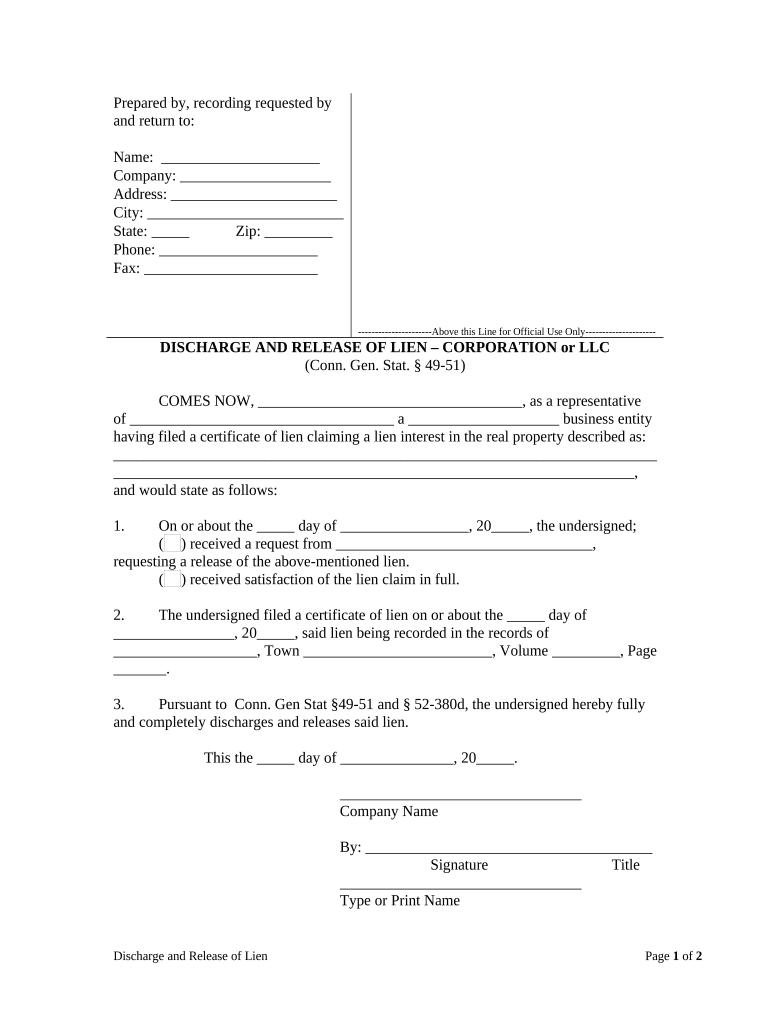

Ct Corporation Llc Form

What is the Connecticut LLC?

The Connecticut LLC, or limited liability company, is a popular business structure that combines the benefits of both a corporation and a partnership. It provides personal liability protection for its owners, known as members, shielding them from personal responsibility for business debts and liabilities. This structure is particularly appealing for small business owners in Connecticut who seek flexibility in management and taxation. An LLC can be owned by one or more individuals or entities, allowing for various ownership arrangements.

Steps to Complete the Connecticut LLC

Establishing a Connecticut LLC involves several key steps:

- Choose a name: The name must be unique and include "Limited Liability Company" or its abbreviation "LLC."

- Designate a registered agent: This individual or business must have a physical address in Connecticut and be available during business hours to receive legal documents.

- File the Certificate of Organization: Submit this document to the Connecticut Secretary of State, which officially creates your LLC.

- Create an Operating Agreement: Although not required by law, this document outlines the management structure and operating procedures of the LLC.

- Obtain necessary licenses and permits: Depending on your business type, additional local, state, or federal licenses may be required.

Legal Use of the Connecticut LLC

The Connecticut LLC is legally recognized and provides various advantages, including limited liability protection and pass-through taxation. This means that profits and losses can be reported on the members' personal tax returns, avoiding double taxation. It is essential for LLCs to comply with state regulations, including filing annual reports and maintaining proper records, to ensure ongoing legal protection and status.

Required Documents for the Connecticut LLC

To form a Connecticut LLC, you will need to prepare and submit several documents:

- Certificate of Organization: This is the primary document required to establish your LLC.

- Operating Agreement: While not mandatory, this document is crucial for outlining the internal workings of the LLC.

- Employer Identification Number (EIN): Obtain this from the IRS for tax purposes, especially if you plan to hire employees or have multiple members.

Filing Deadlines and Important Dates

When establishing a Connecticut LLC, it is important to be aware of key deadlines:

- Certificate of Organization: Must be filed with the Secretary of State before conducting business.

- Annual Report: Due on the anniversary of your LLC's formation, this report must be filed each year to maintain good standing.

Digital vs. Paper Version of the Connecticut LLC

Filing the Connecticut LLC paperwork can be done digitally or via paper. The digital submission process is often faster and allows for immediate confirmation of receipt. However, some may prefer the traditional paper method for record-keeping purposes. Regardless of the method chosen, ensure that all documents are completed accurately to avoid delays in processing.

Quick guide on how to complete ct corporation llc

Complete Ct Corporation Llc effortlessly on any device

Digital document management has become prevalent among companies and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle Ct Corporation Llc on any device with the airSlate SignNow Android or iOS applications and simplify any document-based task today.

How to modify and eSign Ct Corporation Llc with ease

- Locate Ct Corporation Llc and click on Get Form to initiate the process.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method of submitting your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Ct Corporation Llc and ensure outstanding communication at each stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Connecticut LLC company?

A Connecticut LLC company is a limited liability company formed under Connecticut law, providing business owners with liability protection while allowing for flexible management structures. This type of entity is ideal for small to medium-sized businesses looking to operate in Connecticut.

-

How much does it cost to form a Connecticut LLC company?

The cost to form a Connecticut LLC company typically includes a filing fee for the Articles of Organization and any additional fees for name reservation or expedited processing. Overall expenses can vary, so it's important to research current state fees and any associated costs you may encounter.

-

What are the benefits of forming a Connecticut LLC company?

Forming a Connecticut LLC company provides numerous benefits, including limited liability protection, pass-through taxation, and enhanced credibility with customers and clients. Additionally, LLCs have fewer formalities compared to corporations, allowing for easier management.

-

What features does airSlate SignNow offer for a Connecticut LLC company?

airSlate SignNow offers comprehensive eSignature and document management features specifically tailored for businesses, including a Connecticut LLC company. Users can easily send, sign, and manage documents securely, making it a great tool for efficient business operations.

-

How does airSlate SignNow integrate with my Connecticut LLC company’s operations?

airSlate SignNow integrates seamlessly with various business tools and software commonly used by a Connecticut LLC company. This includes CRM systems, file storage solutions, and productivity apps, ensuring your document workflow remains streamlined and efficient.

-

Can a Connecticut LLC company utilize airSlate SignNow for compliance purposes?

Yes, a Connecticut LLC company can utilize airSlate SignNow to help ensure compliance with legal documentation requirements. The platform provides audit trails and secure storage, helping businesses maintain accurate records of their transactions.

-

What is the typical turnaround time for documents signed by a Connecticut LLC company using airSlate SignNow?

The typical turnaround time for documents signed using airSlate SignNow is very quick, often completed in minutes. This efficiency is crucial for a Connecticut LLC company looking to expedite contracts and other important documents.

Get more for Ct Corporation Llc

- Illinois revenue board form

- Instructions for form 706 rev september 2022 instructions for form 706 united states estate and generation skipping transfer

- Wwwuslegalformscom form library 284364 au 724au 724 fill and sign printable template online us legal forms

- Catalog number 68076q form

- 2827 power of attorney form

- Instruction 1099 b form

- Forms 1099 r 1099 misc 1099 k 1099 nec and w 2g

- Ppdffillercomenmicro catalogirs health insurance form templatespdffiller

Find out other Ct Corporation Llc

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document