Connecticut Disclaimer Form

What is the Connecticut Disclaimer

The Connecticut Disclaimer is a legal document that allows an individual to refuse an inheritance or a gift of property. This process is particularly relevant in the context of intestate succession, where a person dies without a will. By executing a disclaimer, the individual effectively relinquishes their right to the property, allowing it to pass to the next eligible heir according to Connecticut law. This can be a strategic decision for tax planning or to avoid potential complications in estate management.

Steps to complete the Connecticut Disclaimer

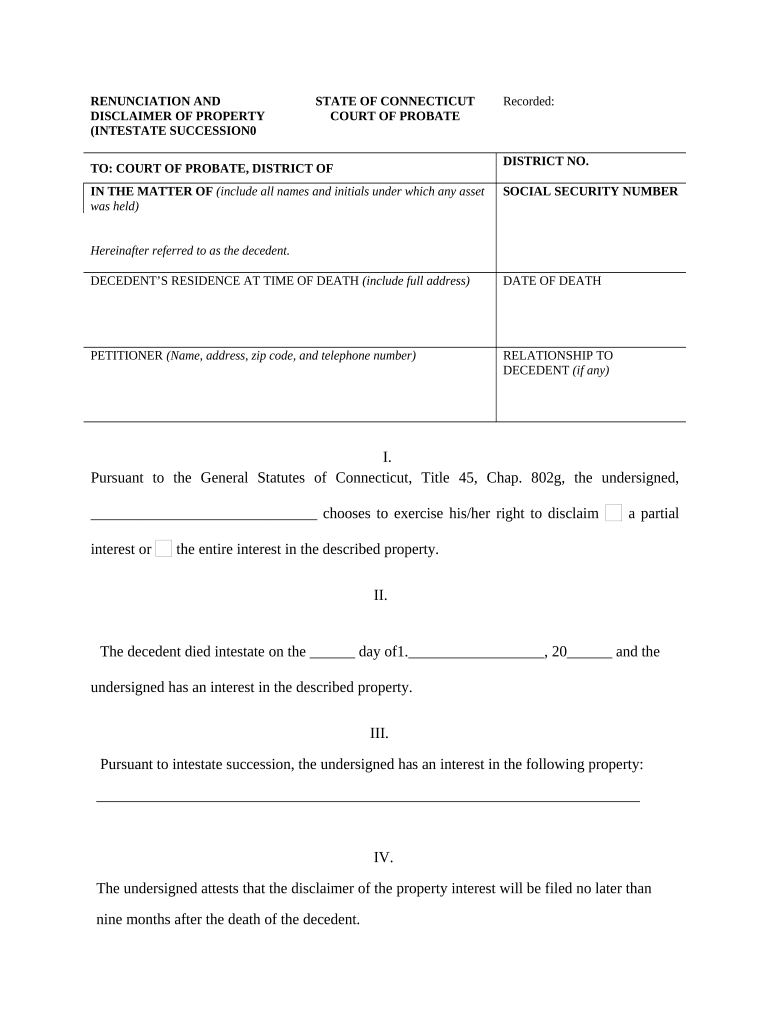

Completing the Connecticut Disclaimer involves several key steps to ensure that the document is legally valid and effective. First, the individual must clearly express their intention to disclaim the property. This is typically done by filling out the appropriate disclaimer form, which should include specific details such as the description of the property and the date of the decedent's death. Next, the disclaimer must be signed and dated by the disclaimant. It is essential to file the disclaimer with the probate court within nine months of the decedent's death to comply with state regulations. Finally, retaining a copy of the filed disclaimer for personal records is advisable.

Legal use of the Connecticut Disclaimer

The legal validity of the Connecticut Disclaimer hinges on compliance with state laws governing disclaimers. Under Connecticut law, a disclaimer must be in writing and signed by the disclaimant. It should also specify the property being disclaimed and the reason for the disclaimer. The document must be filed with the appropriate probate court to be enforceable. Failure to adhere to these requirements may result in the disclaimer being deemed invalid, which could lead to unintended inheritance of the property.

Key elements of the Connecticut Disclaimer

Several key elements must be included in a Connecticut Disclaimer to ensure its effectiveness. These include:

- Identification of the Disclaimant: The full name and address of the person disclaiming the property.

- Description of the Property: A clear and specific description of the property being disclaimed.

- Decedent Information: The name of the deceased and the date of their death.

- Statement of Disclaimer: A clear declaration that the disclaimant is refusing the property.

- Signature and Date: The disclaimant's signature and the date of signing.

State-specific rules for the Connecticut Disclaimer

Connecticut has specific rules governing the execution and filing of disclaimers. Notably, disclaimers must be filed within nine months of the decedent's death. Additionally, the disclaimant cannot have accepted any benefits from the property prior to filing the disclaimer, as this would invalidate the document. Understanding these state-specific rules is crucial for individuals considering a disclaimer as part of their estate planning strategy.

Examples of using the Connecticut Disclaimer

There are various scenarios in which a Connecticut Disclaimer may be used effectively. For instance, if an individual inherits a property that they cannot maintain or afford, they may choose to disclaim it, allowing the property to pass to another heir who is better suited to manage it. Another example is when an individual wishes to disclaim an inheritance to minimize tax liabilities, thereby allowing the property to be passed to their children or other beneficiaries. These examples illustrate the flexibility and strategic value of the Connecticut Disclaimer in estate planning.

Quick guide on how to complete connecticut disclaimer

Effortlessly Prepare Connecticut Disclaimer on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without any hold-ups. Manage Connecticut Disclaimer on any platform with the airSlate SignNow mobile apps for Android or iOS and streamline any document-related process today.

How to Edit and Electronically Sign Connecticut Disclaimer with Ease

- Obtain Connecticut Disclaimer and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes only seconds and has the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether it's via email, SMS, invitational link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document duplicates. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Connecticut Disclaimer, ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Connecticut succession and how can it be facilitated?

Connecticut succession refers to the process of transferring assets from a deceased person to their heirs in Connecticut. Utilizing platforms like airSlate SignNow can simplify this process by providing easy-to-use, electronic signature capabilities for essential documents. This ensures that all necessary paperwork is properly signed and filed, streamlining the succession process.

-

How does airSlate SignNow support the Connecticut succession process?

airSlate SignNow offers features specifically designed to aid in the Connecticut succession process by allowing users to eSign vital estate documents securely. This digital solution accelerates the preparation and execution of wills, trusts, and other succession-related documents, helping you manage the process more efficiently.

-

What are the pricing options for airSlate SignNow in relation to Connecticut succession needs?

airSlate SignNow provides various pricing plans that cater to different business needs, including those related to Connecticut succession. Whether you’re an individual or a company, there are cost-effective solutions available that can accommodate your requirements while streamlining document management during the succession process.

-

What features does airSlate SignNow offer that are beneficial for Connecticut succession?

Key features of airSlate SignNow that support Connecticut succession include customizable templates, mobile access, secure storage, and easy document sharing. These functionalities allow users to create, sign, and manage essential succession documents with ease, ensuring compliance with Connecticut laws.

-

Can airSlate SignNow integrate with other tools for managing Connecticut succession?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM systems and cloud storage solutions. This integration capability enhances efficiency by allowing users to manage all aspects of Connecticut succession in one centralized location, ensuring that all documents are properly organized and accessible.

-

What benefits does airSlate SignNow provide for businesses handling Connecticut succession?

Using airSlate SignNow for Connecticut succession provides several advantages, including reduced paper usage, faster turnaround times for document signing, and increased accuracy through digital workflows. These benefits make it an ideal choice for businesses looking to streamline their succession planning processes.

-

Is airSlate SignNow easy to use for individuals managing their Connecticut succession?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible for individuals who may not be tech-savvy. With intuitive navigation and straightforward processes, users can efficiently manage their Connecticut succession documents without any hassle.

Get more for Connecticut Disclaimer

- Demande de document de voyage pour adulte demande de document de voyage pour adulte pour les apatrides et les personnes protges form

- Portalctgov drs drs formsdrs forms ct

- Department of revenue services state of connecticut form

- Form ct 941 2021 connecticut quarterly reconciliation of

- Department of revenue services state of connecticut 450 form

- Child abroad general passport application canadaca form

- Opwddnygovprocurement opportunitiesbroomenew york state vendor responsibility questionnaire for profit form

- State connecticutform ct 1040es 2021connecticut department of revenue servicesindividual income tax forms connecticut

Find out other Connecticut Disclaimer

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online