California Wage Form

What is the California Wage

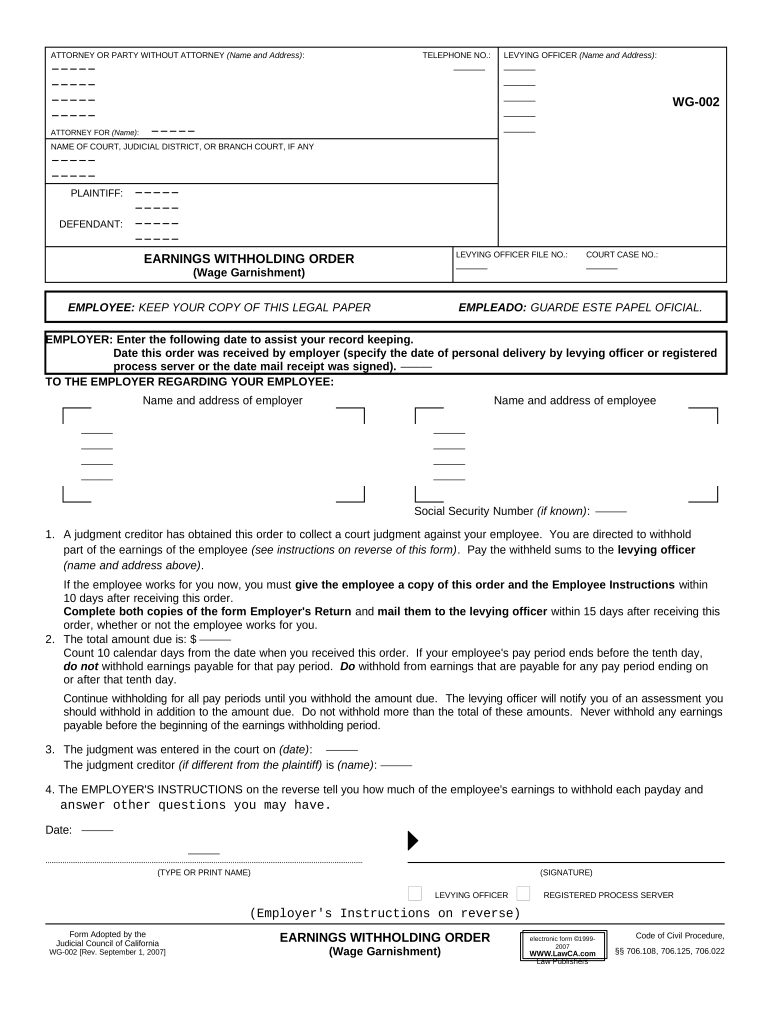

The California Wage refers to the legal framework governing the compensation that employees in California are entitled to receive for their work. This includes minimum wage laws, overtime pay, and other wage-related regulations. Understanding the California Wage is essential for both employers and employees to ensure compliance with state labor laws and to protect workers' rights.

Steps to complete the California Wage

Completing the California Wage process involves several key steps to ensure that all necessary information is accurately reported. First, determine the applicable wage rate based on job classification and hours worked. Next, calculate any overtime pay if applicable, adhering to the state's regulations. Finally, document all calculations and ensure that pay stubs reflect the correct wage information. This process helps maintain transparency and compliance with California labor laws.

Legal use of the California Wage

The legal use of the California Wage encompasses adhering to state regulations regarding employee compensation. Employers must ensure that wages meet or exceed the minimum wage set by California law, which varies based on location and business size. Additionally, employers are required to provide accurate pay statements and comply with regulations surrounding overtime and deductions. Understanding these legal requirements helps prevent disputes and fosters a fair workplace.

Required Documents

When dealing with California Wage issues, several documents are essential for compliance and record-keeping. These include employee pay stubs, time sheets, and any agreements related to wage rates or overtime. Employers should maintain accurate records of these documents to ensure they can demonstrate compliance with wage laws if questioned. Proper documentation is crucial for both employee protection and employer accountability.

Penalties for Non-Compliance

Failure to comply with California Wage laws can result in significant penalties for employers. These penalties may include fines, back pay for employees, and potential legal action. Employers may also face increased scrutiny from state labor agencies. Understanding the risks associated with non-compliance emphasizes the importance of adhering to wage regulations and maintaining accurate payroll practices.

Form Submission Methods (Online / Mail / In-Person)

Submitting wage-related forms in California can be done through various methods, including online submissions, mailing physical documents, or delivering them in person. Online submissions are often the most efficient, allowing for quicker processing times. However, some forms may require physical signatures or additional documentation, making mail or in-person submissions necessary. Employers should choose the method that best suits their operational needs while ensuring compliance with submission deadlines.

Eligibility Criteria

Eligibility for California Wage protections is determined by several factors, including employment status, job classification, and hours worked. Employees must meet specific criteria to qualify for minimum wage and overtime protections. Understanding these eligibility requirements is crucial for both employees seeking fair compensation and employers ensuring compliance with state laws.

Quick guide on how to complete california wage 497299612

Complete California Wage effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute to conventional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents quickly and efficiently. Manage California Wage on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to edit and electronically sign California Wage effortlessly

- Locate California Wage and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to preserve your changes.

- Select how you wish to share your form, via email, text message (SMS), a shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new paper copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign California Wage to guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is CA garnishment and how does it work?

CA garnishment refers to a legal process where a portion of a person's earnings is withheld to pay off a debt. This process is typically initiated through a court order and affects wages, bank accounts, or other assets. Understanding CA garnishment is essential for both employers and employees to ensure compliance with state laws.

-

How can airSlate SignNow help with CA garnishment documentation?

AirSlate SignNow simplifies the process of preparing and signing documents related to CA garnishment. With our user-friendly platform, users can easily create, send, and eSign legal documents required for garnishment proceedings. This streamlines communication and reduces delays, ensuring timely compliance with court requirements.

-

Is airSlate SignNow cost-effective for managing CA garnishment documents?

Yes, airSlate SignNow offers a cost-effective solution for managing CA garnishment documents. Our pricing plans are designed to fit various business sizes and needs, enabling you to efficiently handle garnishment-related paperwork without breaking the bank. Plus, our features save you time and resources, enhancing overall productivity.

-

What features does airSlate SignNow offer for handling CA garnishment procedures?

AirSlate SignNow provides features such as document templates, secure eSigning, and tracking capabilities tailored for CA garnishment procedures. These features ensure that the process is smooth and compliant with legal requirements. Additionally, our platform allows easy collaboration among multiple parties involved in the garnishment process.

-

Can airSlate SignNow integrate with other tools for CA garnishment management?

Yes, airSlate SignNow can seamlessly integrate with various business management tools to enhance your CA garnishment management processes. Our integrations with popular applications ensure that you can centralize your documentation workflow. This allows for easier tracking and processing of garnishment-related tasks.

-

What are the benefits of using airSlate SignNow for CA garnishment?

Using airSlate SignNow for CA garnishment provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance with legal standards. Our platform also offers secure storage for sensitive documents and an easy-to-use interface, which streamlines the garnishment process. Overall, it helps businesses save time and reduce errors in documentation.

-

How secure is airSlate SignNow for handling sensitive CA garnishment information?

AirSlate SignNow prioritizes the security of sensitive CA garnishment information through advanced encryption and compliance with industry standards. Our platform ensures that all documents are stored securely and are only accessible to authorized users. This level of security provides peace of mind when managing sensitive legal documents.

Get more for California Wage

Find out other California Wage

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe