Non Foreign Affidavit under IRC 1445 Colorado Form

What is the Non Foreign Affidavit Under IRC 1445 Colorado

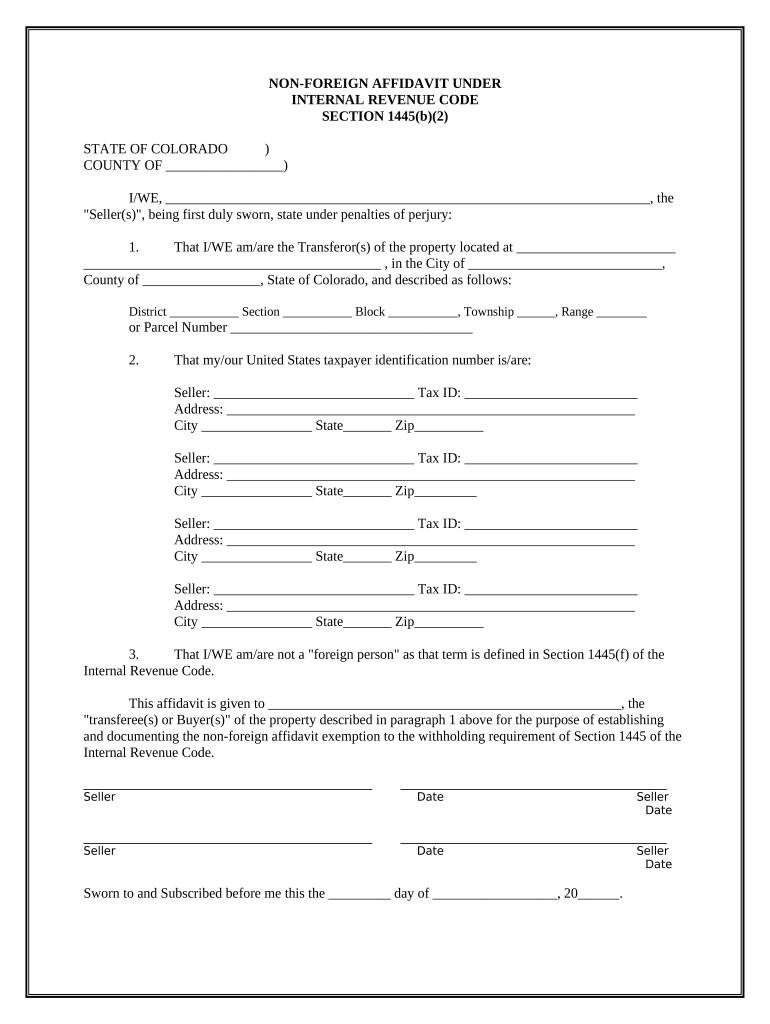

The Non Foreign Affidavit Under IRC 1445 is a legal document required in Colorado for transactions involving real estate where the seller is not a foreign person. This affidavit serves as a declaration that the seller meets the criteria outlined in the Internal Revenue Code, specifically IRC Section 1445, which pertains to withholding tax obligations on foreign sellers. By completing this affidavit, the seller certifies their status as a non-foreign individual or entity, thus exempting the buyer from withholding taxes on the sale proceeds.

Steps to Complete the Non Foreign Affidavit Under IRC 1445 Colorado

Completing the Non Foreign Affidavit Under IRC 1445 involves several key steps:

- Gather necessary information, including the seller's name, address, and taxpayer identification number.

- Clearly state the property details, including the address and legal description.

- Complete the affidavit form, ensuring all sections are filled accurately.

- Sign and date the affidavit in the presence of a notary public to validate the document.

- Provide the completed affidavit to the buyer or their representative for record-keeping.

Legal Use of the Non Foreign Affidavit Under IRC 1445 Colorado

The Non Foreign Affidavit Under IRC 1445 is legally binding and plays a crucial role in real estate transactions in Colorado. It protects both the buyer and seller by ensuring compliance with federal tax laws. The buyer is relieved from the obligation to withhold taxes on the sale proceeds, provided the seller has submitted a valid affidavit. Failure to use this affidavit when required may result in penalties for the buyer, including potential tax liabilities.

Key Elements of the Non Foreign Affidavit Under IRC 1445 Colorado

Key elements of the Non Foreign Affidavit Under IRC 1445 include:

- The seller's declaration of their non-foreign status.

