Property Valuation Colorado Form

What is the Property Valuation Colorado

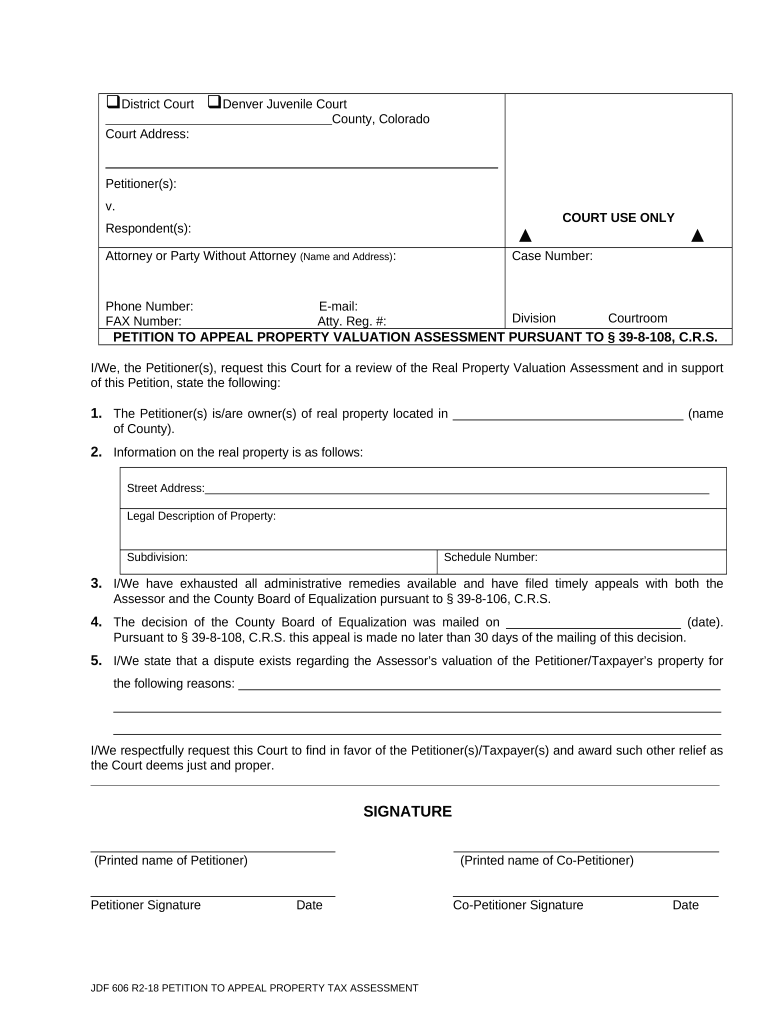

The property valuation Colorado form is a crucial document used to determine the market value of real estate properties within the state. This valuation is essential for various purposes, including taxation, sales, and refinancing. The process involves assessing the property’s features, location, and market trends to arrive at an accurate value. Understanding this form is vital for property owners, buyers, and real estate professionals, as it impacts financial decisions and legal obligations.

How to use the Property Valuation Colorado

Using the property valuation Colorado form involves several steps to ensure accuracy and compliance. First, gather all necessary information about the property, including its size, location, and any improvements made. Next, fill out the form with precise details, ensuring that all sections are completed. It is also important to review the form for accuracy before submission. Once completed, the form can be submitted electronically or in paper format, depending on the requirements of the local authority.

Steps to complete the Property Valuation Colorado

Completing the property valuation Colorado form requires careful attention to detail. Follow these steps for an effective submission:

- Collect property information, including address, size, and features.

- Research comparable properties in the area to understand market value.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check the information for any errors or omissions.

- Submit the form electronically through a secure platform or mail it to the appropriate office.

Legal use of the Property Valuation Colorado

The legal use of the property valuation Colorado form is governed by state regulations. This form serves as an official record for determining property taxes and can be used in legal proceedings related to property disputes. It is essential that the form is filled out correctly to ensure its validity in legal contexts. Compliance with state laws regarding property valuation is crucial for both property owners and real estate professionals.

Key elements of the Property Valuation Colorado

Several key elements are integral to the property valuation Colorado form. These include:

- Property Description: Detailed information about the property’s physical characteristics.

- Market Analysis: Data on comparable properties to establish a fair market value.

- Owner Information: Details of the property owner, including contact information.

- Valuation Methodology: The approach used to determine the property’s value, such as cost, sales comparison, or income approach.

State-specific rules for the Property Valuation Colorado

Each state has unique regulations regarding property valuation. In Colorado, property owners must adhere to specific guidelines when completing the valuation form. These rules may include deadlines for submission, required documentation, and the process for appealing a valuation. Understanding these state-specific rules is essential for ensuring compliance and avoiding potential penalties.

Quick guide on how to complete property valuation colorado

Complete Property Valuation Colorado effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Property Valuation Colorado on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Property Valuation Colorado without effort

- Obtain Property Valuation Colorado and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow has specifically designed for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to confirm your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from your chosen device. Modify and eSign Property Valuation Colorado and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is property valuation colorado and why is it important?

Property valuation Colorado refers to the process of determining the market value of real estate in Colorado. It is crucial for buyers, sellers, and investors to understand the true worth of a property to make informed decisions, whether they're negotiating a price or preparing for tax assessments.

-

How can I get a property valuation in Colorado?

You can obtain a property valuation in Colorado through various methods, including hiring a professional appraiser, using online valuation tools, or consulting a real estate agent with local expertise. At airSlate SignNow, we can help facilitate the document processes associated with these evaluations.

-

What factors influence property valuation colorado?

Several factors affect property valuation Colorado, including location, property size, condition, comparable sales in the area, and market trends. Understanding these elements can lead to a more accurate assessment of a property's worth.

-

What are the costs associated with property valuation in Colorado?

The costs of property valuation in Colorado can vary signNowly based on the method used and the property type. While some online tools may offer complimentary assessments, hiring a professional appraiser typically ranges from $300 to $500, reflecting their expertise and the complexity of the property.

-

How does airSlate SignNow integrate with property valuation services in Colorado?

airSlate SignNow offers seamless integrations with various property valuation services, allowing users to eSign documents directly related to property transactions. This integration streamlines the process, enabling quicker and more efficient deal closures in the Colorado real estate market.

-

What are the benefits of obtaining a property valuation in Colorado?

Obtaining a property valuation in Colorado provides numerous benefits, such as ensuring you’re making a sound investment, setting a competitive selling price, and understanding property taxes. Knowing your property's value empowers you to leverage the best opportunities in the market.

-

Is property valuation in Colorado different from appraisal?

While property valuation Colorado and appraisal are often used interchangeably, there are nuances. Valuation typically refers to an estimate of a property’s worth based on various data, while an appraisal is a formal assessment conducted by a licensed professional, often required for financing.

Get more for Property Valuation Colorado

- Notice to beneficiaries of being named in will wisconsin form

- Estate planning questionnaire and worksheets wisconsin form

- Document locator and personal information package including burial information form wisconsin

- Demand to produce copy of will from heir to executor or person in possession of will wisconsin form

- Compromise and review application for workers compensation wisconsin form

- Rehab specialist certification application for workers compensation wisconsin form

- Wi workers compensation form

- Rehab services quarterly report for workers compensation wisconsin form

Find out other Property Valuation Colorado

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online