Colorado Collection Form

What is the Colorado Collection

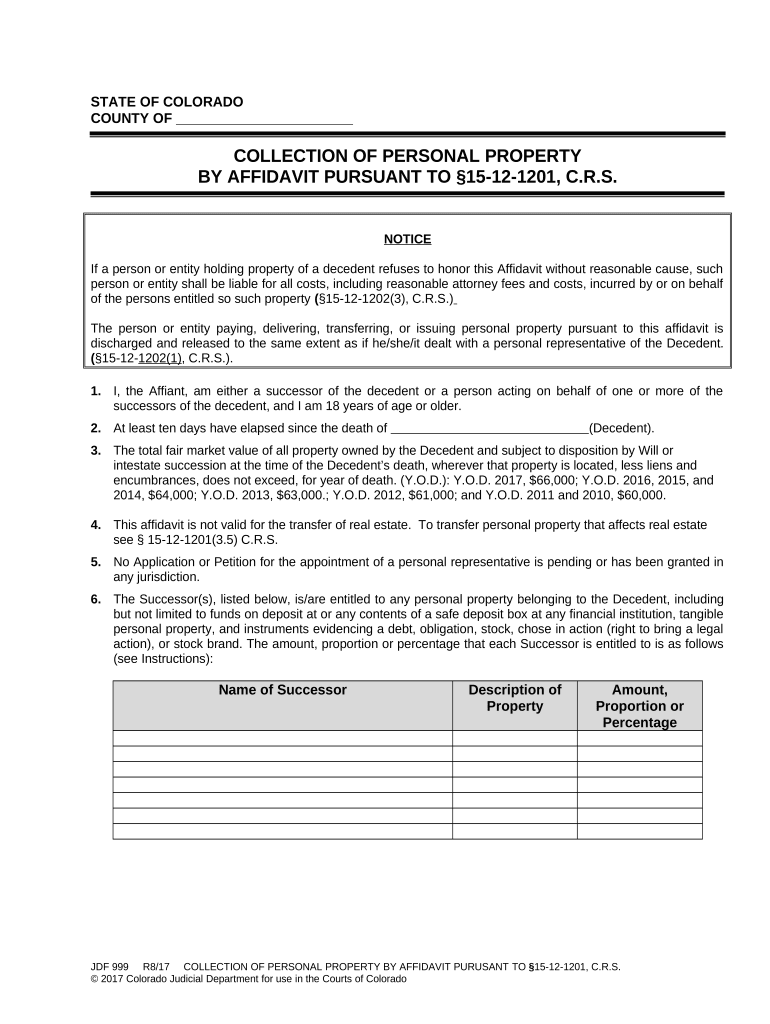

The Colorado Collection refers to a specific set of forms and documents used primarily for tax and financial reporting purposes in the state of Colorado. These forms are essential for individuals and businesses to report income, expenses, and other financial activities accurately. The Colorado Collection encompasses various forms that may include tax returns, information returns, and other related documentation necessary for compliance with state regulations.

How to use the Colorado Collection

Using the Colorado Collection involves several steps to ensure that all required forms are completed accurately and submitted on time. First, identify the specific forms relevant to your situation, whether you are an individual taxpayer or a business entity. Next, gather all necessary financial documents, such as income statements and expense receipts. Once you have the required information, fill out the forms carefully, ensuring that all entries are accurate. Finally, submit the completed forms through the appropriate channels, which may include online submission, mailing, or in-person delivery.

Steps to complete the Colorado Collection

Completing the Colorado Collection requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Identify the specific forms needed for your tax situation.

- Gather all relevant financial documents, including W-2s, 1099s, and receipts.

- Fill out the forms accurately, paying attention to details such as names, addresses, and financial figures.

- Review the completed forms for any errors or omissions.

- Submit the forms through the designated method, ensuring you meet any deadlines.

Legal use of the Colorado Collection

The legal use of the Colorado Collection is governed by state tax laws and regulations. To ensure that the forms are legally valid, they must be filled out accurately and submitted within the specified deadlines. Additionally, using electronic signatures through a reliable platform can enhance the legal standing of the documents. Compliance with state regulations, such as the Colorado Revised Statutes, is crucial for the forms to be recognized by tax authorities.

Key elements of the Colorado Collection

Key elements of the Colorado Collection include:

- Accuracy: All information provided must be correct and verifiable.

- Timeliness: Forms must be submitted by the deadlines set by the Colorado Department of Revenue.

- Documentation: Supporting documents must be included to substantiate claims made on the forms.

- Signature: Forms may require a signature, which can be electronic or handwritten, depending on submission methods.

Who Issues the Form

The forms within the Colorado Collection are issued by the Colorado Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides resources and guidance to help individuals and businesses understand their obligations and complete the necessary forms accurately.

Quick guide on how to complete colorado collection

Prepare Colorado Collection effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and safely keep it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your files swiftly without delays. Manage Colorado Collection on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to alter and eSign Colorado Collection with ease

- Locate Colorado Collection and select Get Form to begin.

- Make use of the features we offer to fill out your form.

- Mark signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Decide how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from your chosen device. Modify and eSign Colorado Collection and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Colorado collection in airSlate SignNow?

The Colorado collection in airSlate SignNow refers to a suite of eSignature and document management features designed specifically for users in Colorado. This collection streamlines the process of sending and signing documents digitally, making it a valuable tool for businesses looking to improve efficiency.

-

How much does the Colorado collection cost?

Pricing for the Colorado collection in airSlate SignNow varies based on the subscription plan you choose. We offer several tiers to cater to different business needs, ensuring that you get the best value while leveraging our powerful eSigning features.

-

What features are included in the Colorado collection?

The Colorado collection includes essential features such as customizable templates, real-time tracking, and secure storage for your documents. These features help ensure that your signing process is not only efficient but also compliant with local regulations.

-

How can the Colorado collection benefit my business?

By utilizing the Colorado collection in airSlate SignNow, your business can signNowly reduce the time spent on document management. This results in faster turnaround times for contracts and agreements, ultimately enhancing productivity and customer satisfaction.

-

Does the Colorado collection integrate with other software?

Yes, the Colorado collection in airSlate SignNow seamlessly integrates with popular business applications such as Salesforce, Google Workspace, and Microsoft Office. This ensures a smooth workflow and enhances your ability to manage documents across different platforms.

-

Is the Colorado collection secure for sensitive documents?

Absolutely! The Colorado collection in airSlate SignNow employs state-of-the-art security measures including encryption and secure cloud storage to protect your sensitive documents. This means you can confidently send and sign documents knowing they are secure.

-

Can I try the Colorado collection before committing to a plan?

Yes! airSlate SignNow offers a free trial for the Colorado collection, allowing you to explore its features and assess how well it fits your business needs without any financial commitment. Take advantage of the trial to experience the benefits firsthand.

Get more for Colorado Collection

- Agreement for delayed or partial rent payments wyoming form

- Tenants maintenance repair request form wyoming

- Guaranty attachment to lease for guarantor or cosigner wyoming form

- Amendment to lease or rental agreement wyoming form

- Warning notice due to complaint from neighbors wyoming form

- Lease subordination agreement wyoming form

- Apartment rules and regulations wyoming form

- Agreed cancellation of lease wyoming form

Find out other Colorado Collection

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement