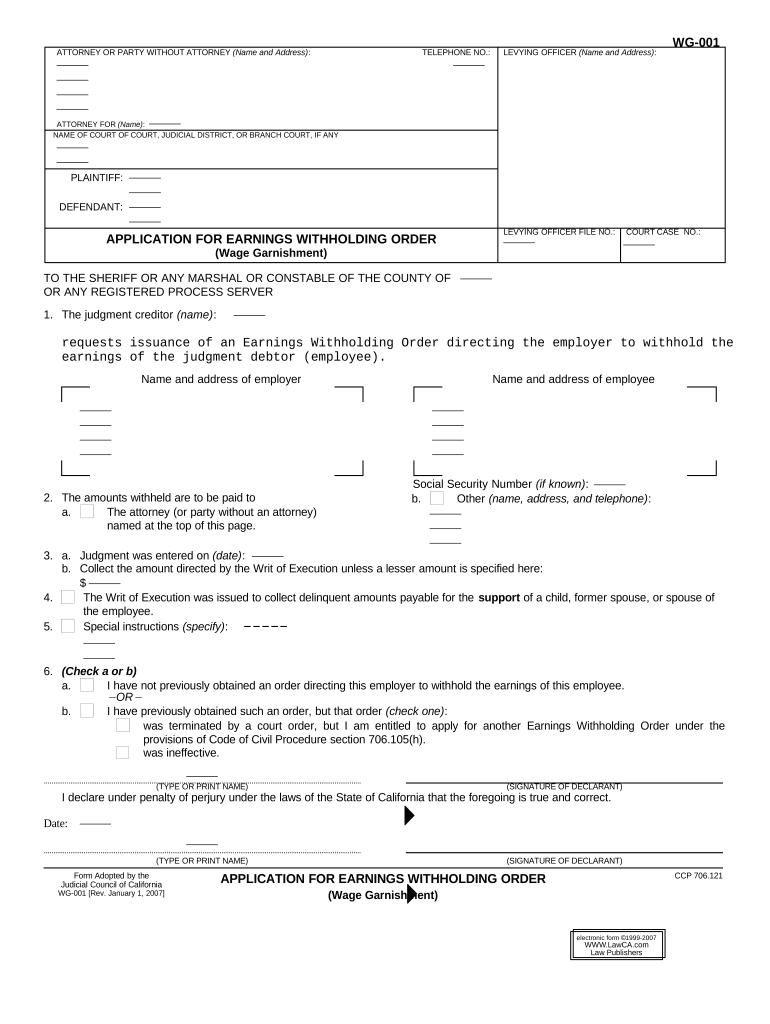

California Wage Form

What is the California Wage Order?

The California Wage Order refers to a set of regulations established by the California Industrial Welfare Commission (IWC) that govern wages, hours, and working conditions for employees in various industries. These orders are designed to ensure fair compensation and working conditions across the state. Each wage order covers specific industries, detailing the minimum wage, overtime pay, meal and rest periods, and other employment standards. Understanding the applicable wage order is crucial for both employers and employees to ensure compliance with state labor laws.

Key Elements of the California Wage Order

Each California Wage Order contains several key elements that outline the rights and responsibilities of employers and employees. These include:

- Minimum Wage: Specifies the minimum hourly wage that must be paid to employees.

- Overtime Pay: Details the conditions under which employees are entitled to overtime pay, typically for hours worked beyond eight in a day or forty in a week.

- Meal and Rest Periods: Outlines the requirements for meal and rest breaks, ensuring employees have adequate time to rest during their shifts.

- Recordkeeping Requirements: Establishes the documentation that employers must maintain regarding employee hours and wages.

Steps to Complete the California Wage Order

Completing the California Wage Order involves several steps to ensure compliance with state regulations. Here are the essential steps:

- Identify the Applicable Wage Order: Determine which wage order applies to your industry.

- Review the Requirements: Familiarize yourself with the specific provisions of the applicable wage order, including minimum wage and overtime rules.

- Document Employee Information: Maintain accurate records of employee hours worked, wages paid, and any applicable deductions.

- Implement Policies: Create and enforce workplace policies that comply with the wage order's requirements.

Legal Use of the California Wage Order

The legal use of the California Wage Order is essential for protecting employee rights and ensuring compliance with labor laws. Employers must adhere to the provisions outlined in the wage order to avoid penalties and legal disputes. Failure to comply can result in wage claims, fines, and other legal actions. It is important for employers to stay informed about changes to wage orders and ensure that their practices align with current regulations.

Eligibility Criteria for the California Wage Order

Eligibility for the California Wage Order varies based on the specific provisions of each order. Generally, all employees within the covered industries are entitled to the protections and benefits outlined in the wage order. However, certain exemptions may apply to specific job classifications or industries. Employers should review the applicable wage order to determine eligibility and ensure compliance with all requirements.

Form Submission Methods

Submitting forms related to the California Wage Order can be done through various methods, including:

- Online Submission: Many forms can be completed and submitted electronically through designated state websites.

- Mail: Forms can be printed, filled out, and mailed to the appropriate state agency.

- In-Person: Some forms may require in-person submission at designated offices or agencies.

Quick guide on how to complete california wage

Complete California Wage effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can locate the required form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage California Wage on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign California Wage with ease

- Locate California Wage and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive data using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign California Wage and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CA wage order?

A CA wage order is a legal directive that outlines the minimum wage and working condition standards for employees in California. It is essential for businesses to comply with these orders to avoid potential legal issues. Understanding the specific provisions within the CA wage order can help businesses ensure fair compensation for their employees.

-

How does airSlate SignNow assist with CA wage order compliance?

airSlate SignNow provides businesses with digital document management tools to easily create and manage agreements related to CA wage order compliance. With customizable templates and electronic signatures, companies can streamline the process of documenting and sharing wage agreements. This ensures that all relevant parties are updated and compliant with the CA wage order.

-

What features of airSlate SignNow support the management of CA wage orders?

Key features of airSlate SignNow that support CA wage order management include eSignature capabilities, document workflows, and secure cloud storage. These features allow companies to efficiently send, track, and retain signed documents required for compliance with CA wage orders. Additionally, automated reminders help ensure that deadlines are met.

-

Is airSlate SignNow a cost-effective solution for managing CA wage orders?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses handling CA wage orders. By reducing the time and resources needed for document management, companies can save on operational costs. The transparent pricing structure further ensures there are no hidden fees, making it ideal for businesses of any size.

-

How can I integrate airSlate SignNow with my existing HR software for CA wage order processing?

airSlate SignNow offers a variety of integrations with popular HR software, making it easier to manage CA wage order processing. By connecting your existing platforms with airSlate SignNow, you can automate workflows and ensure seamless document handling. This integration not only saves time but also enhances accuracy in compliance with CA wage orders.

-

What benefits does airSlate SignNow provide for payroll departments regarding CA wage orders?

For payroll departments, airSlate SignNow simplifies the management of documentation related to CA wage orders, ensuring all agreements are securely signed and stored. This reduces the risk of errors and helps maintain compliance with wage regulations. The ability to quickly access signed documents also facilitates faster payroll processing.

-

Can airSlate SignNow help with employee training on CA wage orders?

While airSlate SignNow primarily focuses on document management, it can be a valuable tool for training employees on CA wage orders by providing easy access to required materials. Companies can share educational resources and documents regarding CA wage orders through the platform. This fosters a better understanding of compliance among employees.

Get more for California Wage

Find out other California Wage

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document