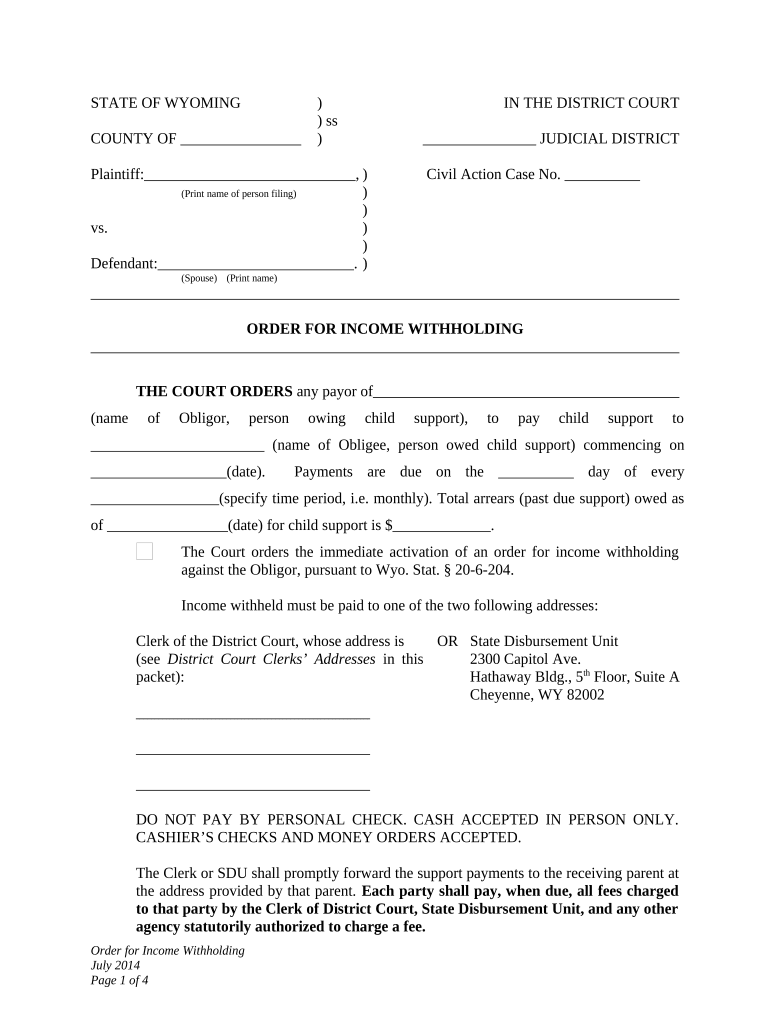

Wyoming Withholding Form

What is the Wyoming Withholding

The Wyoming withholding form is a crucial document used by employers in Wyoming to report and remit state income taxes withheld from employees' wages. This form ensures compliance with state tax regulations and helps maintain accurate records of tax obligations. Employers must understand the significance of this form to fulfill their legal responsibilities and support their employees in meeting their tax requirements.

Steps to Complete the Wyoming Withholding

Completing the Wyoming withholding form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including employee details, tax identification numbers, and income amounts. Next, accurately calculate the withholding amounts based on the current tax rates set by the state. Once the calculations are complete, fill out the form, ensuring that all fields are correctly filled. Finally, review the form for any errors before submitting it to the appropriate state agency.

Legal Use of the Wyoming Withholding

The legal use of the Wyoming withholding form is governed by state tax laws, which require employers to withhold a certain percentage of their employees' wages for state income tax purposes. This form serves as a record of the amounts withheld and must be submitted according to state deadlines. Failure to comply with these regulations can result in penalties or fines, making it essential for employers to understand their obligations regarding this form.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Wyoming withholding form to avoid penalties. Typically, the form is due on a quarterly basis, with deadlines falling on the last day of the month following the end of each quarter. It is crucial for employers to stay informed about these dates to ensure timely submissions and maintain compliance with state tax laws.

Required Documents

To complete the Wyoming withholding form accurately, employers need to gather several required documents. These include employee W-4 forms, which indicate the withholding allowances claimed by each employee, and payroll records that detail the wages paid during the reporting period. Additionally, employers should have access to the current tax rate information to ensure correct calculations.

Form Submission Methods (Online / Mail / In-Person)

The Wyoming withholding form can be submitted through various methods, providing flexibility for employers. Submissions can be made online via the Wyoming Department of Revenue's website, allowing for quick processing. Alternatively, employers may choose to mail the completed form to the appropriate state office or submit it in person, depending on their preference and the resources available.

Penalties for Non-Compliance

Failure to comply with the requirements of the Wyoming withholding form can result in significant penalties for employers. These may include fines for late submissions, interest on unpaid taxes, and potential legal repercussions. Understanding the importance of timely and accurate filing is essential for employers to avoid these consequences and maintain good standing with state tax authorities.

Quick guide on how to complete wyoming withholding

Complete Wyoming Withholding seamlessly on any gadget

Digital document administration has increasingly gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Wyoming Withholding on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Wyoming Withholding with ease

- Obtain Wyoming Withholding and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that task.

- Generate your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Alter and eSign Wyoming Withholding and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Wyoming withholding, and why is it important for businesses?

Wyoming withholding refers to the state tax withheld from employee wages in Wyoming. It's essential for businesses to understand these regulations to ensure compliance and avoid penalties. Proper management of Wyoming withholding can streamline payroll processes and maintain employee satisfaction.

-

How does airSlate SignNow help with managing Wyoming withholding forms?

AirSlate SignNow provides an efficient solution for businesses to manage Wyoming withholding forms electronically. By using our platform, companies can easily send, eSign, and store these documents securely, ensuring streamlined compliance with state requirements. This feature signNowly reduces the time and effort involved in document management.

-

Is there a cost associated with using airSlate SignNow for Wyoming withholding document management?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including options for managing Wyoming withholding documents. Our transparent pricing structure ensures you only pay for the features you require, making it a cost-effective solution for every business size. You can explore our pricing plans to find the best fit for your needs.

-

What features does airSlate SignNow offer for handling Wyoming withholding?

AirSlate SignNow includes several features designed specifically for managing Wyoming withholding, such as customizable templates, electronic signatures, and secure document storage. Additionally, our platform allows for easy collaboration among team members, enabling efficient handling of payroll documents. These features simplify the overall process of managing tax-related forms.

-

Can airSlate SignNow integrate with other payroll systems for Wyoming withholding?

Absolutely! AirSlate SignNow offers integrations with popular payroll systems, making it easy to synchronize data related to Wyoming withholding. This integration ensures that all tax-related documents are seamlessly handled and up-to-date. Businesses can enjoy a smooth onboarding experience with the systems they already use.

-

How does airSlate SignNow enhance the e-signing experience for Wyoming withholding documents?

AirSlate SignNow enhances the e-signing experience by providing an intuitive interface that makes signing Wyoming withholding documents quick and hassle-free. Users can sign on any device, ensuring accessibility and convenience. This boosts efficiency and allows businesses to close documents faster.

-

What support does airSlate SignNow provide for issues related to Wyoming withholding?

AirSlate SignNow offers comprehensive support services to assist businesses with any issues related to Wyoming withholding. Our dedicated support team is available to answer questions and provide guidance on document management and compliance. We strive to ensure that your experience with Wyoming withholding management is smooth and successful.

Get more for Wyoming Withholding

- New mexico discovery interrogatories for divorce proceeding for either plaintiff or defendant form

- New mexico interest form

- New mexico waiver form

- New mexico assignment of mortgage by individual mortgage holder form

- New mexico 30 day form

- Termination lease landlord 481374046 form

- New mexico motion to withdraw as counsel and order approving withdrawal form

- Nm child support form

Find out other Wyoming Withholding

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free