Church Tithe and Offering Spreadsheet Excel Form

What is the Church Tithe And Offering Spreadsheet Excel

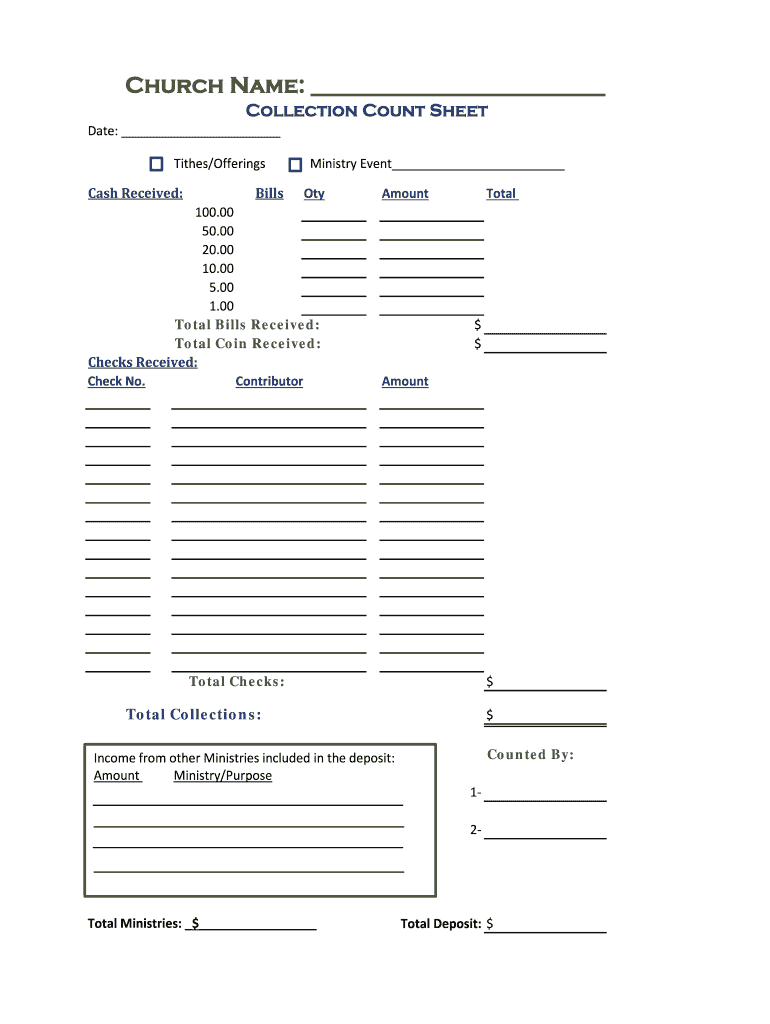

The church tithe and offering spreadsheet in Excel is a specialized tool designed to help churches and religious organizations track and manage their financial contributions. This spreadsheet allows for the systematic recording of tithes, offerings, and donations from congregation members. It typically includes columns for donor names, amounts contributed, dates of contributions, and specific designations for funds, making it easier for church administrators to maintain accurate records. By organizing financial data in this way, churches can ensure transparency and accountability in their financial practices.

How to use the Church Tithe And Offering Spreadsheet Excel

Using the church tithe and offering spreadsheet in Excel involves several straightforward steps. First, download the template or create a new spreadsheet with designated columns for each relevant category, such as donor name, contribution amount, date, and purpose of the donation. Next, input the data as contributions are made, ensuring accuracy in the amounts and details. Regularly updating the spreadsheet allows for real-time tracking of church finances. Additionally, utilizing Excel's built-in functions can help summarize total contributions, generate reports, and analyze giving trends over time.

Steps to complete the Church Tithe And Offering Spreadsheet Excel

Completing the church tithe and offering spreadsheet in Excel requires a methodical approach. Follow these steps:

- Open the spreadsheet template or create a new one in Excel.

- Label the columns with appropriate headings, such as "Donor Name," "Contribution Amount," "Date," and "Designation."

- Enter each contribution as it is received, ensuring that all fields are filled accurately.

- Use Excel formulas to calculate totals for each category, if necessary.

- Save the spreadsheet regularly to prevent data loss.

- Review the data periodically for accuracy and completeness.

Key elements of the Church Tithe And Offering Spreadsheet Excel

The key elements of the church tithe and offering spreadsheet in Excel include:

- Donor Information: Capture essential details about each donor, including names and contact information.

- Contribution Amounts: Record the specific amounts given by each donor.

- Date of Contribution: Track when each contribution was made to maintain a chronological record.

- Designations: Allow donors to specify if their contributions are for general funds, special projects, or other purposes.

- Total Calculations: Use formulas to automatically calculate total contributions for specified periods.

Legal use of the Church Tithe And Offering Spreadsheet Excel

The legal use of the church tithe and offering spreadsheet in Excel is essential for maintaining compliance with financial regulations. Accurate record-keeping is crucial for tax reporting and ensuring that donations are used appropriately. Churches should retain these records for a minimum of three years, as required by the IRS, to substantiate income and expenses during audits. Additionally, using a digital format like Excel can enhance security and accessibility, making it easier to manage and retrieve financial data when needed.

