Instructions for Appealing Property Tax Assessments with the District Court Colorado Form

What is the Instructions For Appealing Property Tax Assessments With The District Court Colorado

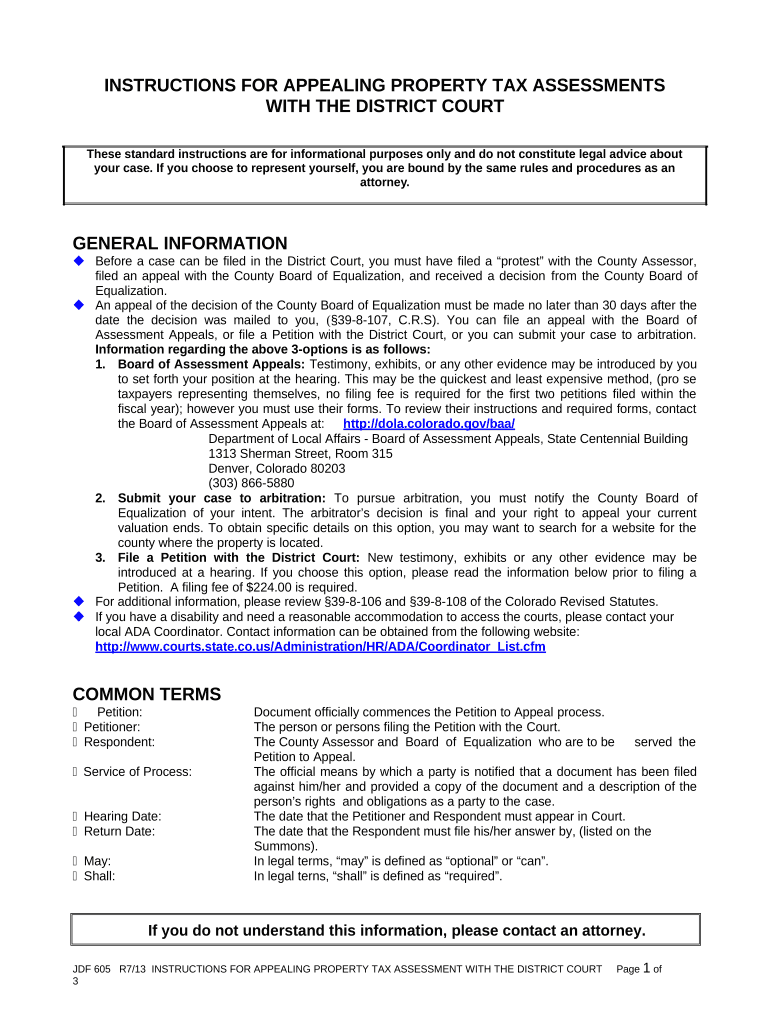

The Instructions For Appealing Property Tax Assessments With The District Court Colorado provide a structured process for taxpayers who believe their property has been incorrectly assessed. This document outlines the necessary steps to formally challenge the property tax assessment made by local authorities. It includes details on eligibility, required documentation, and the timeline for filing an appeal. Understanding this process is crucial for taxpayers who want to ensure they are not overpaying on their property taxes.

Steps to Complete the Instructions For Appealing Property Tax Assessments With The District Court Colorado

Completing the Instructions For Appealing Property Tax Assessments involves several key steps. First, gather all relevant documents, including your property tax assessment notice and any supporting evidence that justifies your appeal. Next, fill out the appeal form accurately, ensuring that all required information is included. After completing the form, submit it to the appropriate district court within the specified deadlines. It is important to keep copies of all documents for your records and to track the submission process.

Required Documents

When appealing property tax assessments, specific documents are necessary to support your case. These typically include:

- Your property tax assessment notice.

- Evidence of property value, such as recent appraisals or comparable sales data.

- Any previous correspondence with the tax assessor's office.

- Proof of identity, which may include a government-issued ID.

Having these documents prepared and organized can significantly enhance the effectiveness of your appeal.

Legal Use of the Instructions For Appealing Property Tax Assessments With The District Court Colorado

The legal framework surrounding the Instructions For Appealing Property Tax Assessments ensures that taxpayers have the right to contest their assessments. This process is governed by state laws that outline the rights and responsibilities of both taxpayers and local authorities. Understanding these legal provisions can empower taxpayers to navigate the appeal process effectively, ensuring their voices are heard in disputes regarding property valuation.

Filing Deadlines / Important Dates

Timeliness is essential when appealing property tax assessments. Each year, specific deadlines are set for filing appeals, which may vary by county. Typically, appeals must be filed within a certain number of days following the receipt of the property tax assessment notice. It is crucial to be aware of these dates to avoid missing the opportunity to contest your assessment. Keeping a calendar with these important dates can help ensure compliance with the necessary timelines.

Who Issues the Form

The Instructions For Appealing Property Tax Assessments are typically issued by the local district court or the county assessor's office. These entities are responsible for overseeing property tax assessments and managing the appeals process. Understanding the role of these offices can provide clarity on where to direct inquiries and how to obtain additional information regarding your appeal.

Quick guide on how to complete instructions for appealing property tax assessments with the district court colorado

Complete Instructions For Appealing Property Tax Assessments With The District Court Colorado effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, enabling you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Instructions For Appealing Property Tax Assessments With The District Court Colorado on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The easiest way to alter and eSign Instructions For Appealing Property Tax Assessments With The District Court Colorado with minimal effort

- Obtain Instructions For Appealing Property Tax Assessments With The District Court Colorado and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal significance as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and eSign Instructions For Appealing Property Tax Assessments With The District Court Colorado and maintain excellent communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the basic Instructions For Appealing Property Tax Assessments With The District Court Colorado?

When appealing a property tax assessment in Colorado, you need to file a notice of appeal with the district court within 30 days of receiving the assessment notice. Include a copy of the assessment and any evidence you have to support your claim. Ensure your appeal is well-documented to increase your chances of a successful outcome.

-

How can airSlate SignNow assist in the appeal process for property tax assessments?

airSlate SignNow offers a seamless solution for sending and eSigning all necessary documents during your appeal process. With our platform, you can easily manage your paperwork, ensuring all instructions for appealing property tax assessments with the district court in Colorado are followed. This streamlines your workflow and saves you valuable time.

-

What features does airSlate SignNow provide for property tax appeal documentation?

Our platform includes features like customizable templates, secure document storage, and real-time tracking, which are perfect for managing your Instructions For Appealing Property Tax Assessments With The District Court Colorado. These tools enhance your efficiency and ensure that your documents are always accessible and well-organized.

-

Is airSlate SignNow a cost-effective solution for managing property tax appeals?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing various documents, including those related to the appeal of property tax assessments. Our pricing plans cater to different needs and budgets, making it easier to incorporate our service while pursuing Instructions For Appealing Property Tax Assessments With The District Court Colorado.

-

Can I integrate airSlate SignNow with other applications for my property tax appeal process?

Absolutely! airSlate SignNow offers integrations with various business applications, allowing you to streamline your operations. These integrations can help you manage the Instructions For Appealing Property Tax Assessments With The District Court Colorado more efficiently by connecting your existing tools with our document management solution.

-

What benefits does airSlate SignNow offer for businesses appealing property tax assessments?

Using airSlate SignNow can greatly benefit businesses by providing a structured approach to manage documents for tax appeals. Our platform ensures that you adhere to the Instructions For Appealing Property Tax Assessments With The District Court Colorado, promotes team collaboration, and reduces the risk of errors in documentation.

-

How do I get started with airSlate SignNow for my property tax appeal?

Getting started with airSlate SignNow is simple! Just visit our website, sign up for an account, and explore our features tailored for appealing property tax assessments. You can access a wide range of resources, including guides that focus on Instructions For Appealing Property Tax Assessments With The District Court Colorado.

Get more for Instructions For Appealing Property Tax Assessments With The District Court Colorado

Find out other Instructions For Appealing Property Tax Assessments With The District Court Colorado

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document