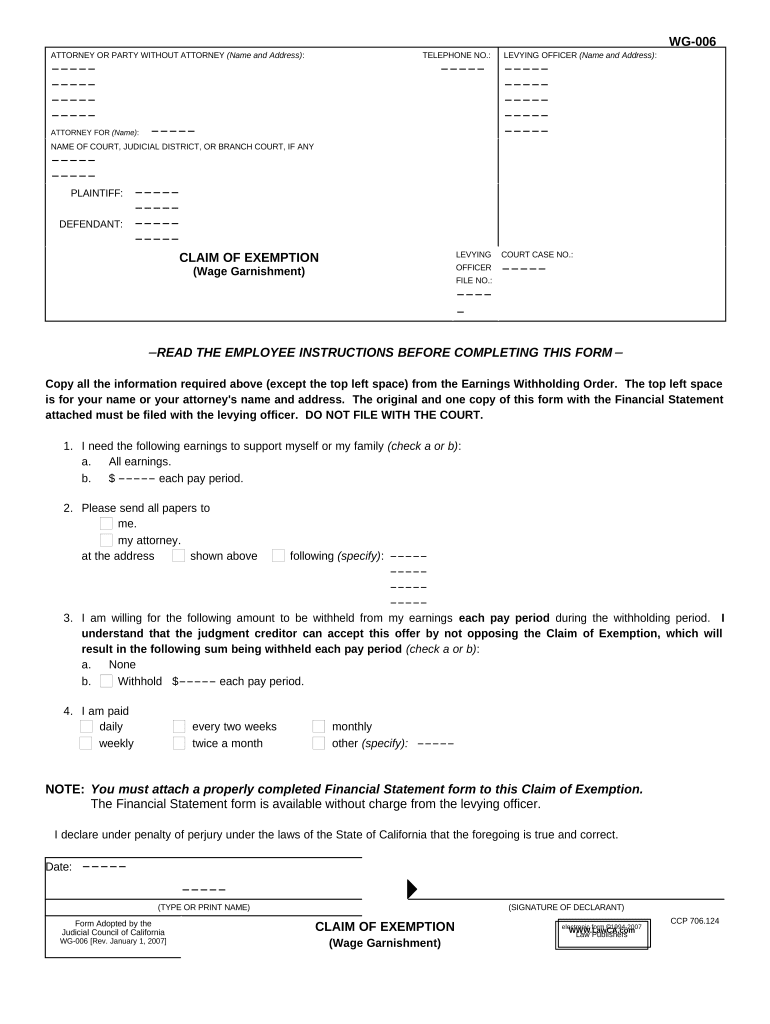

Ca Exemption Form

What is the CA Exemption?

The CA exemption refers to various exemptions available under California law, including tax exemptions and specific claims related to housing and vaccination. These exemptions can provide significant financial relief or legal protections for eligible individuals and businesses. Understanding the specific type of exemption is crucial, as each has its own requirements and implications.

How to Obtain the CA Exemption

To obtain a CA exemption, individuals or businesses must first determine their eligibility based on the specific exemption type. This often involves gathering necessary documentation, such as proof of income or residency. Once eligibility is established, applicants can complete the required forms, which may be available online or through designated state offices. It is essential to follow the guidelines provided for each exemption to ensure proper processing.

Steps to Complete the CA Exemption

Completing a CA exemption form involves several key steps:

- Identify the specific exemption you are applying for, such as a tax exemption or a vaccination exemption.

- Gather all required documentation, which may include identification, proof of income, or residency.

- Fill out the exemption form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

- Submit the form through the appropriate channel, whether online, by mail, or in person.

Legal Use of the CA Exemption

The legal use of the CA exemption is governed by specific laws and regulations. It is vital to understand the legal implications of claiming an exemption, as misuse can lead to penalties or legal repercussions. Compliance with state laws, such as the California Revenue and Taxation Code for tax exemptions, ensures that individuals and businesses protect their rights while benefiting from available exemptions.

Eligibility Criteria

Eligibility for the CA exemption varies depending on the type of exemption being claimed. Common criteria may include:

- Income level, which may determine eligibility for tax exemptions.

- Residency status, particularly for housing-related exemptions.

- Specific health or legal requirements for exemptions related to vaccinations.

It is essential to review the specific requirements for each exemption to ensure compliance and proper qualification.

Required Documents

When applying for a CA exemption, certain documents are typically required to support the application. These may include:

- Proof of identity, such as a driver's license or state ID.

- Income verification documents, like pay stubs or tax returns.

- Residency documentation, such as utility bills or lease agreements.

Having these documents ready can streamline the application process and help avoid delays.

Form Submission Methods

The CA exemption form can be submitted through various methods, depending on the specific exemption type. Common submission methods include:

- Online submission via official state websites.

- Mailing the completed form to the appropriate state agency.

- In-person submission at designated state offices.

Choosing the right submission method is important for ensuring timely processing and compliance with state requirements.

Quick guide on how to complete ca exemption

Complete Ca Exemption with ease on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Ca Exemption on any platform using the airSlate SignNow Android or iOS applications and streamline your document-focused processes today.

How to modify and eSign Ca Exemption effortlessly

- Obtain Ca Exemption and click Get Form to begin.

- Take advantage of the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose your delivery method for your form, whether by email, SMS, invite link, or download it directly to your computer.

Put an end to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Edit and eSign Ca Exemption and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CA exemption form and why is it important?

A CA exemption form is a document that allows businesses to claim certain tax exemptions in California. Understanding the CA exemption form is crucial for companies looking to reduce their tax liabilities while remaining compliant with state laws.

-

How can airSlate SignNow help with CA exemption forms?

airSlate SignNow provides an efficient platform for creating, signing, and managing your CA exemption forms. With our user-friendly interface, you can quickly complete and send out forms, ensuring that your tax documentation is handled seamlessly.

-

Is there a cost associated with using airSlate SignNow for CA exemption forms?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for businesses of all sizes. Our plans include access to features that simplify the management of CA exemption forms, making it an economical choice for managing your documentation needs.

-

What features does airSlate SignNow offer for managing CA exemption forms?

airSlate SignNow includes features such as eSignature, document templates, and automated workflows specifically designed for CA exemption forms. These tools help streamline the signing process and enhance collaboration within your team.

-

Can I integrate airSlate SignNow with other software for handling CA exemption forms?

Absolutely! airSlate SignNow offers integrations with various popular applications, allowing you to manage CA exemption forms alongside your other business tools. This ensures that your workflow remains efficient and organized.

-

What are the benefits of using airSlate SignNow for CA exemption forms?

Using airSlate SignNow for CA exemption forms eliminates the hassle of paperwork and speeds up the signing process. Our platform ensures that your forms are securely signed and stored, which adds an extra layer of convenience for your business operations.

-

How secure is airSlate SignNow when handling CA exemption forms?

Security is a top priority at airSlate SignNow. We implement advanced encryption and compliance measures to protect your CA exemption forms, ensuring that all your sensitive documents remain safe and confidential.

Get more for Ca Exemption

- 1 form for certificate for structural design sufficiency to be submitted before issue of planning permission with respect to

- 1377 lawrence avenue east form

- Ps3 form

- Pndt form f new format 2022

- Printable career interest inventory form

- Hfs 2538b form

- Form 511b request for excursion approval by bb deca ontario

- U s navy fleet bands audition application form

Find out other Ca Exemption

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document