Examples of using the Church Tithe And Offering Spreadsheet Excel

There are various practical applications for the church tithe and offering spreadsheet in Excel. For instance:

- A church can track monthly contributions to evaluate fundraising efforts for a specific project.

- Church leaders can analyze giving patterns over time to identify trends and adjust budget forecasts.

- During annual financial reviews, the spreadsheet can serve as a comprehensive record of all donations received, aiding in transparency and accountability.

Quick guide on how to complete church tithes and offerings record keeping form

Complete Church Tithe And Offering Spreadsheet Excel effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without delays. Handle Church Tithe And Offering Spreadsheet Excel on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Church Tithe And Offering Spreadsheet Excel without hassle

- Obtain Church Tithe And Offering Spreadsheet Excel and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or shareable link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you prefer. Modify and eSign Church Tithe And Offering Spreadsheet Excel and guarantee seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I give tithes and offerings to my church but with no proof. How can I include this on taxes without fear of being audited?

You can’t for amounts more of more than $250 unless your church is willing to give a statement for your donations. Written Record of Charitable Contribution Topic 506 Charitable ContributionsIn the future, churches will handle the record keeping for you if you use a offering envelop. Alternatively you can donate via check or even direct deposit which will provide you proof of donation and ease the administrative burden on your church.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

How do I design a simple record keeping form and what software to use?

form design - Google SearchGiven the number of record keeping apps online and for download, why not use something that exists?A database is often used and recommended for record keeping given the ability of a relational database to manage related records. I use Filemaker. $200.The “White Paper for FMP Novices” is a good read.List of online databasesfilemaker vs - Google Search

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

What is the procedure to fill out the DU admission form? How many colleges and courses can I fill in?

It's as simple as filling any school admission form but you need to be quite careful while filling for courses ,don't mind you are from which stream in class 12 choose all the courses you feel like choosing,there is no limitations in choosing course and yes you must fill all the courses related to your stream ,additionally there is no choice for filling of college names in the application form .

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

Create this form in 5 minutes!

How to create an eSignature for the church tithes and offerings record keeping form

How to generate an electronic signature for your Church Tithes And Offerings Record Keeping Form in the online mode

How to generate an eSignature for the Church Tithes And Offerings Record Keeping Form in Google Chrome

How to create an electronic signature for putting it on the Church Tithes And Offerings Record Keeping Form in Gmail

How to make an eSignature for the Church Tithes And Offerings Record Keeping Form straight from your smartphone

How to generate an eSignature for the Church Tithes And Offerings Record Keeping Form on iOS devices

How to create an eSignature for the Church Tithes And Offerings Record Keeping Form on Android OS

People also ask

-

What is a church tithe and offering spreadsheet excel?

A church tithe and offering spreadsheet excel is a tool designed to help churches manage their financial contributions from members. It allows for easy tracking, recording, and analysis of tithes and offerings, enabling churches to maintain transparency and proper financial management.

-

How can the church tithe and offering spreadsheet excel benefit my church?

Using a church tithe and offering spreadsheet excel can streamline your church's financial processes and improve accuracy in record-keeping. This tool helps in generating reports that can inform budgeting, track trends in donations, and enhance your financial accountability.

-

Is the church tithe and offering spreadsheet excel easy to use for non-technical staff?

Yes, the church tithe and offering spreadsheet excel is designed with user-friendliness in mind, making it accessible for users with varying levels of technical expertise. Simple instructions and templates make it easy to set up and use, ensuring that anyone in the staff can manage it effectively.

-

Are there any integration options with the church tithe and offering spreadsheet excel?

The church tithe and offering spreadsheet excel can often be integrated with accounting software and other tools your church may already use. This capability allows for a more seamless flow of data, helping to avoid manual entry errors and enhancing overall efficiency.

-

What features should I look for in a church tithe and offering spreadsheet excel?

When choosing a church tithe and offering spreadsheet excel, look for features such as customizable templates, automated calculations, reporting capabilities, and compatibility with other software. These features enrich the user experience and enhance financial management processes.

-

How much does the church tithe and offering spreadsheet excel typically cost?

The cost of a church tithe and offering spreadsheet excel can vary depending on the complexity and features included. Many options are available for free or at a low cost, but investing in a more advanced version may provide additional functionalities that can benefit your church's financial operations.

-

Can the church tithe and offering spreadsheet excel help with tax reporting?

Absolutely, the church tithe and offering spreadsheet excel can assist with tax reporting by keeping detailed records of donations throughout the year. Having accurate data organized can streamline the preparation of tax documents and ensure compliance with tax regulations.

Get more for Church Tithe And Offering Spreadsheet Excel

- Pasture leasecontract grazing agreement form

- Oil gas and mineral lease secgovhome form

- Uj o u u ti o w u u new jersey state library form

- For oil and gas facilities form

- Surface lease with subsurface agreement no state of form

- By lessor who owns surface prohibiting drilling form

- Waiver of lease provision form

- Watershed international development research centre form

Find out other Church Tithe And Offering Spreadsheet Excel

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe