Assignment of Mortgage by Individual Mortgage Holder Connecticut Form

What is the Assignment of Mortgage by Individual Mortgage Holder in Connecticut

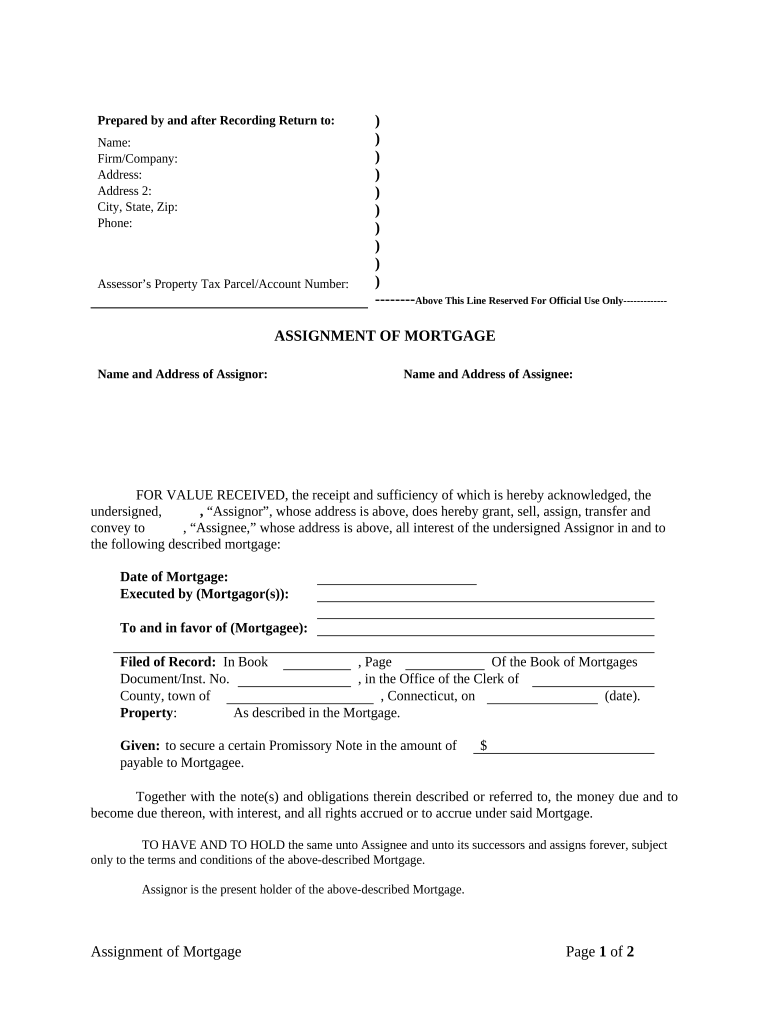

The Assignment of Mortgage by Individual Mortgage Holder in Connecticut is a legal document that transfers the rights and obligations of a mortgage from one individual to another. This form is crucial in real estate transactions, as it ensures that the new mortgage holder has the authority to collect payments and enforce the terms of the mortgage. It is essential for maintaining accurate records of ownership and ensuring that all parties involved in the mortgage are aware of the changes in ownership.

Steps to Complete the Assignment of Mortgage by Individual Mortgage Holder in Connecticut

Completing the Assignment of Mortgage by Individual Mortgage Holder in Connecticut involves several key steps:

- Gather necessary information, including the original mortgage document, details of the current mortgage holder, and the new mortgage holder's information.

- Fill out the assignment form accurately, ensuring that all names and addresses are correct.

- Sign the document in the presence of a notary public to validate the assignment.

- File the completed assignment with the appropriate local county clerk's office to ensure public record.

Legal Use of the Assignment of Mortgage by Individual Mortgage Holder in Connecticut

The legal use of the Assignment of Mortgage by Individual Mortgage Holder in Connecticut is governed by state laws. This document must adhere to specific legal requirements to be considered valid. For instance, it must be signed by the current mortgage holder and notarized. Additionally, it should be filed with the local land records office to provide public notice of the transfer. Failure to comply with these legal stipulations may result in the assignment being deemed invalid.

Key Elements of the Assignment of Mortgage by Individual Mortgage Holder in Connecticut

Several key elements must be included in the Assignment of Mortgage by Individual Mortgage Holder in Connecticut:

- The names and addresses of both the assignor (current mortgage holder) and the assignee (new mortgage holder).

- A clear description of the mortgage being assigned, including the original loan amount and property details.

- The date of the assignment and the signatures of the parties involved.

- A notary acknowledgment to ensure the authenticity of the signatures.

State-Specific Rules for the Assignment of Mortgage by Individual Mortgage Holder in Connecticut

Connecticut has specific rules regarding the Assignment of Mortgage by Individual Mortgage Holder that must be followed. These include:

- The assignment must be recorded in the local land records to provide public notice.

- It must comply with the Connecticut General Statutes regarding mortgage assignments.

- Any fees associated with recording the assignment must be paid at the time of filing.

How to Obtain the Assignment of Mortgage by Individual Mortgage Holder in Connecticut

To obtain the Assignment of Mortgage by Individual Mortgage Holder in Connecticut, individuals can typically find the necessary forms through local county clerk offices or online legal resources. It is important to ensure that the form used is the most current version and complies with state requirements. Additionally, consulting with a legal professional may provide guidance on completing the form correctly.

Quick guide on how to complete assignment of mortgage by individual mortgage holder connecticut

Prepare Assignment Of Mortgage By Individual Mortgage Holder Connecticut effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed materials, as you can easily locate the correct form and store it safely online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Assignment Of Mortgage By Individual Mortgage Holder Connecticut on any gadget with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Assignment Of Mortgage By Individual Mortgage Holder Connecticut effortlessly

- Obtain Assignment Of Mortgage By Individual Mortgage Holder Connecticut and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the data and then click the Done button to save your edits.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Assignment Of Mortgage By Individual Mortgage Holder Connecticut to ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for an Assignment Of Mortgage By Individual Mortgage Holder in Connecticut?

The process for an Assignment Of Mortgage By Individual Mortgage Holder in Connecticut involves drafting a document that transfers mortgage rights from the current holder to another party. This document must be signed, signNowd, and recorded in the appropriate town clerk’s office to ensure its legality. Using airSlate SignNow can streamline this process by allowing you to eSign documents and manage them electronically.

-

How does airSlate SignNow simplify the Assignment Of Mortgage By Individual Mortgage Holder in Connecticut?

airSlate SignNow simplifies the Assignment Of Mortgage By Individual Mortgage Holder in Connecticut by providing an intuitive interface for drafting and signing mortgage assignments. With our platform, you can quickly prepare documents, collect eSignatures, and securely store all relevant files in one location. This saves time and minimizes the chances of errors in your documents.

-

Is airSlate SignNow secure for handling an Assignment Of Mortgage By Individual Mortgage Holder in Connecticut?

Yes, airSlate SignNow employs robust security measures to protect sensitive information when managing an Assignment Of Mortgage By Individual Mortgage Holder in Connecticut. Our platform utilizes encryption, secure cloud storage, and comprehensive audit trails to ensure that your documents are kept safe from unauthorized access. You can trust us to handle your mortgage assignments securely.

-

What are the costs associated with using airSlate SignNow for an Assignment Of Mortgage By Individual Mortgage Holder in Connecticut?

The pricing for using airSlate SignNow for an Assignment Of Mortgage By Individual Mortgage Holder in Connecticut is competitive and tailored to meet the needs of various users. We offer different plans, including monthly and yearly subscriptions, which grant access to features like unlimited eSigning and document management. You can choose a plan that fits your business requirements and budget effectively.

-

Can I use airSlate SignNow for multiple Assignment Of Mortgage transactions in Connecticut?

Absolutely! airSlate SignNow can handle multiple Assignment Of Mortgage transactions in Connecticut with ease. Our platform allows users to manage multiple documents simultaneously, making it easy to track and process various assignments without confusion. This feature is especially beneficial for professionals handling multiple properties or clients.

-

What features does airSlate SignNow offer for managing Assignments Of Mortgage in Connecticut?

airSlate SignNow offers a variety of features tailored for managing Assignments Of Mortgage in Connecticut, including customizable templates, bulk sending options, and real-time tracking of document status. These features enable users to efficiently create, send, and monitor their mortgage assignments, ensuring timely completion. Additionally, our platform supports integrations with other tools to enhance workflow productivity.

-

How can I ensure compliance when executing an Assignment Of Mortgage By Individual Mortgage Holder in Connecticut?

To ensure compliance when executing an Assignment Of Mortgage By Individual Mortgage Holder in Connecticut, it’s essential to follow state laws and regulations regarding mortgage assignments. airSlate SignNow aids in this process by providing you with compliant templates and guidance on required notarization. Always consult legal counsel if you have specific legal questions about your transaction.

Get more for Assignment Of Mortgage By Individual Mortgage Holder Connecticut

Find out other Assignment Of Mortgage By Individual Mortgage Holder Connecticut

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free