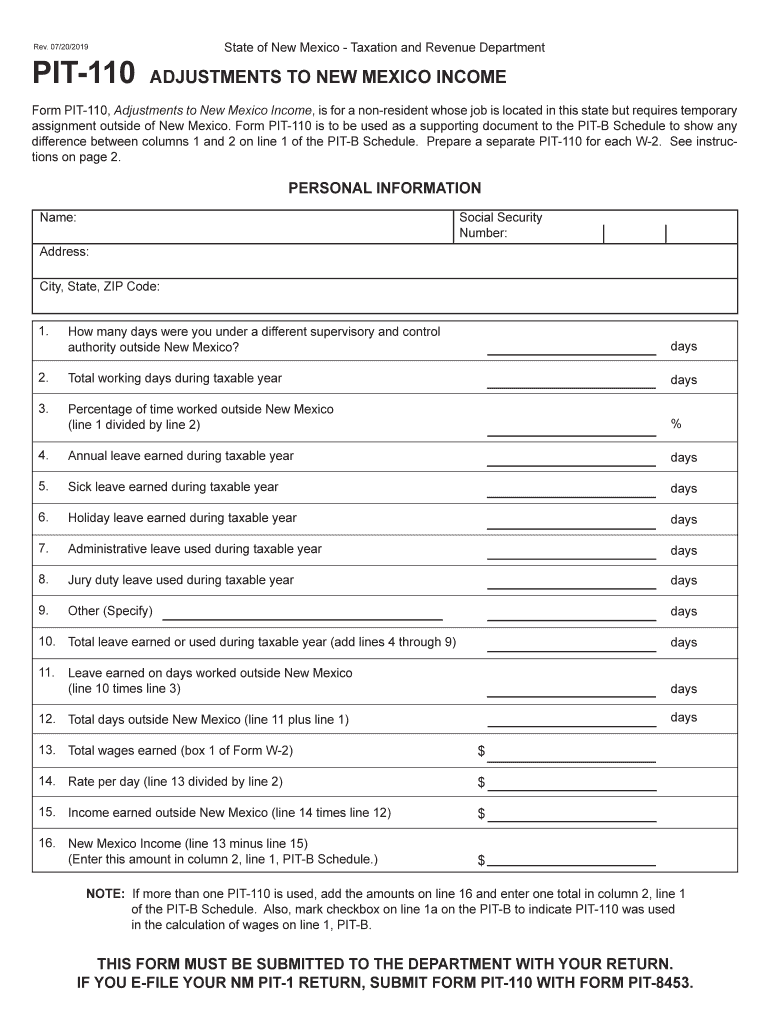

The Pit 110, also known as the New Mexico Form Pit 110, is a crucial document for individuals and businesses in New Mexico. It serves as a tax form used to report income and calculate taxes owed to the state. This form is essential for ensuring compliance with state tax regulations and is typically required for various taxpayer scenarios, including self-employed individuals and businesses. Understanding the purpose and requirements of the Pit 110 is vital for accurate tax reporting and avoiding potential penalties.

How to use the Pit 110

Using the Pit 110 effectively involves several steps. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, complete the form by accurately entering your income information and calculating your tax liability. It is important to follow the specific instructions provided with the form to ensure all sections are filled out correctly. Once completed, the form can be submitted electronically or via mail, depending on your preference and the options available.

Steps to complete the Pit 110

Completing the Pit 110 involves a systematic approach to ensure accuracy. Here are the key steps:

- Gather all required financial documents, including W-2s, 1099s, and any other income records.

- Fill out your personal information at the top of the form.

- Report your total income in the designated sections, ensuring you include all sources of income.

- Calculate any deductions or credits you may qualify for, as these can reduce your overall tax liability.

- Double-check all entries for accuracy before finalizing the form.

- Submit the completed form according to the submission methods available, either online or by mail.

Legal use of the Pit 110

The legal use of the Pit 110 is governed by New Mexico state tax laws. To ensure that the form is legally valid, it must be filled out accurately and submitted by the designated deadlines. The form must also comply with state regulations regarding electronic signatures and submissions. Using a reliable eSignature platform can help ensure that your submission meets all legal requirements, providing peace of mind that your tax obligations are fulfilled correctly.

Filing Deadlines / Important Dates

Filing deadlines for the Pit 110 are critical for compliance with state tax laws. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. However, it is essential to verify specific dates each year, as they can vary based on weekends and holidays. Additionally, if you are filing for an extension, ensure that you understand the extended deadlines and any requirements that must be met to avoid penalties.

Who Issues the Form

The Pit 110 is issued by the New Mexico Taxation and Revenue Department. This state agency is responsible for the administration and enforcement of tax laws in New Mexico. They provide the necessary forms, instructions, and resources to assist taxpayers in fulfilling their tax obligations. It is advisable to refer to their official resources for the most current information regarding the Pit 110 and any updates to tax regulations.

Quick guide on how to complete personal income tax forms nm taxation and revenue department 440165509

Complete Pit 110 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious solution to conventional printed and signed papers, allowing you to obtain the right format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents promptly without delays. Manage Pit 110 on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

The easiest way to edit and eSign Pit 110 seamlessly

- Locate Pit 110 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and then click on the Done button to finalize your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Pit 110 and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct personal income tax forms nm taxation and revenue department 440165509

Create this form in 5 minutes!

How to create an eSignature for the personal income tax forms nm taxation and revenue department 440165509

How to generate an eSignature for the Personal Income Tax Forms Nm Taxation And Revenue Department 440165509 in the online mode

How to create an electronic signature for the Personal Income Tax Forms Nm Taxation And Revenue Department 440165509 in Google Chrome

How to generate an eSignature for signing the Personal Income Tax Forms Nm Taxation And Revenue Department 440165509 in Gmail

How to generate an electronic signature for the Personal Income Tax Forms Nm Taxation And Revenue Department 440165509 right from your smartphone

How to generate an electronic signature for the Personal Income Tax Forms Nm Taxation And Revenue Department 440165509 on iOS

How to generate an electronic signature for the Personal Income Tax Forms Nm Taxation And Revenue Department 440165509 on Android OS

People also ask

-

What is the nm form pit 110?

The nm form pit 110 is a specialized document used primarily for compliance and reporting in various industries. With airSlate SignNow, you can easily fill out, sign, and send this form digitally. This streamlines the process, ensuring smooth and efficient documentation.

-

How can airSlate SignNow assist with the nm form pit 110?

airSlate SignNow allows users to effortlessly manage the nm form pit 110 by providing eSignature functionalities and document routing features. This ensures that all necessary parties can sign the document promptly and securely, meeting compliance standards.

-

What are the pricing options for using airSlate SignNow for nm form pit 110?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a cost-effective basic plan. These plans include features tailored for managing documents like the nm form pit 110, ensuring you get maximum value for your investment.

-

Are there any integrations available for the nm form pit 110 with airSlate SignNow?

Yes, airSlate SignNow offers integrations with many popular applications that can help you manage the nm form pit 110 more effectively. These integrations allow for seamless workflow automation, improving efficiency in document handling and signature collection.

-

What are the key features of airSlate SignNow for the nm form pit 110?

Key features include customizable templates, advanced eSignature capabilities, and robust document management tools specifically designed for forms like the nm form pit 110. These features enhance the user experience and ensure compliance with industry standards.

-

What are the benefits of using airSlate SignNow for nm form pit 110?

Using airSlate SignNow for the nm form pit 110 provides fast turnaround times, increased accuracy, and a user-friendly interface. This helps businesses reduce bottlenecks, improve collaboration, and ensure legal compliance with signed documentation.

-

Is it secure to use airSlate SignNow for the nm form pit 110?

Absolutely, airSlate SignNow employs industry-standard security measures to protect your documents, including the nm form pit 110. With encrypted eSignatures and secure cloud storage, you can trust that your sensitive information is safe.

Get more for Pit 110

Find out other Pit 110

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form