- Identification details of the seller, including name and taxpayer identification number.

- Property information, including address and legal description.

- Signature of the seller and notarization to confirm authenticity.

How to Use the Non Foreign Affidavit Under IRC 1445 Colorado

To use the Non Foreign Affidavit Under IRC 1445, the seller must complete the form accurately and provide it to the buyer during the closing process of a real estate transaction. It is essential for the buyer to retain this document as proof of the seller's non-foreign status, which protects them from withholding tax obligations. Additionally, the affidavit may be required by title companies or lenders during the property transfer process.

Filing Deadlines / Important Dates

While the Non Foreign Affidavit Under IRC 1445 does not have a specific filing deadline, it must be submitted at the time of closing a real estate transaction. It is crucial for sellers to ensure that the affidavit is completed and provided to the buyer prior to the transfer of ownership to avoid any potential tax implications. Buyers should keep track of the closing date to ensure compliance with IRS regulations.

Quick guide on how to complete non foreign affidavit under irc 1445 colorado

Prepare Non Foreign Affidavit Under IRC 1445 Colorado easily on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Non Foreign Affidavit Under IRC 1445 Colorado on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Non Foreign Affidavit Under IRC 1445 Colorado effortlessly

- Obtain Non Foreign Affidavit Under IRC 1445 Colorado and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), an invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks, right from the device of your choice. Modify and eSign Non Foreign Affidavit Under IRC 1445 Colorado and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 Colorado?

A Non Foreign Affidavit Under IRC 1445 Colorado is a legal document required for real estate transactions involving foreign sellers. This affidavit certifies that the seller is not a foreign person, thus exempting the buyer from withholding tax obligations. It is essential for buyers to ensure compliance with federal tax regulations during these transactions.

-

How can airSlate SignNow help with Non Foreign Affidavit Under IRC 1445 Colorado?

airSlate SignNow simplifies the process of signing and managing Non Foreign Affidavit Under IRC 1445 Colorado documents. With our user-friendly platform, businesses can easily create, send, and eSign these affidavits securely. This enhances efficiency and helps ensure compliance with tax regulations.

-

What features does airSlate SignNow offer for processing Non Foreign Affidavit Under IRC 1445 Colorado?

airSlate SignNow provides multiple features for processing Non Foreign Affidavit Under IRC 1445 Colorado, including customizable templates, automated reminders, and secure cloud storage. Users can track document status in real-time and ensure all parties are informed throughout the signing process. These features streamline the workflow for real estate transactions.

-

Is there a cost associated with using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Colorado?

Yes, there are various pricing plans available for using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Colorado. Our pricing is competitive, offering flexible options to suit different business needs. You can choose a plan that best fits your volume of transactions and desired features.

-

Can I integrate airSlate SignNow with other tools for Non Foreign Affidavit Under IRC 1445 Colorado?

Absolutely! airSlate SignNow offers integration with various applications that can assist with the management of Non Foreign Affidavit Under IRC 1445 Colorado. You can connect it with CRMs, document management systems, and other tools to streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Colorado?

Using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Colorado provides numerous benefits, including reduced turnaround times and enhanced document security. It allows for easy tracking of signatures and offers mobile accessibility, ensuring you can manage affidavits anytime, anywhere. Overall, it leads to a more efficient transaction process.

-

Is support available if I have questions regarding Non Foreign Affidavit Under IRC 1445 Colorado?

Yes, airSlate SignNow provides dedicated support for any inquiries regarding Non Foreign Affidavit Under IRC 1445 Colorado. Our knowledgeable support team is available to assist you through email, chat, or phone. We aim to ensure you have a smooth experience while using our platform.

Get more for Non Foreign Affidavit Under IRC 1445 Colorado

- Notice of dishonored check criminal keywords bad check bounced check utah form

- Mutual wills containing last will and testaments for man and woman living together not married with no children utah form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children utah form

- Mutual wills or last will and testaments for man and woman living together not married with minor children utah form

- Non marital cohabitation living together agreement utah form

- Paternity law and procedure handbook utah form

- Bill of sale in connection with sale of business by individual or corporate seller utah form

- Utah marriage form

Find out other Non Foreign Affidavit Under IRC 1445 Colorado

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure

- Sign Virginia Lodger Agreement Template Safe

- Can I Sign Michigan Home Loan Application