Filing Status and Exemption Connecticut Form

What is the Filing Status and Exemption Connecticut

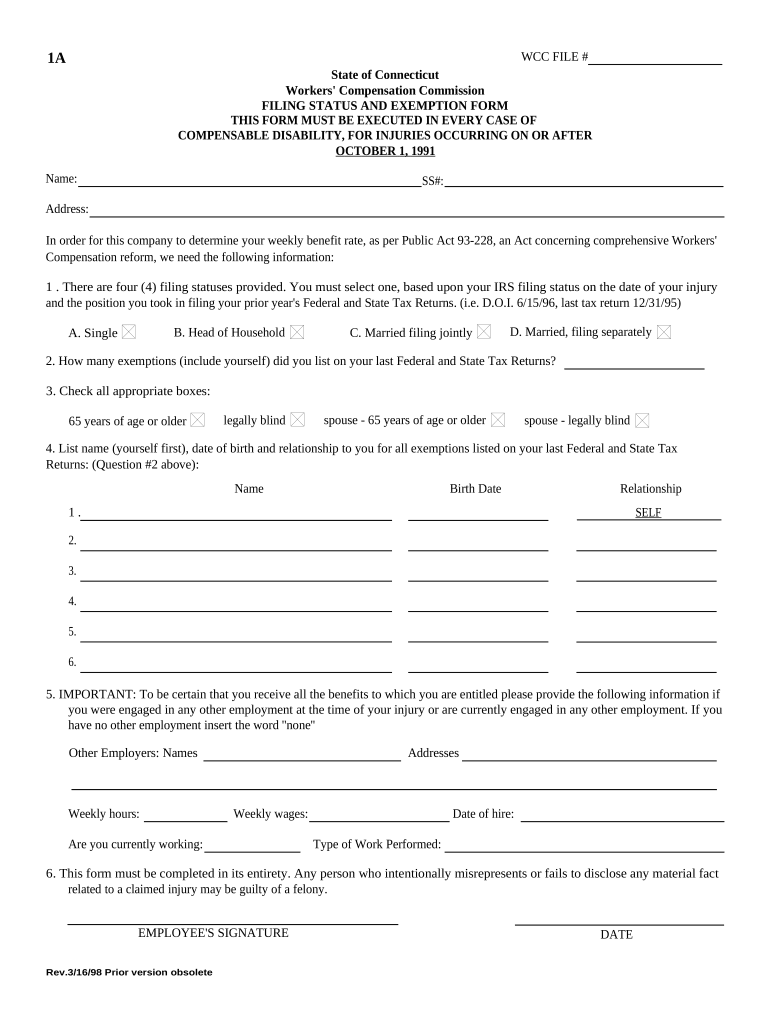

The Filing Status and Exemption Connecticut form is a crucial document used by residents to determine their tax obligations and eligibility for various exemptions. This form helps taxpayers classify their filing status, which can significantly influence their tax rates and potential deductions. The filing status options typically include single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Each category has specific criteria that must be met, impacting the overall tax liability.

Steps to Complete the Filing Status and Exemption Connecticut

Completing the Filing Status and Exemption Connecticut form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including Social Security numbers, income details, and any relevant documentation regarding dependents. Next, select the appropriate filing status based on your situation. Carefully review the exemptions available and determine which ones apply to you. Fill out the form accurately, ensuring all sections are completed. Finally, review your entries for any errors before submitting the form.

Legal Use of the Filing Status and Exemption Connecticut

The legal use of the Filing Status and Exemption Connecticut form is essential for maintaining compliance with state tax laws. This form must be filled out truthfully and submitted by the designated deadlines to avoid penalties. The information provided on this form is used by the Connecticut Department of Revenue Services to assess your tax liability. Misrepresentation or failure to submit the form can lead to legal consequences, including fines or audits.

Required Documents

To successfully complete the Filing Status and Exemption Connecticut form, several documents may be required. These typically include:

- Social Security cards for all individuals listed on the form

- Income statements such as W-2s or 1099s

- Documentation for any claimed exemptions, such as proof of dependents

- Previous year’s tax return for reference

Having these documents on hand will facilitate a smoother filing process and help ensure the accuracy of the information provided.

Eligibility Criteria

Eligibility for filing status and exemptions in Connecticut is determined by various factors, including marital status, income level, and the number of dependents. For instance, to qualify for head of household status, a taxpayer must be unmarried and have paid more than half the costs of maintaining a home for a qualifying person. Each status has specific requirements that must be met, and understanding these criteria is vital for accurate completion of the form.

Form Submission Methods

The Filing Status and Exemption Connecticut form can be submitted through multiple methods to accommodate different preferences. Taxpayers can file electronically using approved e-filing software, which often streamlines the process and reduces errors. Alternatively, the form can be printed and mailed to the Connecticut Department of Revenue Services. In-person submissions may also be possible at designated offices, providing a direct way to ensure the form is received.

Quick guide on how to complete filing status and exemption connecticut

Complete Filing Status And Exemption Connecticut seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Filing Status And Exemption Connecticut on any platform using the airSlate SignNow Android or iOS apps and enhance any document-related process today.

The easiest way to alter and electronically sign Filing Status And Exemption Connecticut without any hassle

- Obtain Filing Status And Exemption Connecticut and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just moments and carries the same legal validity as a traditional wet ink signature.

- Verify all the information and click the Done button to save your edits.

- Choose how you wish to submit your form, via email, text message (SMS), or an invite link, or download it to your computer.

Forget about missing or lost files, tedious document searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign Filing Status And Exemption Connecticut and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Filing Status and Exemption in Connecticut?

Filing Status and Exemption in Connecticut refers to the classification you choose on your tax return that can affect your tax liability. It defines your marital status and how many exemptions you can claim, which in turn influences your overall tax calculations. Understanding Filing Status and Exemption Connecticut is essential for maximizing potential refunds and cash flow.

-

How can airSlate SignNow help with Filing Status and Exemption forms in Connecticut?

airSlate SignNow provides a seamless platform for electronically signing and managing Filing Status and Exemption forms in Connecticut. With our user-friendly interface, you can easily prepare and send tax documents for eSignature, ensuring compliance and accuracy. This streamlines the process, ultimately saving you time and reducing the chance of errors.

-

What features does airSlate SignNow offer for tax documents related to Filing Status and Exemption Connecticut?

airSlate SignNow offers robust features for managing tax documents, including customizable templates, secure eSignatures, and advanced tracking options. These features equip you with the tools needed to handle Filing Status and Exemption Connecticut efficiently and effectively. Enhance your documentation process while ensuring that all your files are compliant and up-to-date.

-

Is airSlate SignNow cost-effective for managing Filing Status and Exemption documents in Connecticut?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing Filing Status and Exemption documents in Connecticut. With flexible pricing plans and the elimination of paper-based workflows, you can signNowly reduce administrative costs. By investing in our services, you also save time, allowing you to focus more on your core business activities.

-

Can I integrate airSlate SignNow with my existing tax software for Filing Status and Exemption Connecticut?

Absolutely! airSlate SignNow integrates smoothly with various popular tax software, allowing seamless management of Filing Status and Exemption documents in Connecticut. This integration streamlines the data transfer process, eliminates repetitive data entry, and improves overall efficiency. By incorporating our solution, you enhance your existing tools without compromising functionality.

-

What types of businesses benefit from using airSlate SignNow for Filing Status and Exemption Connecticut?

All types of businesses can benefit from using airSlate SignNow for Filing Status and Exemption in Connecticut, from freelancers to large enterprises. Our platform is particularly advantageous for businesses that require a reliable solution for document management and eSignature. By ensuring compliance and improving efficiency, airSlate SignNow supports companies in navigating the complexities of tax filing.

-

How secure is airSlate SignNow when handling Filing Status and Exemption forms in Connecticut?

Security is a top priority at airSlate SignNow, especially when managing sensitive Filing Status and Exemption forms in Connecticut. We employ advanced encryption, secure data storage, and compliance with industry standards to protect your documents. With airSlate SignNow, you can sign and manage your tax documents confidently, knowing that your data is safe.

Get more for Filing Status And Exemption Connecticut

- Income tax forms 2022 for tax year 2021 maryland

- Print blank tax formsgeorgia department of revenue

- Md resident income tax return marylandtaxesgov form

- 600s corporation tax return georgia department of revenue form

- Corporation tax return form

- Form it 257 claim of right credit tax year 2021

- Form ct 636 alcoholic beverage production credit tax year

- Partners instructions for form it 204 ip taxnygov

Find out other Filing Status And Exemption Connecticut

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile