Ct Gift Deed Form

Understanding the Connecticut Gift Deed

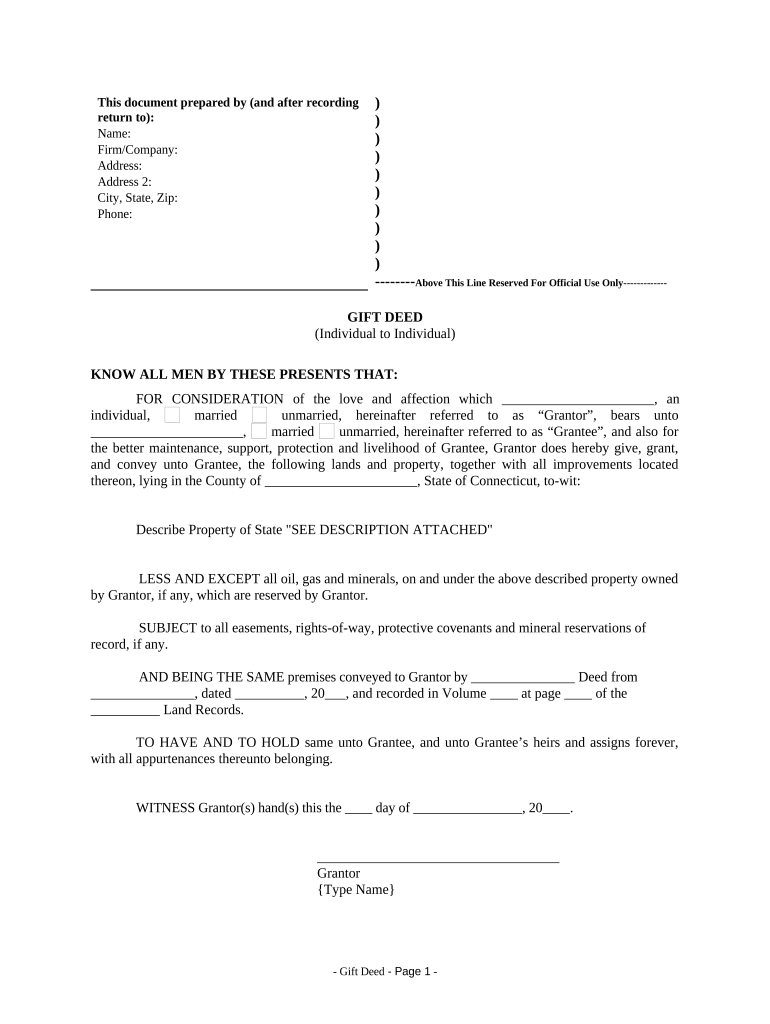

The Connecticut gift deed is a legal document that facilitates the transfer of property ownership from one individual to another without any exchange of money. This deed serves to formalize the intention of the donor to give a gift, typically real estate, to the recipient, known as the grantee. The gift deed must include specific information, such as the names of the parties involved, a description of the property, and the signature of the donor. It is essential to ensure that the deed complies with Connecticut state laws to be considered valid.

Steps to Complete the Connecticut Gift Deed

Completing a Connecticut gift deed involves several important steps to ensure that the document is legally binding. First, gather all necessary information, including the full names and addresses of both the donor and the grantee, as well as a detailed description of the property being gifted. Next, fill out the gift deed form accurately, ensuring that all required fields are completed. After that, the donor must sign the deed in front of a notary public to authenticate the document. Finally, the completed deed should be filed with the local land records office to officially record the transfer of ownership.

Legal Use of the Connecticut Gift Deed

The legal use of a Connecticut gift deed is primarily to transfer property ownership without compensation. This document can be beneficial in various scenarios, such as estate planning or gifting property to family members. However, it is crucial to understand that the gift deed must comply with state regulations to avoid potential disputes. Additionally, the donor should be aware of any tax implications associated with the gift, as large gifts may trigger federal gift tax requirements.

Required Documents for the Connecticut Gift Deed

When preparing to execute a Connecticut gift deed, certain documents are required to ensure a smooth process. These typically include:

- A completed gift deed form.

- Identification documents for both the donor and the grantee.

- A property description, including the address and legal description.

- Any prior deeds or documents related to the property, if applicable.

Having these documents ready will facilitate the completion and filing of the gift deed.

State-Specific Rules for the Connecticut Gift Deed

Connecticut has specific rules governing the execution and recording of gift deeds. For instance, the donor must be of sound mind and must not be under duress when signing the deed. Additionally, the deed must be notarized to be legally valid. It is also important to file the gift deed with the local land records office within a certain timeframe to ensure the transfer is officially recognized. Understanding these rules can help prevent any legal issues that may arise from improper execution.

IRS Guidelines on Gift Deeds

The Internal Revenue Service (IRS) provides guidelines regarding the tax implications of gifting property through a gift deed. Generally, if the value of the gift exceeds a specific threshold, the donor may be required to file a gift tax return. It is advisable for donors to consult IRS regulations or a tax professional to understand their obligations and ensure compliance with federal tax laws. This knowledge can help avoid unexpected tax liabilities.

Quick guide on how to complete ct gift deed

Accomplish Ct Gift Deed effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers a superb eco-friendly alternative to conventional printed and signed documents, as you can readily access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Ct Gift Deed on any device with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to alter and eSign Ct Gift Deed with ease

- Obtain Ct Gift Deed and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form—by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Ct Gift Deed and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Connecticut deed form?

A Connecticut deed form is a legal document used to transfer ownership of real property in the state of Connecticut. It includes details such as the names of the grantor and grantee, the property description, and the signatures of the parties involved. Using the correct Connecticut deed form is crucial to ensure a valid and enforceable transfer.

-

How much does airSlate SignNow charge for using the Connecticut deed form?

airSlate SignNow offers competitive pricing for its services, including the use of Connecticut deed forms. The pricing varies based on subscription plans, with affordable options available for both individuals and businesses. By subscribing, you gain access to unlimited document sending and eSigning, making it a cost-effective solution.

-

What features are included when using the Connecticut deed form with airSlate SignNow?

When you use the Connecticut deed form in airSlate SignNow, you benefit from features such as customizable templates, eSignatures, and secure document storage. Additionally, you can track document statuses in real-time, making it easier to manage your property transactions efficiently. These features streamline the process, saving you time and effort.

-

Are there any integrations available for the Connecticut deed form on airSlate SignNow?

Yes, airSlate SignNow supports various integrations that enhance the use of the Connecticut deed form. You can integrate with popular applications such as Google Drive, Dropbox, and CRM systems to manage your documents seamlessly. These integrations help you access and store your Connecticut deed forms in a centralized location.

-

What are the benefits of using airSlate SignNow for a Connecticut deed form?

Using airSlate SignNow for a Connecticut deed form offers numerous benefits, including ease of use, convenience, and enhanced security. The platform allows you to complete the deed form online, reducing the need for physical paperwork. Additionally, eSigning ensures that the document is legally valid while maintaining a secure transaction.

-

Can I customize the Connecticut deed form in airSlate SignNow?

Yes, airSlate SignNow allows users to customize their Connecticut deed forms according to specific needs. You can add or remove fields, adjust the layout, and include any additional information required for your property transfer. This customization feature ensures that your deed form meets all legal and personal requirements.

-

Is the Connecticut deed form compliant with state regulations?

Absolutely. The Connecticut deed form provided by airSlate SignNow is designed to meet all state regulations and requirements for property transfers. By using this platform, you can ensure that your deed form complies with local laws, reducing the risk of legal issues in the future.

Get more for Ct Gift Deed

Find out other Ct Gift Deed

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later