California Installments Fixed Rate Promissory Note Secured by Personal Property California Form

What is the California Installments Fixed Rate Promissory Note Secured By Personal Property California

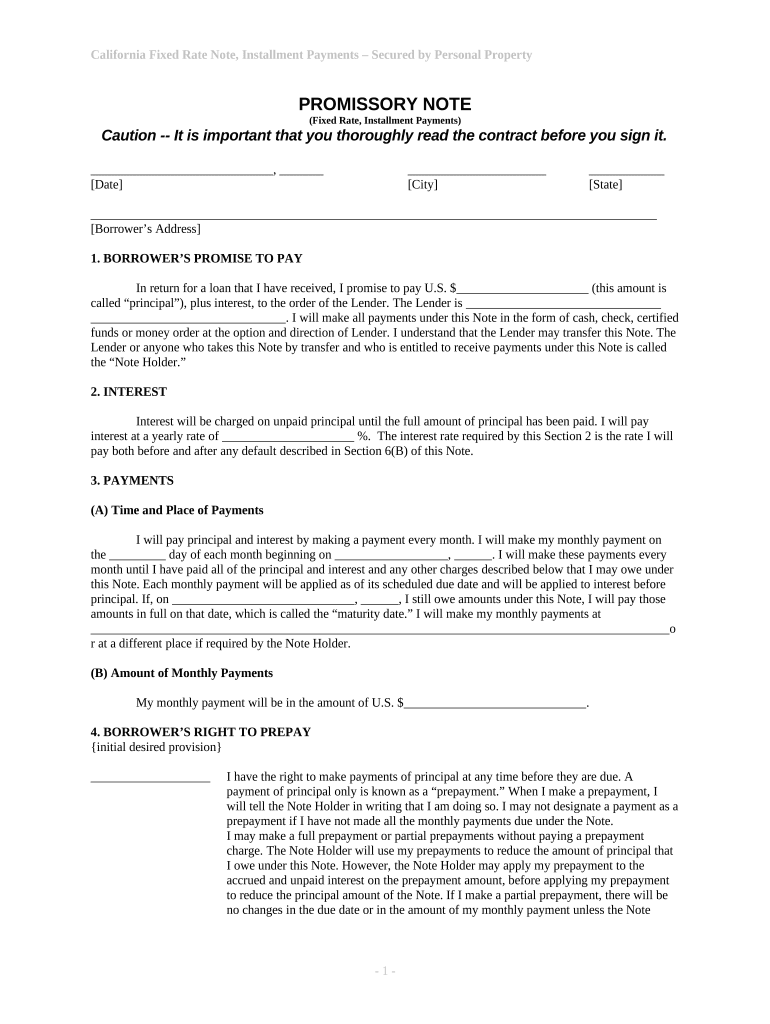

The California Installments Fixed Rate Promissory Note Secured By Personal Property is a legal document that outlines the terms of a loan where the borrower agrees to repay the lender in fixed installments over a specified period. This note is secured by personal property, meaning that the lender has a claim to the property if the borrower defaults on the loan. It is commonly used in various financial transactions, including personal loans and business financing, to ensure that both parties understand their rights and obligations.

Key Elements of the California Installments Fixed Rate Promissory Note Secured By Personal Property California

Several essential components make up this promissory note. These include:

- Borrower and Lender Information: Names and addresses of both parties involved.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the loan.

- Payment Schedule: Details on how and when payments will be made, including the frequency and amount of each installment.

- Collateral Description: A clear description of the personal property securing the loan.

- Default Terms: Conditions under which the borrower would be considered in default and the lender's rights in such an event.

Steps to Complete the California Installments Fixed Rate Promissory Note Secured By Personal Property California

Completing this promissory note involves several steps to ensure accuracy and legal compliance:

- Gather necessary information, including personal details of both parties and specifics about the loan.

- Clearly outline the terms of the loan, including the amount, interest rate, and payment schedule.

- Describe the personal property that will serve as collateral.

- Review the document for clarity and completeness to avoid misunderstandings.

- Both parties should sign the document in the presence of a witness or notary, if required.

Legal Use of the California Installments Fixed Rate Promissory Note Secured By Personal Property California

This promissory note is legally binding provided it meets specific requirements under California law. It must include all necessary elements and be signed by both parties. Additionally, compliance with relevant eSignature laws, such as the ESIGN Act and UETA, is crucial when executing the document electronically. Ensuring that the note is properly executed protects the rights of both the borrower and lender, providing legal recourse in case of disputes.

How to Use the California Installments Fixed Rate Promissory Note Secured By Personal Property California

To utilize this promissory note effectively, follow these guidelines:

- Ensure both parties understand the terms before signing.

- Keep a copy of the signed document for personal records.

- Monitor payment schedules to maintain compliance with the agreement.

- Communicate openly about any changes or issues that may arise during the repayment period.

State-Specific Rules for the California Installments Fixed Rate Promissory Note Secured By Personal Property California

California has specific regulations that govern promissory notes, including requirements for interest rates and disclosure obligations. It is essential to adhere to these state laws to ensure the validity of the note. For instance, the maximum interest rate may be capped under California usury laws, and failure to comply with these regulations can result in penalties or the unenforceability of the note.

Quick guide on how to complete california installments fixed rate promissory note secured by personal property california

Effortlessly prepare California Installments Fixed Rate Promissory Note Secured By Personal Property California on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage California Installments Fixed Rate Promissory Note Secured By Personal Property California on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign California Installments Fixed Rate Promissory Note Secured By Personal Property California without hassle

- Locate California Installments Fixed Rate Promissory Note Secured By Personal Property California and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Edit and eSign California Installments Fixed Rate Promissory Note Secured By Personal Property California and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a California Installments Fixed Rate Promissory Note Secured By Personal Property California?

A California Installments Fixed Rate Promissory Note Secured By Personal Property California is a legal document used to outline the terms of a loan where the borrower agrees to repay the principal and interest over a set period. This document secures the loan against personal property, providing peace of mind for lenders. Understanding its structure and purpose is essential for both borrowers and lenders.

-

What are the benefits of using a California Installments Fixed Rate Promissory Note Secured By Personal Property California?

Using a California Installments Fixed Rate Promissory Note Secured By Personal Property California offers several advantages, including fixed interest rates that stabilize monthly payments. It also provides legal protection for lenders, ensuring that the loan is secured against the borrower’s personal assets. This arrangement can foster trust and transparency between both parties involved.

-

How do I create a California Installments Fixed Rate Promissory Note Secured By Personal Property California?

Creating a California Installments Fixed Rate Promissory Note Secured By Personal Property California is straightforward with tools like airSlate SignNow. Users can easily input loan details and terms through our platform, ensuring compliance with California regulations. Once completed, the document can be sent electronically for signing, streamlining the entire process.

-

What features does airSlate SignNow provide for creating promissory notes?

airSlate SignNow offers intuitive features for creating California Installments Fixed Rate Promissory Note Secured By Personal Property California documents, including customizable templates and eSignature capabilities. The platform allows real-time collaboration and document tracking, ensuring all parties are informed about their obligations. This enhances efficiency and reduces the chances of errors.

-

Is there a cost associated with using airSlate SignNow for promissory notes?

Yes, there is a subscription fee for using airSlate SignNow, which varies based on the plan selected. This cost is often offset by the time and resources saved in managing California Installments Fixed Rate Promissory Note Secured By Personal Property California documents. We provide a cost-effective solution that includes all necessary features for seamless document management.

-

Can I integrate airSlate SignNow with other tools for managing loans?

Absolutely! airSlate SignNow can easily integrate with various tools and platforms to help manage California Installments Fixed Rate Promissory Note Secured By Personal Property California processes efficiently. This compatibility enhances workflow by allowing users to link documents, communication, and data management systems seamlessly. Integrations improve overall productivity.

-

How secure is my information when using airSlate SignNow for promissory notes?

airSlate SignNow prioritizes the security of your information, utilizing industry-standard encryption methods to protect California Installments Fixed Rate Promissory Note Secured By Personal Property California documents. Our platform adheres to strict compliance regulations to ensure that sensitive data is secure throughout the signing and storage processes. You can trust us to safeguard your information.

Get more for California Installments Fixed Rate Promissory Note Secured By Personal Property California

- Affidavit to allow service by publication wyoming form

- Notice of publication wyoming form

- Affidavit following service by publication wyoming form

- Wyoming withholding form

- Order modifying child support and judgment for arrears for child support modification wyoming form

- Wyoming child modification form

- Child support modification sample 497432415 form

- Wyoming child support 497432416 form

Find out other California Installments Fixed Rate Promissory Note Secured By Personal Property California

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure