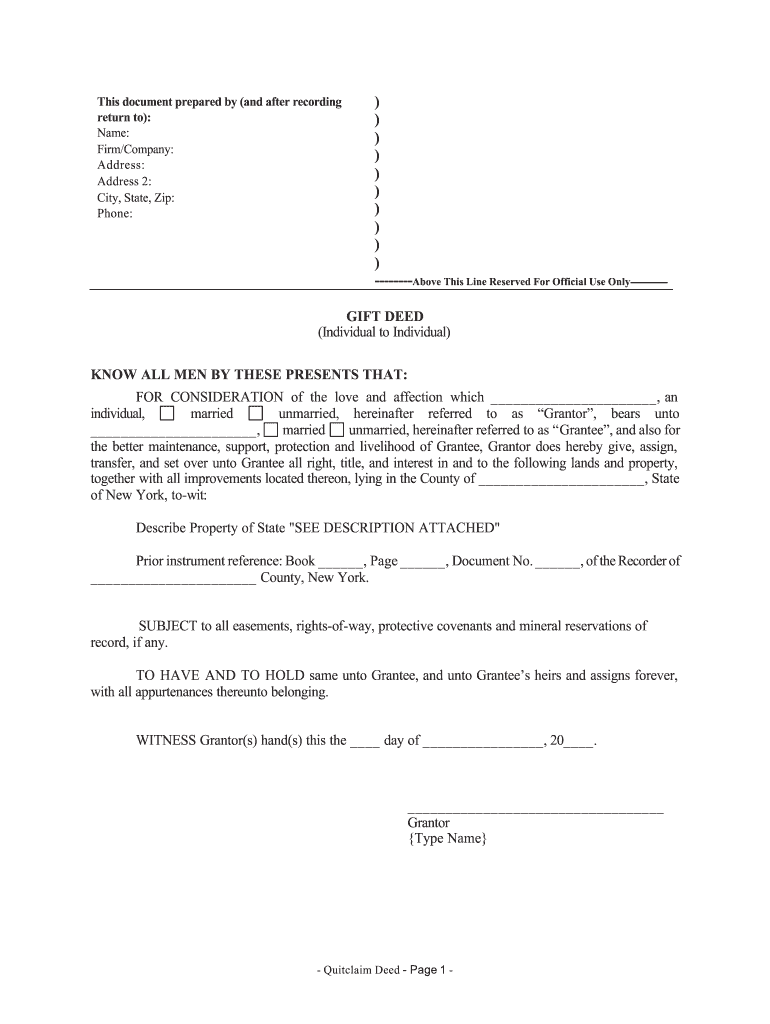

New York Gift Deed for Individual to Individual Form

Understanding the gift deed in California

A gift deed in California is a legal document that allows an individual to transfer property or assets to another person without any exchange of money. This document is essential for establishing the intent of the giver to make a gift and to ensure that the transfer is recognized by law. The gift deed must include specific details such as the names of the parties involved, a description of the property being gifted, and the date of the transfer. It is important to note that a gift deed is irrevocable, meaning once the gift is made, the giver cannot take it back.

Key elements of a California gift deed

When creating a gift deed in California, certain key elements must be included to ensure its validity:

- Grantor and Grantee Information: Full names and addresses of both the person giving the gift and the person receiving it.

- Description of the Property: A detailed description of the property being gifted, including any relevant identifiers such as parcel numbers.

- Intent to Gift: A clear statement indicating that the transfer is a gift and not a sale or exchange.

- Signature: The grantor must sign the document, and it is advisable to have the signature notarized to enhance its legal standing.

- Date of Transfer: The date on which the transfer is intended to take place.

Steps to complete a gift deed in California

Completing a gift deed in California involves several steps:

- Gather necessary information about both the grantor and grantee.

- Obtain a gift deed template or create one that includes all required elements.

- Fill out the gift deed with accurate details, ensuring clarity and completeness.

- Sign the document in the presence of a notary public to validate the deed.

- Record the gift deed with the county recorder's office where the property is located to make the transfer official.

Legal use of a gift deed in California

A gift deed is legally binding in California when executed correctly. It serves as proof of ownership transfer and can be used in various legal situations, such as estate planning or tax considerations. It is advisable to consult with a legal professional to ensure compliance with all applicable laws and regulations, especially if the gift involves real property. This helps to avoid potential disputes or challenges regarding the validity of the gift deed.

Required documents for a gift deed in California

To complete a gift deed in California, the following documents may be required:

- Identification documents for both the grantor and grantee.

- A completed gift deed template.

- Any existing property deeds or titles related to the property being gifted.

- Proof of property value, which may be necessary for tax purposes.

IRS guidelines on gift deeds

The Internal Revenue Service (IRS) has specific guidelines regarding gifts, including gift deeds. Gifts exceeding a certain value may require the filing of a gift tax return. For the tax year 2023, the annual exclusion amount is $17,000 per recipient. If the value of the gift exceeds this limit, the giver may need to file Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. It is important to keep accurate records of the gift deed and any related transactions for tax purposes.

Quick guide on how to complete new york gift deed for individual to individual

Complete New York Gift Deed For Individual To Individual effortlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly solution to conventional printed and signed paperwork, allowing you to obtain the accurate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, adjust, and eSign your documents promptly and without hurdles. Manage New York Gift Deed For Individual To Individual on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and eSign New York Gift Deed For Individual To Individual with ease

- Obtain New York Gift Deed For Individual To Individual and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or mistakes that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign New York Gift Deed For Individual To Individual while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

If a couple is applying for a US B-1 visa, do they need to fill out a form for individuals or groups?

Go for group.

-

What form can I fill out as a self-employed individual to make my CPA’s job easier?

A QuickBooks Trial Balance and Detailed General Ledger - printed and in Excel format. Work with your CPA to create an appropriate chart of accounts for your business. And use a good bookkeeper to keep your books. If your books look good, the CPA will ask some question to gain comfort and then accept your numbers with little further investigation.Please do not bring a boxful of crumpled receipts. You will pay more for your CPA to uncrumple them and categorize them. If you are a really small business, a legal pad sheet categorizing your receipts. If your receipts are a mess, or your books a mess, your CPA needs to ask a lot more questions and spend a lot more time gaining comfort with your books. Bad books from a shady client means a lot of grief for the CPA and a lot more fees.

-

Can an individual form a company on the MCA service? Is it mandatory to fill out MCA forms for a company formed by a CA only?

Yes an individual can form a company on the MCA service by filling mca form 18, it is not mandatory that only a chartered accountant can fill out MCA forms for a company but is mostly prefered by many companies to do so.

-

I am applying for a job as Interaction Designer in New York, the company has an online form to fill out and they ask about my current salary, I am freelancing.. What should I fill in?

As Sarah said, leave it blank or, if it's a free-form text field, put in "Freelancer".If you put in $50k and they were thinking of paying $75k, you just lost $25k/year. If you put in $75k, but their budget only allows $50k, you may have lost the job on that alone.If you don't put in anything, leave it to the interview, and tell thm that you're a freelancer and adjust your fee according to the difficulty of the job, so there's no set income. If they ask for how much you made last year, explain that that would include periods between jobs, where you made zero, so it's not a fair number.In any financial negotiation, an old saying will always hold true - he who comes up with a number first, loses. Jobs, buying houses - they're both the same. Asking "How much?" is the better side to be on. then if they say they were thinking of $50k-$75k, you can tell them that it's just a little less than you were charging, but the job looks to be VERY interesting, the company seems to be a good one to work for and you're sure that when they see what you're capable of, they'll adjust your increases. (IOW, "I'll take the $75k, but I expect to be making about $90k in a year.")They know how to play the game - show them that you do too.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

Create this form in 5 minutes!

How to create an eSignature for the new york gift deed for individual to individual

How to create an eSignature for the New York Gift Deed For Individual To Individual online

How to generate an electronic signature for the New York Gift Deed For Individual To Individual in Google Chrome

How to generate an eSignature for putting it on the New York Gift Deed For Individual To Individual in Gmail

How to generate an electronic signature for the New York Gift Deed For Individual To Individual right from your smart phone

How to make an electronic signature for the New York Gift Deed For Individual To Individual on iOS

How to make an electronic signature for the New York Gift Deed For Individual To Individual on Android

People also ask

-

What is a New York Gift Deed For Individual To Individual?

A New York Gift Deed For Individual To Individual is a legal document that allows one individual to transfer property ownership to another individual as a gift without any exchange of money. This type of deed is particularly useful for estate planning and simplifying property transfers among family members or friends in New York.

-

How can airSlate SignNow help me create a New York Gift Deed For Individual To Individual?

airSlate SignNow provides an easy-to-use platform for creating a New York Gift Deed For Individual To Individual. With customizable templates and a straightforward eSign process, you can quickly draft, sign, and send your gift deed digitally, ensuring a hassle-free experience.

-

What are the costs associated with a New York Gift Deed For Individual To Individual?

The costs for filing a New York Gift Deed For Individual To Individual can vary depending on local recording fees and any legal assistance you may require. However, using airSlate SignNow reduces overall expenses by offering a cost-effective solution for drafting and eSigning your gift deed without needing extensive legal help.

-

Is the New York Gift Deed For Individual To Individual legally binding?

Yes, a New York Gift Deed For Individual To Individual is legally binding once it is properly executed and recorded with the appropriate county clerk. Using airSlate SignNow ensures that your document adheres to New York state laws and is securely stored for future reference.

-

Can I customize my New York Gift Deed For Individual To Individual with airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your New York Gift Deed For Individual To Individual with specific details, such as the names of the parties involved, property descriptions, and any special conditions. This flexibility ensures your deed meets your unique needs.

-

What features does airSlate SignNow offer for eSigning my New York Gift Deed For Individual To Individual?

airSlate SignNow offers a range of features for eSigning your New York Gift Deed For Individual To Individual, including secure electronic signatures, document tracking, and real-time collaboration. These features streamline the signing process, making it efficient and reliable.

-

Are there any integrations available with airSlate SignNow for managing my New York Gift Deed For Individual To Individual?

Yes, airSlate SignNow provides various integrations with popular business tools, allowing you to manage your New York Gift Deed For Individual To Individual seamlessly. Whether you need to connect with cloud storage, CRM systems, or workflow automation tools, airSlate SignNow has you covered.

Get more for New York Gift Deed For Individual To Individual

Find out other New York Gift Deed For Individual To Individual

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent