Beneficiary Deed Form

What is the Beneficiary Deed

A beneficiary deed is a legal document that allows property owners in Arizona to designate one or more beneficiaries to receive their property upon their death, without the need for probate. This deed is particularly useful for individuals looking to simplify the transfer of real estate to their heirs. By executing a beneficiary deed, the property owner retains full control over the property during their lifetime, including the ability to sell, lease, or modify the property as desired.

How to use the Beneficiary Deed

To effectively use a beneficiary deed, the property owner must complete the form accurately and ensure it is recorded with the appropriate county recorder's office in Arizona. The form should include the owner's details, a legal description of the property, and the names of the designated beneficiaries. Once recorded, the beneficiary deed becomes effective immediately, allowing the property to pass directly to the beneficiaries upon the owner's death, bypassing the probate process.

Steps to complete the Beneficiary Deed

Completing a beneficiary deed involves several key steps:

- Obtain the beneficiary deed form from a reliable source.

- Fill in the property owner's name and address, along with the legal description of the property.

- List the beneficiaries who will receive the property upon the owner's death.

- Sign the form in the presence of a notary public to ensure its validity.

- Record the completed deed with the county recorder's office where the property is located.

Legal use of the Beneficiary Deed

The legal use of a beneficiary deed in Arizona is governed by state laws that outline its requirements and effects. This deed must be executed while the property owner is alive and of sound mind. It is essential to follow the legal formalities, such as notarization and recording, to ensure that the deed is enforceable. Failure to comply with these requirements may result in the deed being deemed invalid, which could complicate the transfer of property.

State-specific rules for the Beneficiary Deed

Arizona has specific rules regarding the use of beneficiary deeds. For instance, the deed must clearly state that it is a beneficiary deed and include the phrase "transfer on death" to distinguish it from other types of deeds. Additionally, Arizona law allows for multiple beneficiaries, but it is crucial to specify how the property will be divided among them. Understanding these state-specific rules helps ensure that the deed is executed correctly and fulfills the property owner's intentions.

Required Documents

When preparing a beneficiary deed, the following documents are typically required:

- A completed beneficiary deed form.

- A legal description of the property, which can usually be found on the property deed or tax records.

- Identification for the property owner, such as a driver's license or state ID.

- Proof of ownership, if necessary.

Form Submission Methods (Online / Mail / In-Person)

Once the beneficiary deed is completed and notarized, it must be submitted to the county recorder's office. This can typically be done in person, where staff can assist with the recording process. Some counties may also offer online recording options, allowing property owners to submit documents electronically. It is advisable to check with the local county recorder's office for specific submission methods and any associated fees.

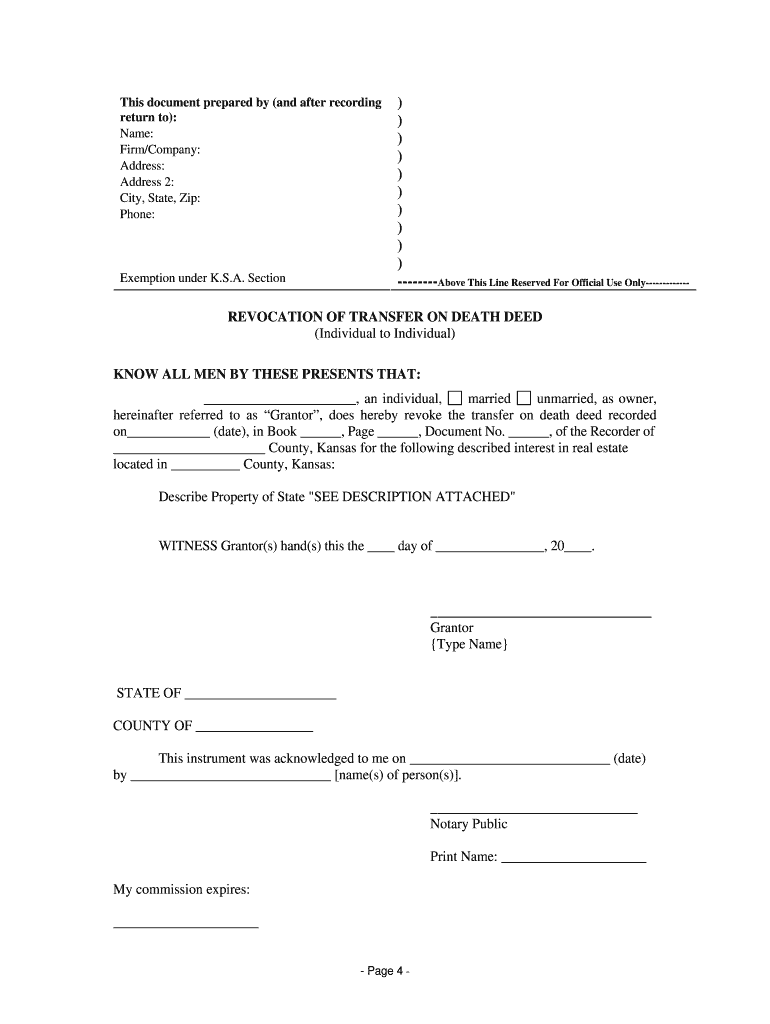

Quick guide on how to complete kansas revocation of transfer on death deed beneficiary deed for individual to individual

Effortlessly prepare Beneficiary Deed on any device

The management of online documents has gained signNow traction among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Beneficiary Deed on any platform using airSlate SignNow's Android or iOS applications and streamline your document-based processes today.

Easily modify and eSign Beneficiary Deed without hassle

- Locate Beneficiary Deed and click Get Form to begin.

- Use the tools available to fill out your form.

- Highlight key sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to save your amendments.

- Choose your delivery method for the form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate new printed copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and eSign Beneficiary Deed to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What kind of financial contracts between two individuals are allowed in India? Like a bond with a death penalty on forfeiture would be illegal but a title deed transfer for a house is not.

The answer to this question would be a mini law class! So, here we go -The legal definition of Contract is -"A Contract is an Agreement enforceable by law".Therefore contract needs an agreement (which means there should be meeting of minds) which is enforceable by law (which means needless of say, it cannot be about something illegal).In order to enter into a contract, you need to have the following things done -1. OfferOffer is when a certain stipulation is offered or proposed.For example - I offer to sell you my Television.An offer is complete when it is reciprocated to another person. Once it signNowes the other person, the offeror cannot withdraw his offer.2. AcceptanceAcceptance is when the offeree agrees to bind himself with the stipulation.Example - You agree to buy my Television.An acceptance once received by the Offeror cannot be withdrawn by the Offeree.3. ConsiderationFor a contract to be complete, this is the third most important thing.Consideration means the price paid by the other party in exchange of the terms of the contract. So, in the above example, Money you pay me for the television is my consideration and Television is yours.Quid - Pro - Quo.There are other things like capacity of the parties as well as consent that makes a contract valid or the absence of which makes it invalid.In the example shared in your question, having a clause of death penalty would be illegal and hence invalid as a contract.So, all the other (financial or not) contract, that fulfill the above conditions, where parties have the capacity to contract, where there is free and informed consent, the contract is valid.

-

Can an individual form a company on the MCA service? Is it mandatory to fill out MCA forms for a company formed by a CA only?

Yes an individual can form a company on the MCA service by filling mca form 18, it is not mandatory that only a chartered accountant can fill out MCA forms for a company but is mostly prefered by many companies to do so.

-

For individuals that received a blood donation / transfusion, how many went on to develop a form of mental ill health?

Blood Donations are totally healthy for the average human. Normally healthy people donate their blood and a very small percentage of them can have an adverse reaction. This reaction could range from agitation, sweating, to pallor, cold feeling, sense of weakness, and even nausea.According to a study done by PMC, only about 0.2% of donors suffered from severe issues such as convulsive syncope.However there are little to no cases of people developing mental illnesses. I personally recommend that—if you are healthy, to donate some blood.

-

Which ITR form should I fill for payments received from the USA to a salaried individual in India for freelancing work, and how should I declare this in ITR? There is no TDS record of this payment as it is outside India.

You can use ITR-1 to show it as Income from Other SOurcesIf you want to claim expense against this income, then you are better off showing it in ITR-2 again as Income from Other Sources. In this case dont claim too many expenses against Income from Other Sources because that usually triggers a scrutinyIf this is going to be regular, then you will need to fill ITR-3 and show this as Income from Business/Profession. The negative of this ITR is that it is quite voluminous and you will have to prepare a Balance Sheet and Profit and loss account even if your income from this source exceeds an amount as low as Rs. 1,20,000/-.

Create this form in 5 minutes!

How to create an eSignature for the kansas revocation of transfer on death deed beneficiary deed for individual to individual

How to create an electronic signature for your Kansas Revocation Of Transfer On Death Deed Beneficiary Deed For Individual To Individual online

How to create an eSignature for the Kansas Revocation Of Transfer On Death Deed Beneficiary Deed For Individual To Individual in Chrome

How to create an eSignature for signing the Kansas Revocation Of Transfer On Death Deed Beneficiary Deed For Individual To Individual in Gmail

How to create an electronic signature for the Kansas Revocation Of Transfer On Death Deed Beneficiary Deed For Individual To Individual from your smart phone

How to make an electronic signature for the Kansas Revocation Of Transfer On Death Deed Beneficiary Deed For Individual To Individual on iOS

How to generate an electronic signature for the Kansas Revocation Of Transfer On Death Deed Beneficiary Deed For Individual To Individual on Android devices

People also ask

-

What is a Beneficiary Deed and how does it work?

A Beneficiary Deed is a legal document that allows property owners to transfer their real estate to beneficiaries upon their death, avoiding probate. With airSlate SignNow, you can easily create, sign, and manage your Beneficiary Deed electronically, ensuring a smooth transition of property ownership.

-

How can airSlate SignNow help with creating a Beneficiary Deed?

airSlate SignNow provides an intuitive platform for drafting a Beneficiary Deed, allowing users to customize templates and gather necessary signatures electronically. This simplifies the process and ensures that your Beneficiary Deed is legally binding and securely stored.

-

Is there a cost associated with using airSlate SignNow for a Beneficiary Deed?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for creating and managing a Beneficiary Deed. You can choose a plan that fits your budget, ensuring you have access to all necessary features without overspending.

-

What features does airSlate SignNow offer for managing a Beneficiary Deed?

airSlate SignNow offers features such as document templates, electronic signatures, real-time tracking, and cloud storage for your Beneficiary Deed. These tools enhance efficiency and security, making it easier to manage important legal documents.

-

Can I integrate airSlate SignNow with other software for my Beneficiary Deed?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow when creating and managing a Beneficiary Deed. This integration capability enhances productivity and ensures all your documents are easily accessible.

-

What are the benefits of using a Beneficiary Deed?

Using a Beneficiary Deed can simplify the transfer of property to heirs, avoid probate, and provide peace of mind knowing your wishes will be honored. With airSlate SignNow, the process of creating and signing this important document is straightforward and efficient.

-

Is my Beneficiary Deed secure with airSlate SignNow?

Yes, airSlate SignNow prioritizes document security, ensuring that your Beneficiary Deed is protected with advanced encryption and secure cloud storage. You can trust that your sensitive information and legal documents are safe from unauthorized access.

Get more for Beneficiary Deed

Find out other Beneficiary Deed

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF